- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Should BWXT's Dual Microreactor and Bulgarian Megaproject Wins Require Action From BWX Technologies (BWXT) Investors?

Reviewed by Sasha Jovanovic

- BWX Technologies, Inc. recently announced it supplied TRISO nuclear fuel to Idaho National Laboratory for the U.S. Army’s Project Pele microreactor and, in a separate development, will provide Owner’s Engineer services in a consortium for Bulgaria’s planned Kozloduy Units 7 and 8, under a long-term contract valued in the hundreds of millions of euros.

- Together, these projects highlight BWXT’s dual role at the frontier of advanced microreactor fuel development and in large-scale international nuclear new-builds, broadening its reach across both next-generation defense applications and civil power infrastructure.

- We’ll now consider how BWXT’s long-term Kozloduy Owner’s Engineer role may influence the company’s pre-existing investment narrative and growth assumptions.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

BWX Technologies Investment Narrative Recap

To own BWX Technologies, you generally need to believe in sustained demand for specialized nuclear capabilities in both defense and civil markets, supported by a large, long-dated backlog. The Kozloduy Owner’s Engineer award reinforces the civil nuclear growth angle, but in my view does not displace the main short term catalyst, which still sits in execution of existing high value contracts and backlog conversion, nor the key risk around potential future shifts in U.S. defense spending.

The Kozloduy Units 7 and 8 Owner’s Engineer contract, spanning around ten years and worth hundreds of millions of euros, looks most relevant here, since it directly expands BWXT’s role in international new build nuclear projects. It fits alongside prior catalysts tied to advanced reactors and life extension work by adding a long duration services stream, while still leaving investors to watch how BWXT manages margin pressure in commercial operations as its mix tilts toward more complex, multi party civil projects.

Yet investors should also be aware that if civil nuclear margins stay under pressure, especially as projects like Kozloduy scale up...

Read the full narrative on BWX Technologies (it's free!)

BWX Technologies' narrative projects $3.9 billion revenue and $494.7 million earnings by 2028. This requires 11.1% yearly revenue growth and about a $200 million earnings increase from $294.4 million today.

Uncover how BWX Technologies' forecasts yield a $216.40 fair value, a 21% upside to its current price.

Exploring Other Perspectives

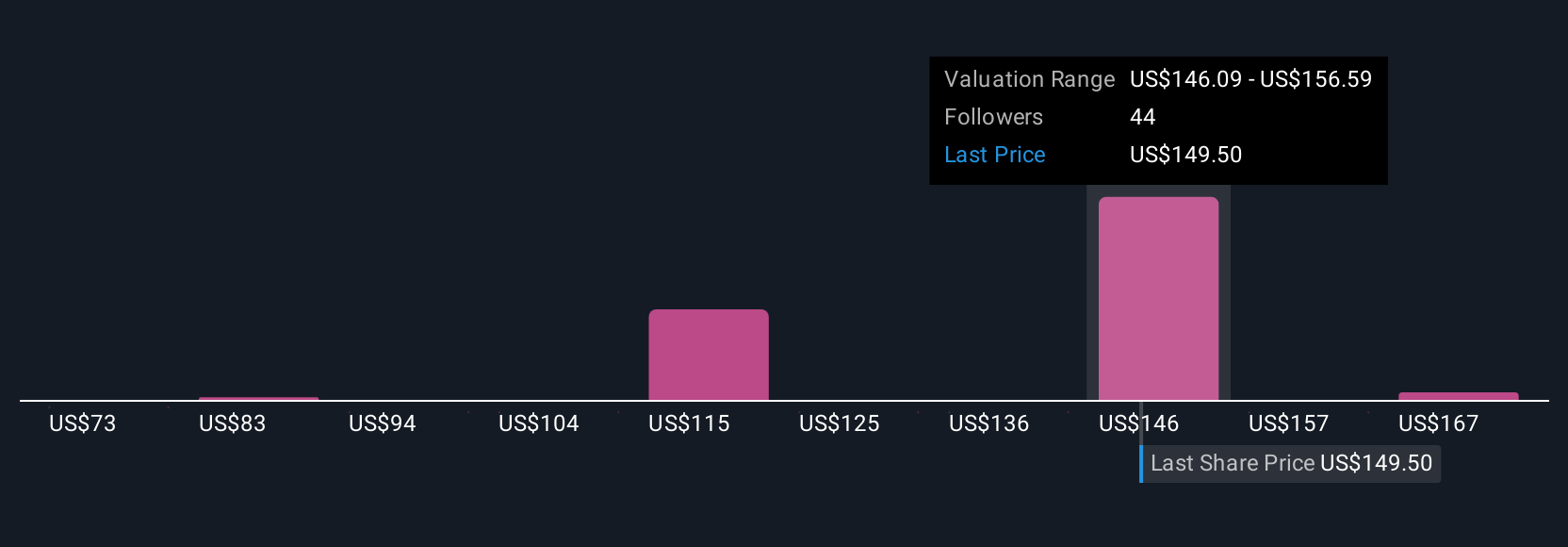

Nine Simply Wall St Community fair value estimates for BWX Technologies range widely from US$120 to US$250, underlining how differently individuals view its prospects. Some are focused on the expanding backlog tied to projects such as Kozloduy and Pele, while others weigh concentration in long term defense work and civil margin risk, so it is worth comparing several of these viewpoints before deciding how the story fits your own expectations.

Explore 9 other fair value estimates on BWX Technologies - why the stock might be worth as much as 40% more than the current price!

Build Your Own BWX Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWX Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BWX Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWX Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026