- United States

- /

- Oil and Gas

- /

- NYSE:DHT

US Dividend Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the U.S. equities market attempts to rebound from last week's downturn, with major indices like the Dow Jones and S&P 500 showing little change in early trading, investors are closely monitoring opportunities for stability and growth. In this environment, dividend stocks can offer a compelling option for those seeking consistent income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.87% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.66% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.59% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.92% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.44% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.67% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

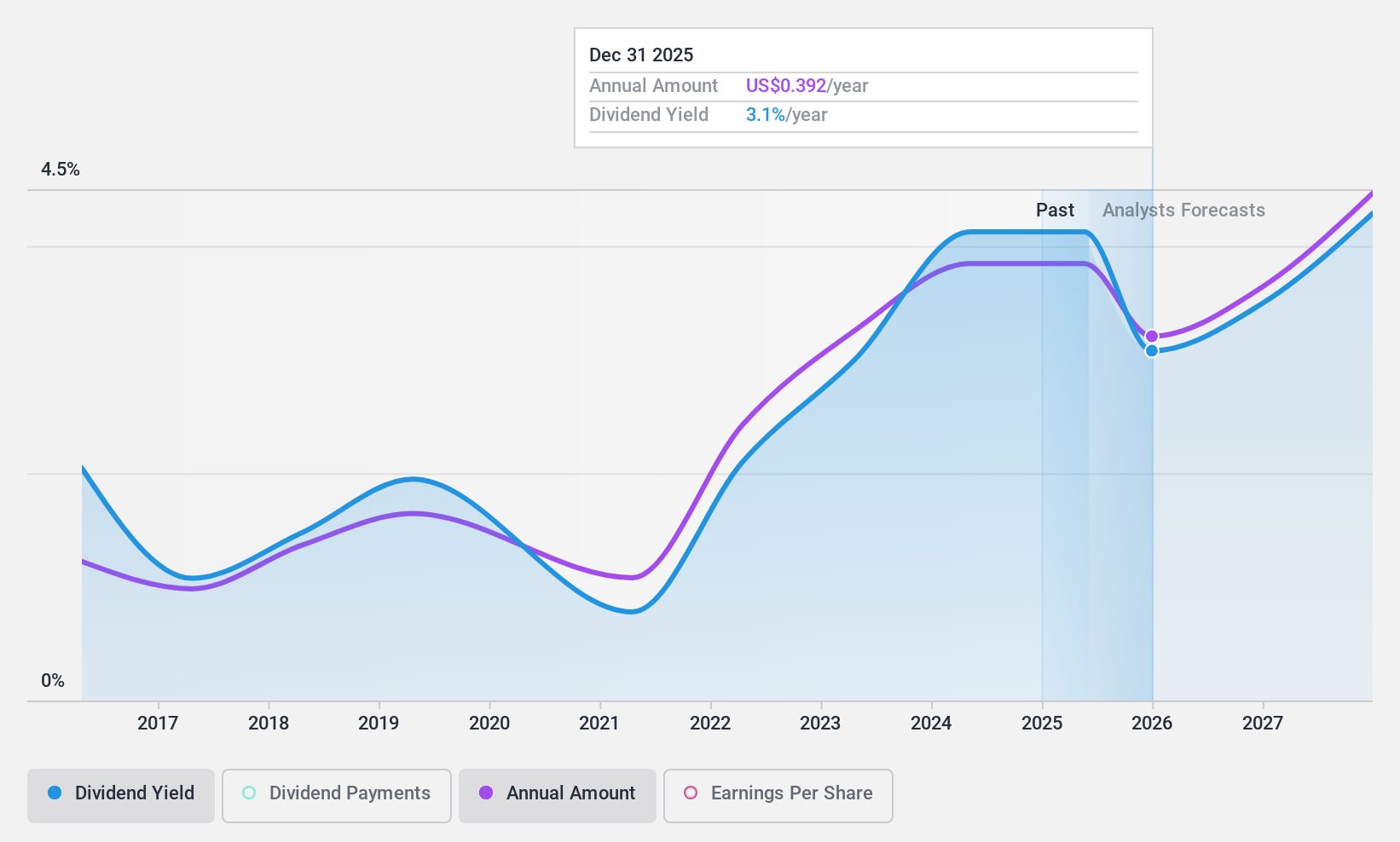

CNH Industrial (NYSE:CNH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNH Industrial N.V. is an equipment and services company involved in the design, production, marketing, sale, and financing of agricultural and construction equipment across multiple regions including North America, Europe, the Middle East, Africa, South America, and the Asia Pacific with a market cap of approximately $13.61 billion.

Operations: CNH Industrial generates revenue through its segments of Financial Services ($2.80 billion), Industrial Activities - Agriculture ($15.54 billion), and Industrial Activities - Construction ($3.41 billion).

Dividend Yield: 4.3%

CNH Industrial's dividend payments are well-covered by earnings with a payout ratio of 34.1%, but its cash flow coverage is tighter at 87.6%. Despite the dividends increasing over the past decade, they have been volatile and unreliable, with recent earnings showing a decline in revenue and net income compared to last year. CNH trades below its estimated fair value, yet its financial position is challenged by debt not well covered by operating cash flow.

- Get an in-depth perspective on CNH Industrial's performance by reading our dividend report here.

- Our valuation report unveils the possibility CNH Industrial's shares may be trading at a discount.

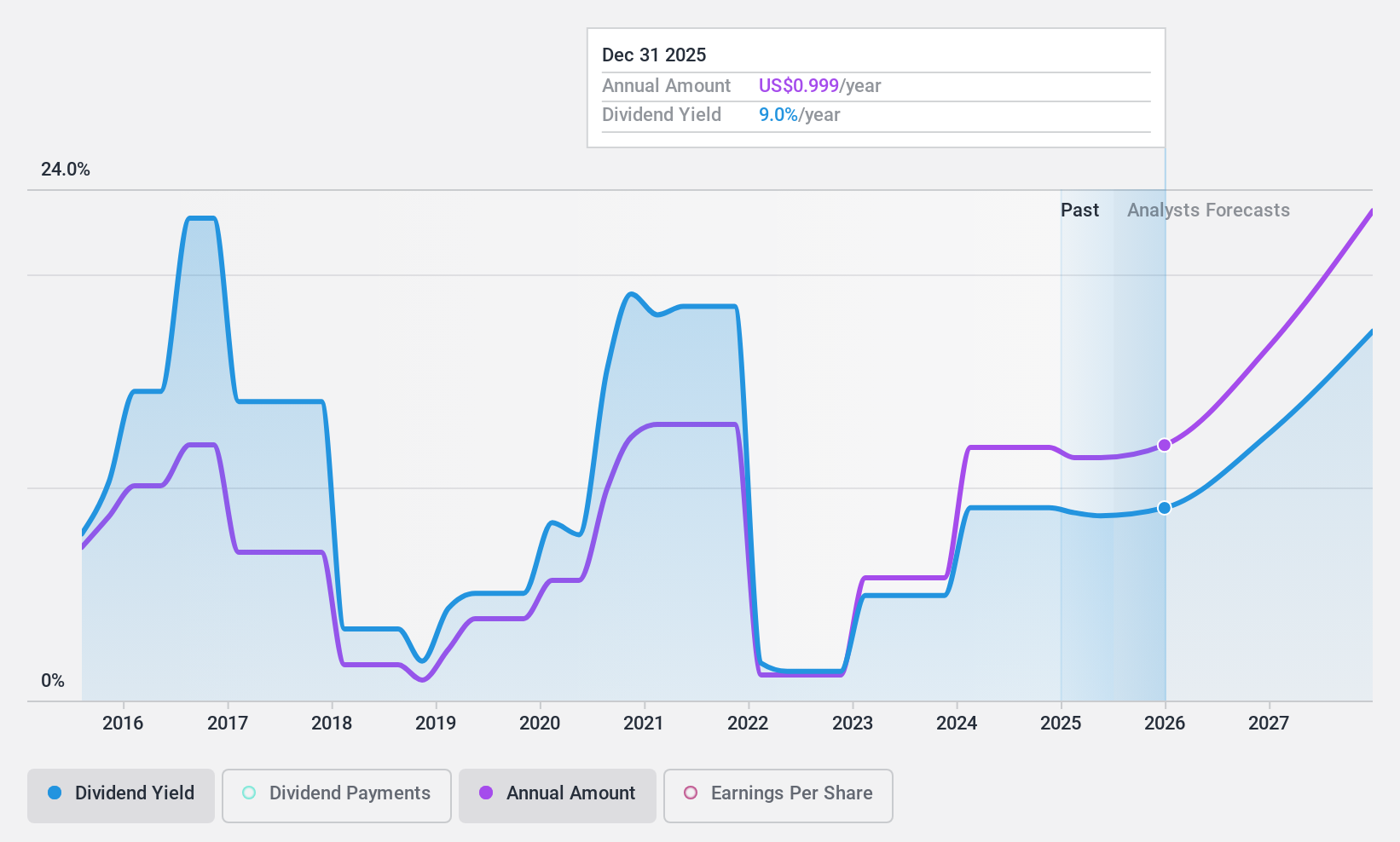

DHT Holdings (NYSE:DHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DHT Holdings, Inc. owns and operates crude oil tankers through its subsidiaries in Monaco, Singapore, and Norway, with a market cap of approximately $1.69 billion.

Operations: DHT Holdings, Inc. generates its revenue primarily from its fleet of crude oil tankers, amounting to $583.76 million.

Dividend Yield: 9.5%

DHT Holdings' recent earnings report shows a slight increase in net income, but its dividend remains volatile and unreliable over the past decade. Despite a high dividend yield of 9.47%, the payout is not well covered by earnings, with a payout ratio of 99.7%. The cash payout ratio stands at 84.6%, indicating dividends are covered by cash flow but not sustainably so. DHT's price-to-earnings ratio suggests it may be undervalued compared to the broader market.

- Click to explore a detailed breakdown of our findings in DHT Holdings' dividend report.

- Upon reviewing our latest valuation report, DHT Holdings' share price might be too pessimistic.

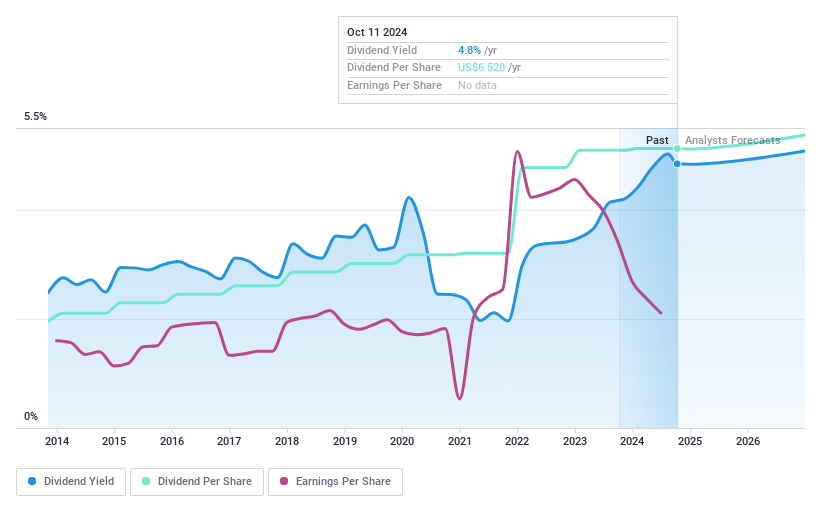

United Parcel Service (NYSE:UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery company offering transportation, delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services with a market cap of approximately $114.41 billion.

Operations: United Parcel Service, Inc. generates revenue through its three primary segments: International Package ($17.64 billion), U.S. Domestic Package ($59.72 billion), and Supply Chain Solutions ($13.33 billion).

Dividend Yield: 4.9%

UPS recently confirmed a quarterly dividend of $1.63 per share, continuing its decade-long stable and growing dividends. However, with a high payout ratio of 98.4%, these dividends are not well covered by earnings or cash flows, raising sustainability concerns despite a top-tier yield of 4.86%. The company faces legal challenges over alleged misleading revenue projections, impacting investor confidence after significant stock price declines in July 2024 following revised guidance and margin reductions.

- Click here to discover the nuances of United Parcel Service with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that United Parcel Service is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 133 more companies for you to explore.Click here to unveil our expertly curated list of 136 Top US Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, and Norway.

Excellent balance sheet with reasonable growth potential and pays a dividend.