- United States

- /

- Communications

- /

- NasdaqGM:CLFD

US Growth Companies With High Insider Ownership In November 2024

Reviewed by Simply Wall St

As the U.S. stock market seeks to recover from a recent downturn, with major indices like the Dow Jones Industrial Average and S&P 500 experiencing fluctuations, investors are paying close attention to growth companies that demonstrate resilience. In this context, companies with high insider ownership often attract interest due to their potential alignment of management's interests with those of shareholders, making them noteworthy in today's market environment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.5% | 31.5% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.7% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's review some notable picks from our screened stocks.

Burke & Herbert Financial Services (NasdaqCM:BHRB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is a bank holding company for Burke & Herbert Bank & Trust Company, offering community banking products and services in Virginia and Maryland, with a market cap of approximately $1.03 billion.

Operations: The company generates revenue of $181.38 million from its community banking products and services in Virginia and Maryland.

Insider Ownership: 12.4%

Earnings Growth Forecast: 72.5% p.a.

Burke & Herbert Financial Services is poised for substantial growth, with revenue expected to rise 27.4% annually, outpacing the US market. Despite a recent $350 million shelf registration filing indicating potential capital raising, insider activity remains positive with more shares bought than sold in the past three months. However, profit margins have declined from last year and shareholders experienced significant dilution. Earnings are forecast to grow significantly at 72.5% per year despite low return on equity projections.

- Click here to discover the nuances of Burke & Herbert Financial Services with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Burke & Herbert Financial Services is trading beyond its estimated value.

Clearfield (NasdaqGM:CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clearfield, Inc. manufactures and sells a range of fiber connectivity products both in the United States and internationally, with a market cap of approximately $403.80 million.

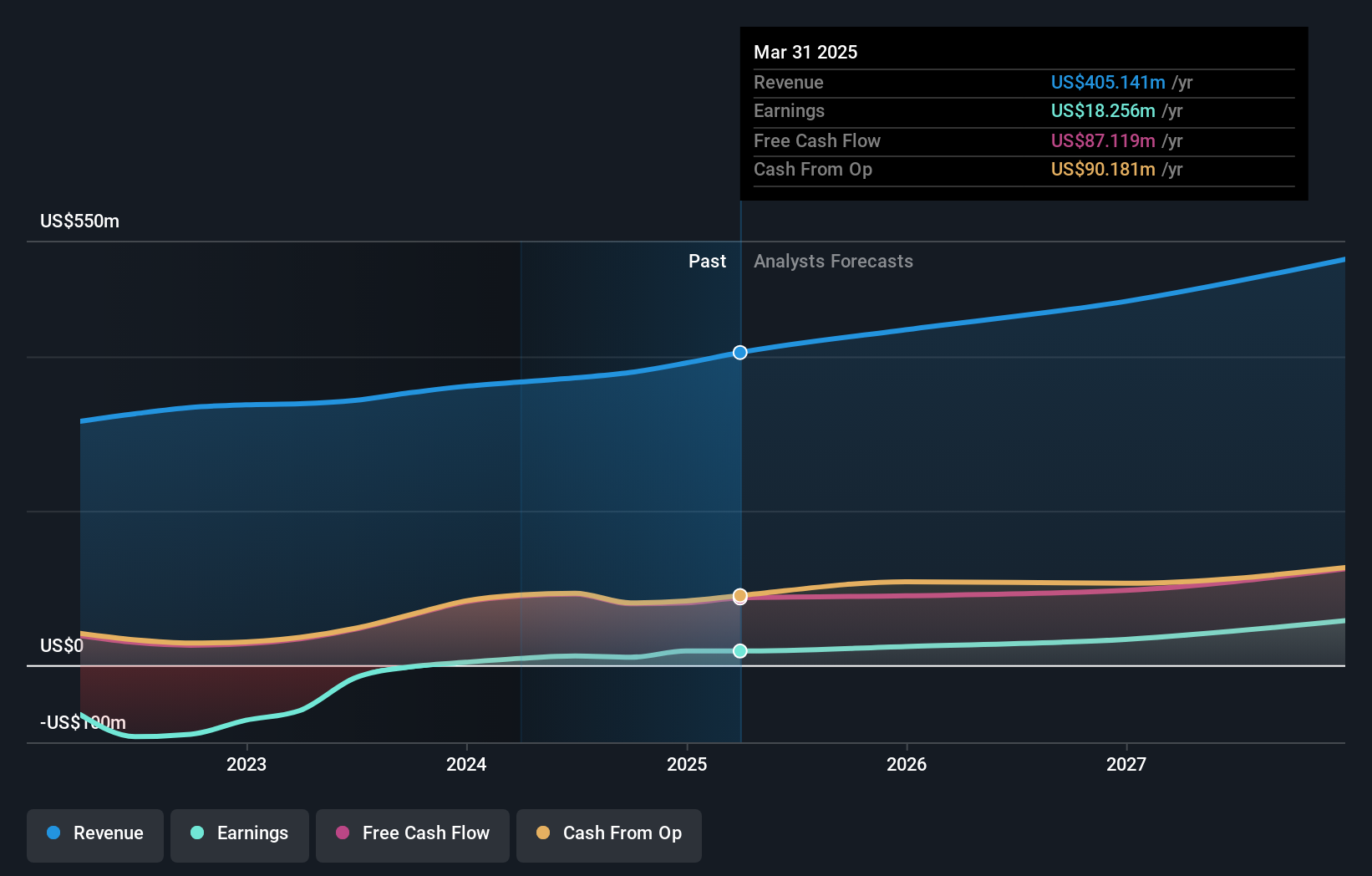

Operations: The company generates revenue from its segments, with Clearfield contributing $125.63 million and Nestor Cables adding $43.41 million.

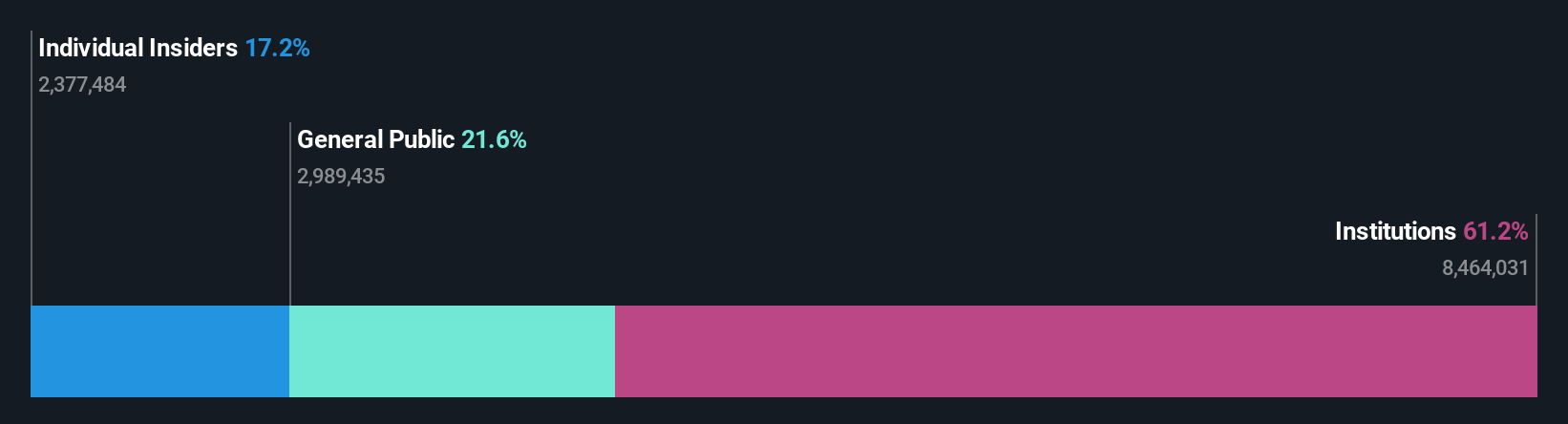

Insider Ownership: 16.6%

Earnings Growth Forecast: 91.1% p.a.

Clearfield, Inc. is forecasted to achieve significant earnings growth of 91.08% annually and is expected to become profitable within three years, outperforming the broader US market's growth expectations. Despite a challenging fiscal year with sales declining from US$268.72 million to US$166.71 million and a net loss of US$12.45 million, analysts project a stock price increase of 62.8%. The company trades at 66.3% below its estimated fair value and anticipates revenue between US$170-185 million for fiscal year 2025, driven by domestic market expansion efforts and strategic leadership changes aimed at enhancing marketing strategies and product innovation in fiber solutions.

- Take a closer look at Clearfield's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Clearfield's current price could be quite moderate.

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $989.42 million.

Operations: Fiverr generates revenue through its online marketplace operations worldwide.

Insider Ownership: 13.9%

Earnings Growth Forecast: 42.9% p.a.

Fiverr International is poised for substantial growth, with earnings projected to rise 42.9% annually, outpacing the US market average. The company anticipates revenue between US$388 million and US$390 million for 2024, reflecting steady expansion. Trading at a significant discount of 45.2% below its estimated fair value, analysts foresee a potential stock price increase of 24.5%. Despite no recent insider trading activity, its strong forecasted return on equity at 24.6% underscores robust financial health.

- Dive into the specifics of Fiverr International here with our thorough growth forecast report.

- According our valuation report, there's an indication that Fiverr International's share price might be on the cheaper side.

Turning Ideas Into Actions

- Delve into our full catalog of 210 Fast Growing US Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLFD

Clearfield

Manufactures and sells various fiber connectivity products in the United States and internationally.

Reasonable growth potential with adequate balance sheet.