- United States

- /

- Trade Distributors

- /

- NYSE:BXC

BlueLinx Holdings Inc.'s (NYSE:BXC) Shares Bounce 27% But Its Business Still Trails The Market

BlueLinx Holdings Inc. (NYSE:BXC) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 58%.

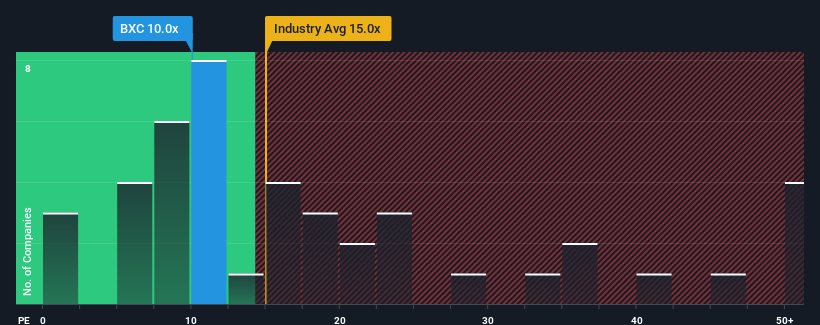

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may still consider BlueLinx Holdings as an attractive investment with its 10x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, BlueLinx Holdings has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for BlueLinx Holdings

What Are Growth Metrics Telling Us About The Low P/E?

BlueLinx Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 69% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 108% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 20% as estimated by the four analysts watching the company. That's not great when the rest of the market is expected to grow by 10%.

With this information, we are not surprised that BlueLinx Holdings is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Despite BlueLinx Holdings' shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of BlueLinx Holdings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for BlueLinx Holdings (1 is a bit concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BlueLinx Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BXC

BlueLinx Holdings

Engages in the distribution of residential and commercial building products in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives