- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

A Look at Cadre Holdings's Valuation Following Strong Q2 Revenue Growth and Resilient Sector Demand

Reviewed by Kshitija Bhandaru

Cadre Holdings (CDRE) has caught attention after reporting solid revenue growth and improved profitability in Q2, even as economic headwinds affected competitors. Persistent demand for its safety equipment and a firm industry backdrop are shaping investor interest.

See our latest analysis for Cadre Holdings.

Interestingly, Cadre Holdings has exhibited positive momentum, leading NYSE gainers recently as its share price responded to robust Q2 results and ongoing industry demand. While the 3-year total shareholder return stands at an impressive 47%, the current share price suggests that investors are viewing the company’s bright profit outlook and relatively low valuation as attractive for the long term.

If you’re tracking momentum among aerospace and defense names, now could be the perfect time to spot new opportunities with our See the full list for free.

With Cadre Holdings posting strong results and trading below its estimated intrinsic value, the key question for investors is whether there is still room for upside or if the market has already factored in all the growth potential.

Most Popular Narrative: 4.8% Undervalued

With Cadre Holdings closing at $36.67 and the most followed narrative setting fair value at $38.50, there is a slight but notable upside according to current projections. This shapes investor expectations for further growth potential, particularly amid steady industry tailwinds and company-specific catalysts.

Ongoing global instability and public safety concerns are driving higher and recurring demand for Cadre's protective equipment and nuclear safety products. This supports consistent long-term revenue growth across core markets, with additional benefit expected as delayed government contracts are fulfilled.

Curious how ambitious growth forecasts and a transformative international strategy could impact future returns? There is a key assumption here about rising profit margins and expanding sales that could surprise you. Uncover the bold projections and financial levers that push this fair value target above today’s share price.

Result: Fair Value of $38.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in large contracts or challenges integrating recent acquisitions could hinder Cadre Holdings’ growth trajectory and reduce its projected margin expansion.

Find out about the key risks to this Cadre Holdings narrative.

Another View: What About Ratio-Based Valuation?

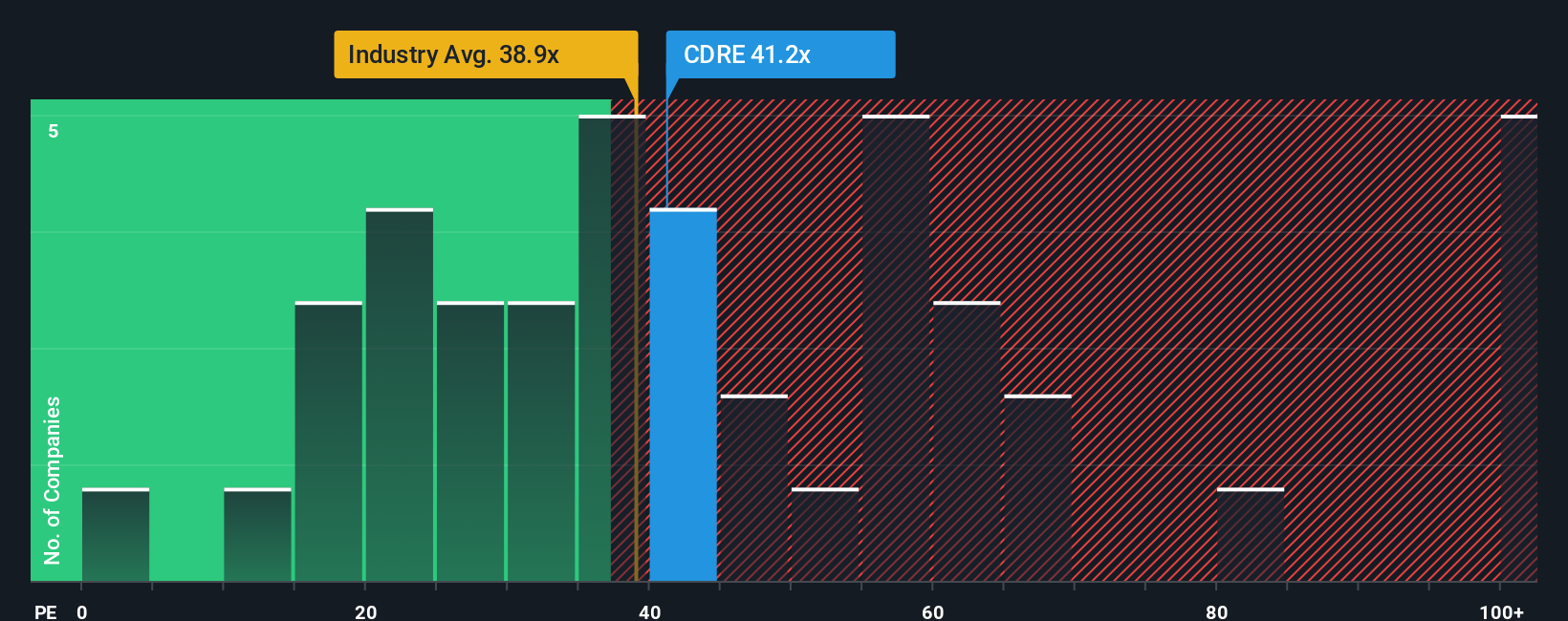

Looking at Cadre Holdings through the lens of a key market valuation ratio, the shares are trading at 39.1 times earnings. This aligns with the Aerospace & Defense sector average but is lower than the 45.7 times earnings seen among peer companies. However, compared to the fair ratio of 27.8, the current figure suggests some valuation risk if the market’s mood changes. Is this a sign that investors are counting on significantly stronger growth ahead, or could expectations be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadre Holdings Narrative

If you prefer your own take or want to dig deeper into the numbers, you can build a personalized view of Cadre Holdings in just a few minutes. Do it your way

A great starting point for your Cadre Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The market’s most exciting trends are just a click away. See what you could be missing out on today.

- Get ahead of the curve with these 24 AI penny stocks, bringing artificial intelligence to industries everywhere and offering exposure to the future of tech-driven growth.

- Boost your portfolio’s income potential by tapping into these 19 dividend stocks with yields > 3%, featuring companies that deliver healthy yields above 3% for steady, reliable returns.

- Unlock hidden value by browsing these 896 undervalued stocks based on cash flows, which are trading below their intrinsic worth based on real cash flows. This can help set you up for smart moves others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety equipment and other related products that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives