- United States

- /

- Machinery

- /

- NYSE:CAT

Caterpillar (CAT): Assessing Valuation After Strategic Data Center Partnership with Vertiv and Energy Sector Growth

Reviewed by Simply Wall St

Caterpillar (CAT) just announced a new collaboration with Vertiv, aiming to deliver advanced on-site power and cooling solutions designed for AI-driven data centers. This marks a clear shift toward energy infrastructure opportunities in rapidly expanding digital markets.

See our latest analysis for Caterpillar.

Caterpillar’s momentum is hard to miss. Shares have climbed 59% year-to-date, leading the Dow, as investors respond to booming energy infrastructure demand and blockbuster orders in its energy and transportation businesses. With a 1-year total shareholder return over 44% and a remarkable 155% three-year total return, both short- and long-term performance are pointing to renewed confidence in Caterpillar’s future prospects.

If Caterpillar’s infrastructure push has you thinking bigger, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Caterpillar shares reaching all-time highs, supported by a robust backlog and analyst optimism, the key question for investors now is clear: Is CAT undervalued based on its prospects, or has the market already priced in years of future growth?

Most Popular Narrative: 2.4% Undervalued

Caterpillar's most followed narrative sets a fair value just above its last close of $573.73. This reflects upbeat expectations that slightly exceed current market pricing. This view is shaped by positive analyst forecasts paired with increased confidence in the company’s multi-year fundamentals.

Record backlog growth across all three primary segments, driven by strong global infrastructure demand (particularly in North America, Africa, and the Middle East), positions Caterpillar for above-trend sales growth in late 2025 and into 2026, supporting top-line revenue expansion.

Curious which financial levers are fueling this bullish stance? Analysts are counting on robust sales momentum, operating profit expansion, and a powerful synergy between margin gains and global demand. The exact growth assumptions might surprise you, so dig deeper for the full story behind this valuation.

Result: Fair Value of $587.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including rising tariff pressures and the potential for more intense price competition. Both of these factors could quickly test the bullish outlook.

Find out about the key risks to this Caterpillar narrative.

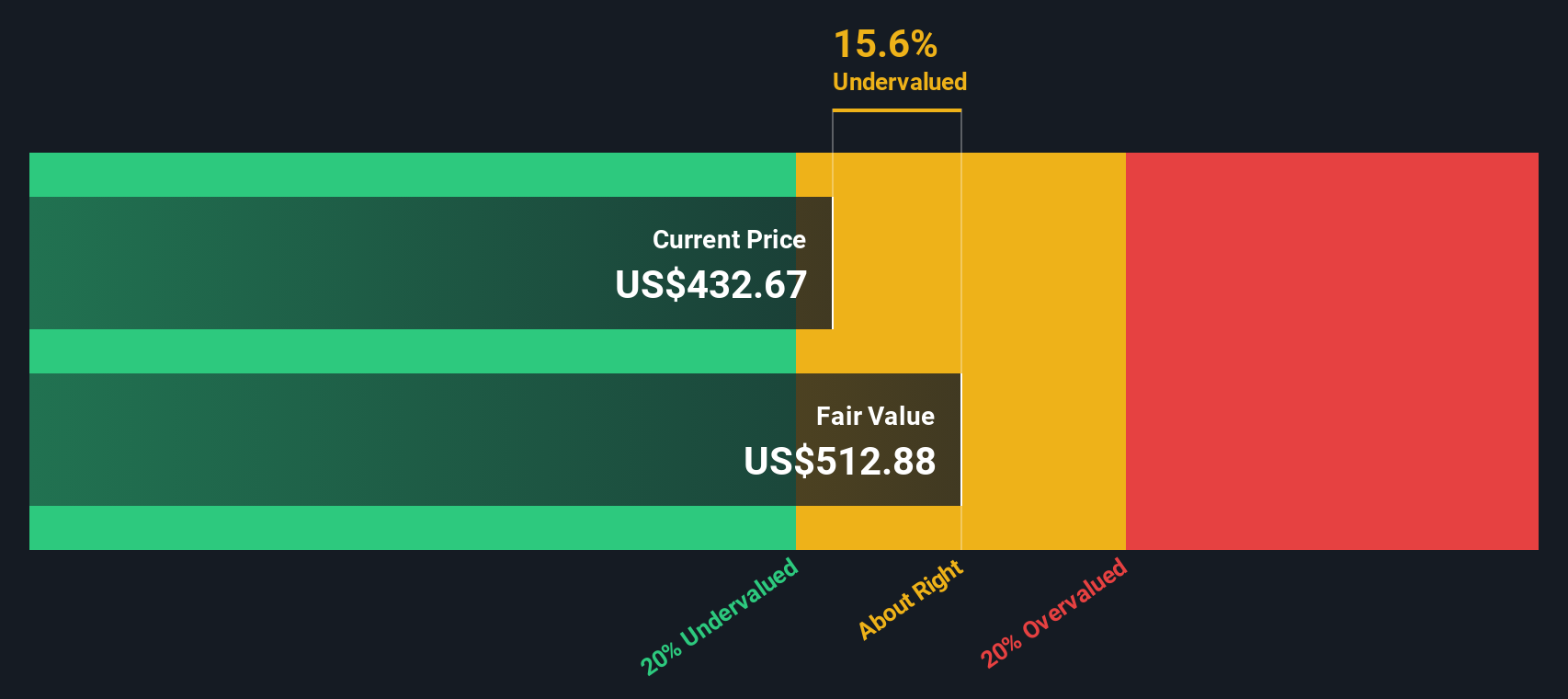

Another View: SWS DCF Model Signals a Different Story

While analyst narratives see Caterpillar as slightly undervalued, our SWS DCF model offers a different perspective. According to this approach, CAT’s shares are trading above its estimated fair value of $550.70. This suggests the market may already be factoring in some aggressive growth expectations. Could sentiment be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Caterpillar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Caterpillar Narrative

If you have a different take or want to dive deeper into the numbers yourself, you can build your own Caterpillar narrative in minutes with Do it your way.

A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s market momentum pass you by. Take action and uncover unique investment angles you might be missing right now. These opportunities are just a quick look away.

- Pinpoint strong yield opportunities and grow your income stream by evaluating these 15 dividend stocks with yields > 3% currently offering yields above 3%.

- Capitalize on a fast-moving tech sector by targeting innovation leaders among these 25 AI penny stocks poised to transform entire industries.

- Zero in on future game-changers and unlock potential early by reviewing these 3579 penny stocks with strong financials showing impressive financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success