- United States

- /

- Building

- /

- NYSE:CARR

Carrier Global (CARR): Assessing Valuation After CEO’s $1M Stock Buy and Cautious Growth Outlook

Reviewed by Simply Wall St

Carrier Global (CARR) grabbed investor attention after CEO David Gitlin purchased $1 million in company stock. This came shortly after the company posted stronger-than-expected third-quarter earnings and offered a more cautious outlook for the months ahead.

See our latest analysis for Carrier Global.

Carrier Global’s share price has faced significant pressure lately, with a 17% drop over the past three months and a 10% pullback in the last month alone. Despite the recent dip, the latest total shareholder return shows a strong longer-term story, with five-year returns exceeding 54%. Momentum has clearly faded since the start of the year as investors balance management’s recent vote of confidence with cautious near-term outlooks and shifting risk perceptions following earnings and insider activity.

If this mix of insider action and shifting sentiment has you interested in what else might be out there, why not take the opportunity to discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst targets and management signaling confidence, is Carrier Global now an undervalued opportunity, or are investors right to question whether future growth is already priced in?

Most Popular Narrative: 25% Undervalued

Carrier Global’s most-followed narrative points to a fair value that is notably higher than the latest share price, suggesting that the market may be missing key growth drivers. This perspective considers the company’s current discounted price relative to projections for profitability and expansion in evolving markets.

Carrier's introduction of differentiated products, such as air-cooled commercial heat pumps and the integration of HEMS technology with Google Cloud's AI, positions them to capture the growing demand for sustainable and smart energy solutions, potentially driving future revenue growth.

Curious about which financial levers could unlock a much higher valuation? One major area involves significant focus on rapid service growth and the potential for a transformative margin upswing. The narrative includes specific and aggressive forecasts—do you want to see how these all add up to support such a high fair value?

Result: Fair Value of $72.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as weaker residential HVAC demand and regional headwinds. These factors could undermine long-term growth expectations and challenge the current undervalued outlook.

Find out about the key risks to this Carrier Global narrative.

Another View: Are Current Valuation Multiples Too High?

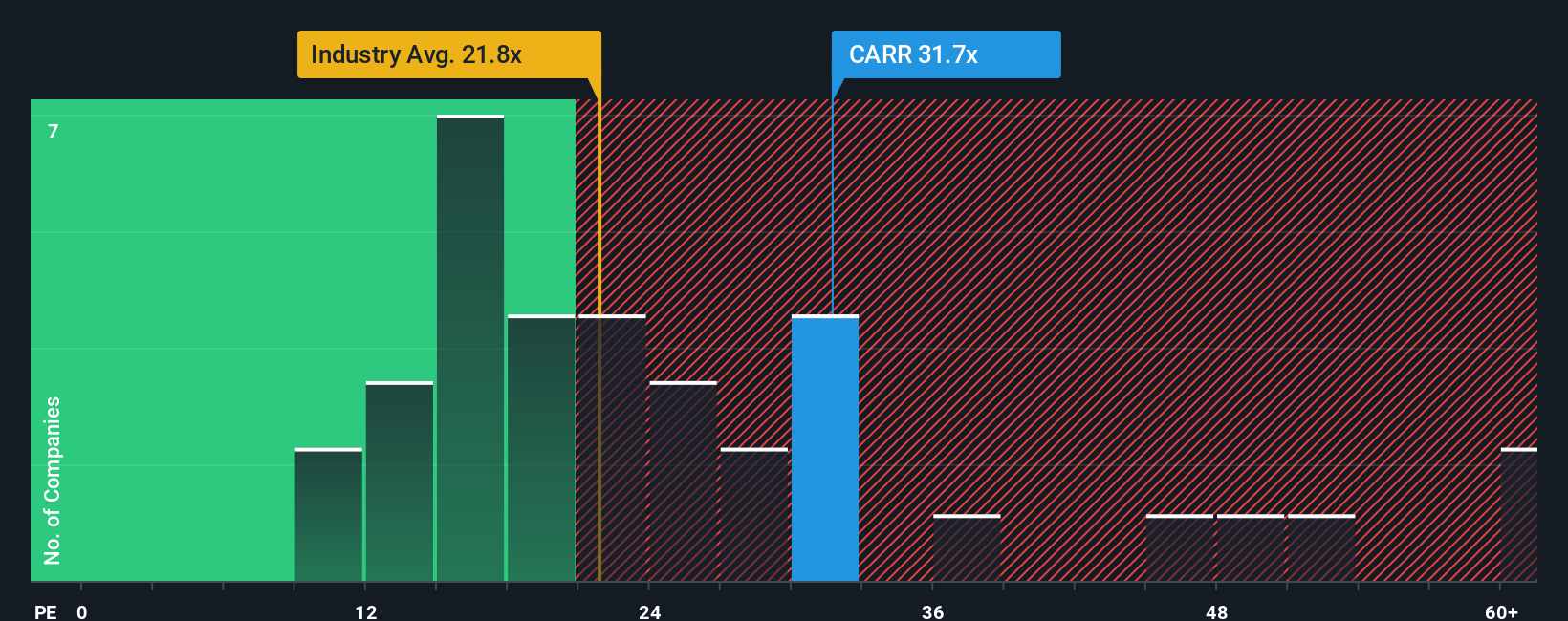

While the market currently prices Carrier Global at a price-to-earnings ratio of 33.2x, this stands notably above both the peer average of 28.9x and the US Building industry average of 18.9x. Yet, the fair ratio is estimated at 38.9x, suggesting the market could still adjust upward. This premium could offer room for growth, but it also signals higher expectations. Will the company deliver enough to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carrier Global Narrative

If you have a different perspective, or want to test your own ideas with the data, you can craft your own Carrier Global story in just a few minutes. Do it your way

A great starting point for your Carrier Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by when you can access fresh stock ideas instantly. Use the Simply Wall Street Screener to get ahead of the market and act on conviction today.

- Unlock income potential with steady yields. See which companies are offering standout returns with these 15 dividend stocks with yields > 3%.

- Catch the next big wave in artificial intelligence momentum by jumping into these 25 AI penny stocks backed by strong fundamentals and rapid adoption.

- Capitalize on high-value opportunities others might miss by targeting these 923 undervalued stocks based on cash flows poised for strong cash flow gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.