Carrier Global Corporation (NYSE:CARR) shareholders (or potential shareholders) will be happy to see that the Chairman & CEO, David Gitlin, recently bought a whopping US$1.0m worth of stock, at a price of US$52.62. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 2.4%.

The Last 12 Months Of Insider Transactions At Carrier Global

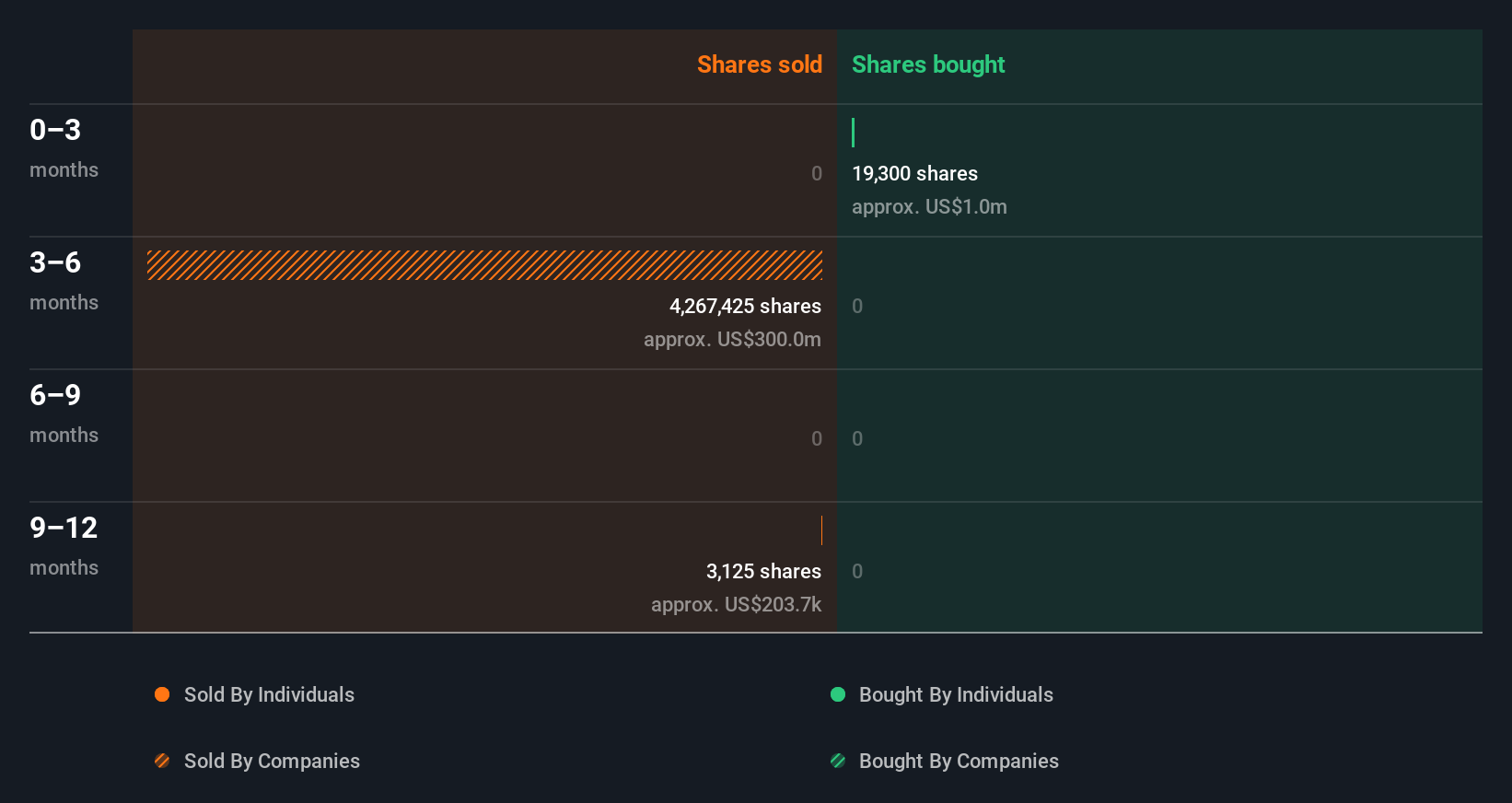

Notably, that recent purchase by David Gitlin is the biggest insider purchase of Carrier Global shares that we've seen in the last year. That means that an insider was happy to buy shares at around the current price of US$54.88. That means they have been optimistic about the company in the past, though they may have changed their mind. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the Carrier Global insider decided to buy shares at close to current prices. David Gitlin was the only individual insider to buy during the last year.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

View our latest analysis for Carrier Global

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Insider Ownership Of Carrier Global

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. It appears that Carrier Global insiders own 0.2% of the company, worth about US$70m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At Carrier Global Tell Us?

The recent insider purchase is heartening. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest Carrier Global insiders are well aligned, and that they may think the share price is too low. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 1 warning sign for Carrier Global you should know about.

Of course Carrier Global may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026