- United States

- /

- Machinery

- /

- NYSE:CMI

Cummins (CMI) Valuation Check After Analyst Upgrades and Growing Data Center Power Exposure

Reviewed by Simply Wall St

Recent analyst upgrades and upbeat commentary around Cummins (CMI) have pushed the stock back into focus, as investors weigh its growing data center backup power exposure against a softer heavy truck cycle.

See our latest analysis for Cummins.

That backdrop helps explain why the latest share price of $506.72 sits on top of a powerful 45.76 percent year to date share price return and a 47.09 percent one year total shareholder return, signaling momentum that looks more like a sustained rerating than a short term pop.

If Cummins data center angle has you rethinking where industrial growth could come from next, it might be worth exploring aerospace and defense stocks as another pocket of mission critical power and infrastructure plays.

With Cummins trading just shy of analyst targets yet still showing a sizable intrinsic discount, the key question now is whether investors are underestimating its data center and power shift, or if the market is already pricing in that future growth.

Most Popular Narrative Narrative: 2.8% Undervalued

With Cummins last closing at $506.72 against a most popular narrative fair value near $522, the story leans toward modest upside anchored in durable earnings power.

The fair value estimate has risen slightly to approximately $522 from about $510, reflecting modestly higher long-term earnings expectations. The future P/E has moved up slightly to roughly 20.0x from about 19.7x, pointing to a small expansion in the valuation multiple applied to forward earnings.

Curious what justifies paying a richer multiple for a mature industrial name, and how growth, margins, and earnings are expected to evolve from here? The narrative quietly embeds a shift in profitability and scale that could reshape how investors value Cummins’ data center and truck cycle exposure. Want to see the exact assumptions driving that higher fair value and where the upside really comes from?

Result: Fair Value of $521.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that optimism could be tested if the North American truck downturn deepens or if regulatory and tariff uncertainty continues to inflate Cummins’ cost base.

Find out about the key risks to this Cummins narrative.

Another View: Multiples Tell A Richer Story

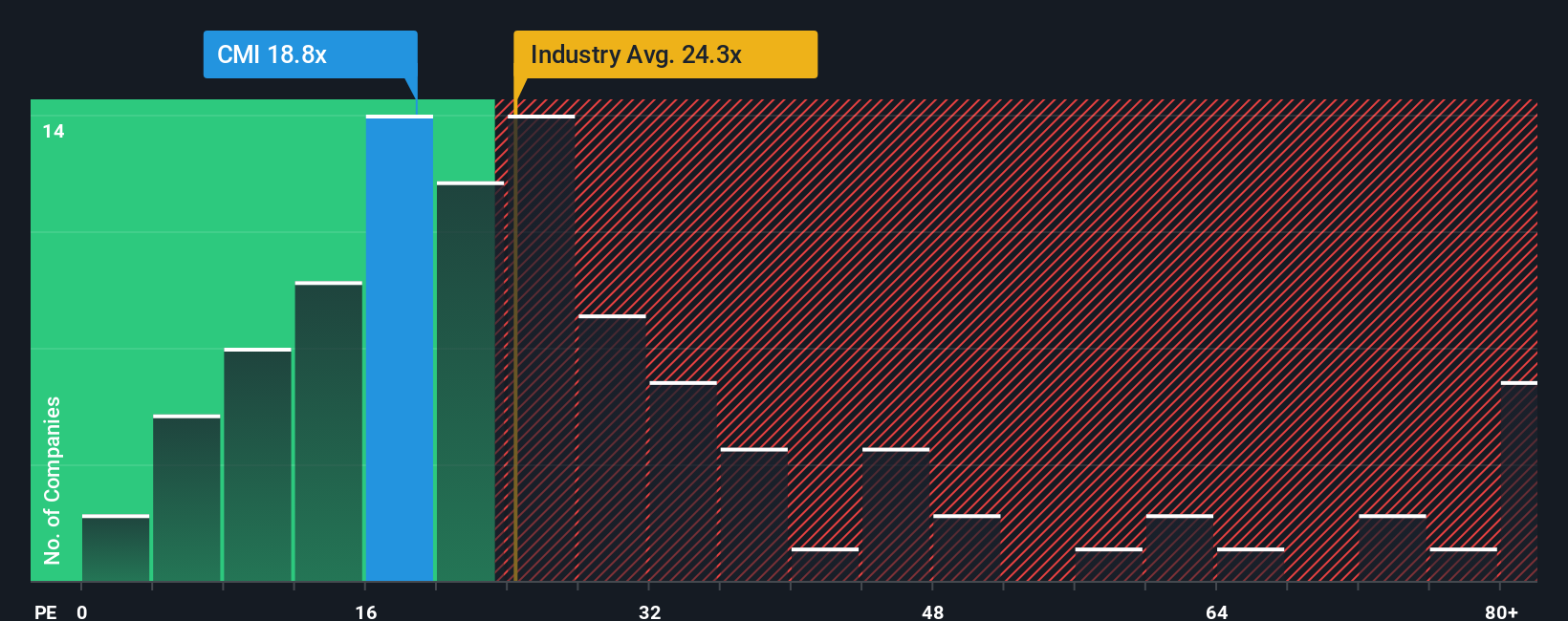

Step back from that 2.8 percent narrative undervaluation and the picture looks less forgiving. Cummins trades on a 26.2x price to earnings ratio versus 25.3x for the US Machinery industry and 23.5x for peers. Our fair ratio is a much higher 34.9x, suggesting either a quality premium that could grow or a margin of error that could shrink fast if expectations wobble. Is this a sensible rerating or a narrow runway for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cummins Narrative

If this interpretation does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a personalized narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cummins.

Looking for more investment ideas?

Ready to level up your portfolio strategy, not just your Cummins view? Use the Simply Wall St Screener to uncover targeted opportunities you do not want to miss.

- Explore potential pricing opportunities by searching through these 914 undervalued stocks based on cash flows that the market may not have fully recognized yet.

- Seek income-focused opportunities by concentrating on these 13 dividend stocks with yields > 3% that provide regular cash payouts.

- Look at developments in digital finance with these 79 cryptocurrency and blockchain stocks that are involved in blockchain enabled business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion