- United States

- /

- Machinery

- /

- NYSE:CAT

How Investors May Respond To Caterpillar (CAT) Entering AI Data Center Power Solutions with Vertiv Collaboration

Reviewed by Sasha Jovanovic

- On November 18, 2025, Vertiv and Caterpillar announced a collaboration to create integrated energy optimization solutions for AI data centers by combining Vertiv's power distribution and cooling technologies with Caterpillar's power generation and CCHP expertise.

- This partnership addresses rising demand for efficient, scalable on-site power and cooling in AI centers, aiming to accelerate deployments while reducing energy use and carbon footprint.

- We'll explore how Caterpillar's entry into the AI-focused data center energy market could reshape its investment outlook and industry positioning.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Caterpillar Investment Narrative Recap

Caterpillar appeals to shareholders who believe in global infrastructure demand, energy transition, and the company’s ability to weather cyclical volatility through strong customer relationships and diversified end-markets. The new Vertiv partnership positions Caterpillar at the center of the surging AI data center trend, providing another demand driver to offset macroeconomic uncertainties, though near-term risks such as tariff exposure and operating margin pressure remain critical considerations. For now, the collaboration bolsters growth potential but does not materially reduce the impact of tariffs, the biggest short-term risk for the stock.

Among Caterpillar’s recent announcements, the August 2025 agreement with Hunt Energy to support data center power infrastructure stands out as particularly relevant. Together with the Vertiv alliance, these moves underline Caterpillar’s pursuit of growth in the AI and cloud data center segment, a key current catalyst for energy generation and equipment orders.

But with ongoing tariff headwinds still looming, investors should be aware that...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's outlook anticipates $74.0 billion in revenue and $13.5 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.5% and a $4.1 billion increase in earnings from the current $9.4 billion level.

Uncover how Caterpillar's forecasts yield a $559.22 fair value, in line with its current price.

Exploring Other Perspectives

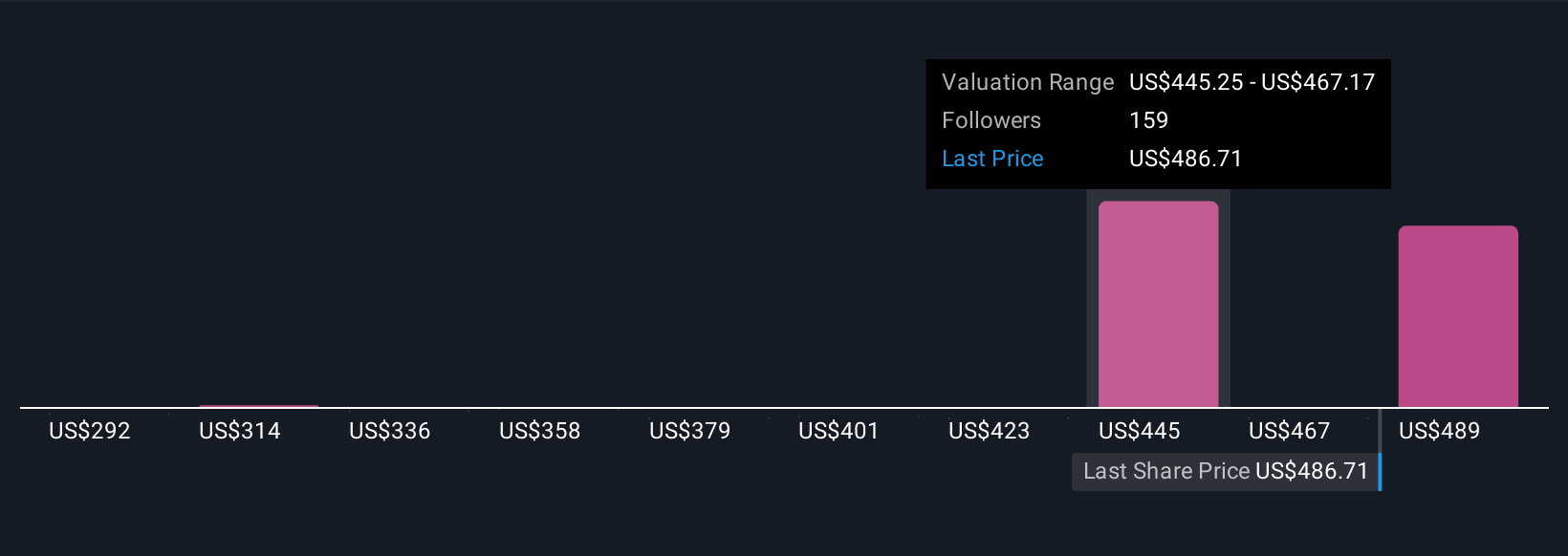

Eighteen fair value estimates from the Simply Wall St Community put Caterpillar’s perceived worth between US$291.79 and US$559.22 per share. With fresh partnerships targeting data center power growth, your outlook on tariff impacts could make a significant difference, explore how other investors see it now.

Explore 18 other fair value estimates on Caterpillar - why the stock might be worth 47% less than the current price!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives