- United States

- /

- Machinery

- /

- NYSE:CMI

What Cummins (CMI)'s 10% Dividend Increase Means For Shareholders

Reviewed by Simply Wall St

- On July 15, 2025, Cummins announced that its Board of Directors approved a 10% increase in the quarterly cash dividend, raising it from $1.82 to $2.00 per share, with the dividend payable on September 4, 2025, to shareholders of record as of August 22, 2025.

- This marks the 16th consecutive year Cummins has grown its quarterly dividend, highlighting the company’s consistent shareholder return policy even as leadership evolves with the addition of automotive veteran Matthew Tsien to its Board.

- We'll explore how the recurring dividend hikes strengthen Cummins’ investment narrative and shape expectations for long-term shareholder returns.

Cummins Investment Narrative Recap

To own Cummins shares, investors generally need to believe in sustained underlying demand for power solutions, ongoing product innovation, and disciplined capital allocation. The recent dividend increase reinforces management’s commitment to shareholder returns, yet its immediate effect on key near-term catalysts, such as growth from new engine platforms or green technologies, appears limited. The primary risk remains potential revenue pressure from softer demand in North America’s truck market and exposure to regulatory uncertainty, particularly around emissions standards. Among recent developments, the election of Matthew Tsien to the Board brings critical expertise in electrification and future technologies. His experience aligns closely with Cummins’ ongoing initiatives in clean energy and emissions-compliant product launches, which are important to addressing regulatory risks and positioning the company for emerging growth opportunities. On the other hand, what could drive a shift for investors is the risk that regulatory changes, especially those related to upcoming emissions standards...

Read the full narrative on Cummins (it's free!)

Cummins' outlook anticipates $38.3 billion in revenue and $3.3 billion in earnings by 2028. This is based on a 4.2% annual revenue growth and a $0.5 billion increase in earnings from the current $2.8 billion.

Uncover how Cummins' forecasts yield a $347.23 fair value, in line with its current price.

Exploring Other Perspectives

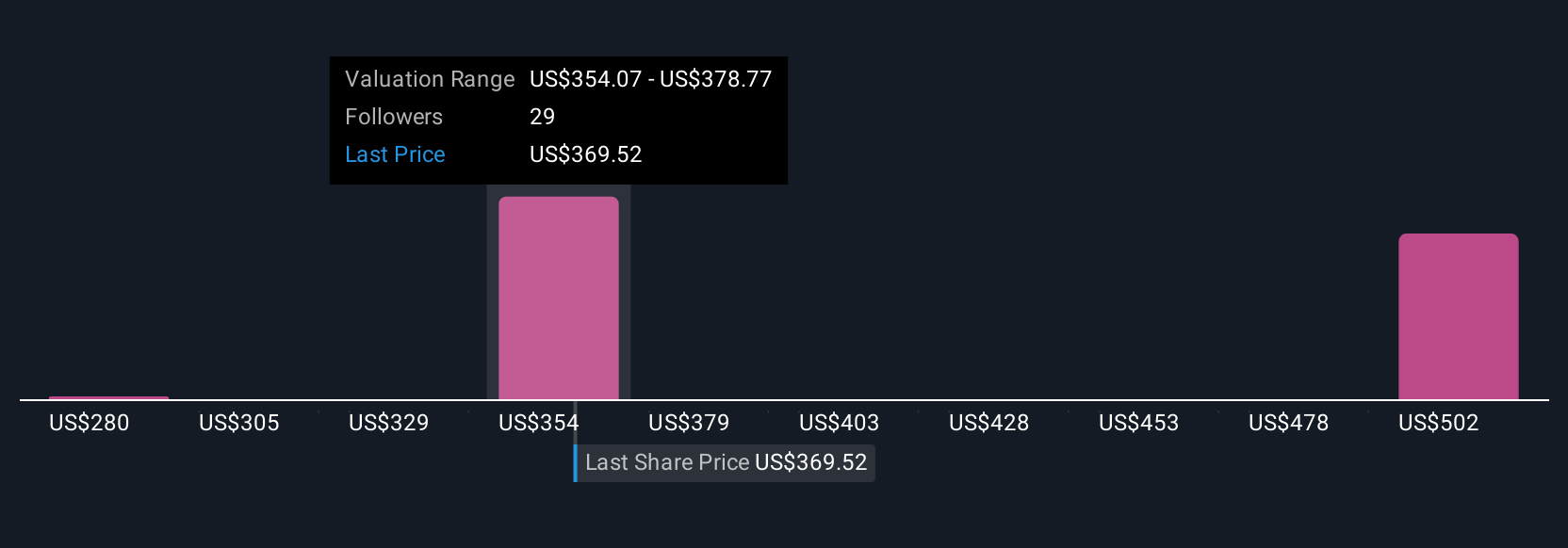

Four members of the Simply Wall St Community estimate Cummins’ fair value between US$280 and US$525, offering a wide view on where the stock could head. While consensus points to innovation and product launches as key growth drivers, opinions about regulatory risk also shape how some see the company’s future earning power.

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives