- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Has BWXT Run Too Far After Its 82% Rally and New Nuclear Contracts in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching BWX Technologies lately, you’re probably wondering whether it's time to hop on board or keep your distance. The stock has been grabbing attention for its impressive performance as well as for its potential going forward. Over the past week, shares jumped 6.9%, while the past month alone saw an eye-catching gain of 20.6%. Year-to-date, BWX Technologies is up a remarkable 82.2%. Its returns over longer periods, such as 62.3% over the last year and more than 275% in both the three- and five-year windows, paint the picture of a company with real staying power.

Part of this strength is linked to steady market demand for defense and nuclear technologies, which has only increased in recent months as geopolitical concerns have dominated headlines. Investors are taking notice, and that surge in demand could signal both growth potential and, perhaps, a shift in how the market perceives risk around the stock.

But before you get swept up in the momentum, let’s talk numbers. Based on six key valuation checks commonly used to spot undervalued stocks, BWX Technologies doesn’t score any points. It is currently undervalued in exactly 0 out of 6 assessments. That might raise eyebrows for anyone looking for a bargain, but as always, there is more to valuation than a single score or metric. Let’s break down how these different approaches measure up, and stay tuned, because at the end we’ll dig into a smarter way to value BWX Technologies that could change your perspective.

BWX Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BWX Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its expected future cash flows and then discounting them back to today’s dollars. This approach is often used to gauge what a business is truly worth based on its real-world earning power over time.

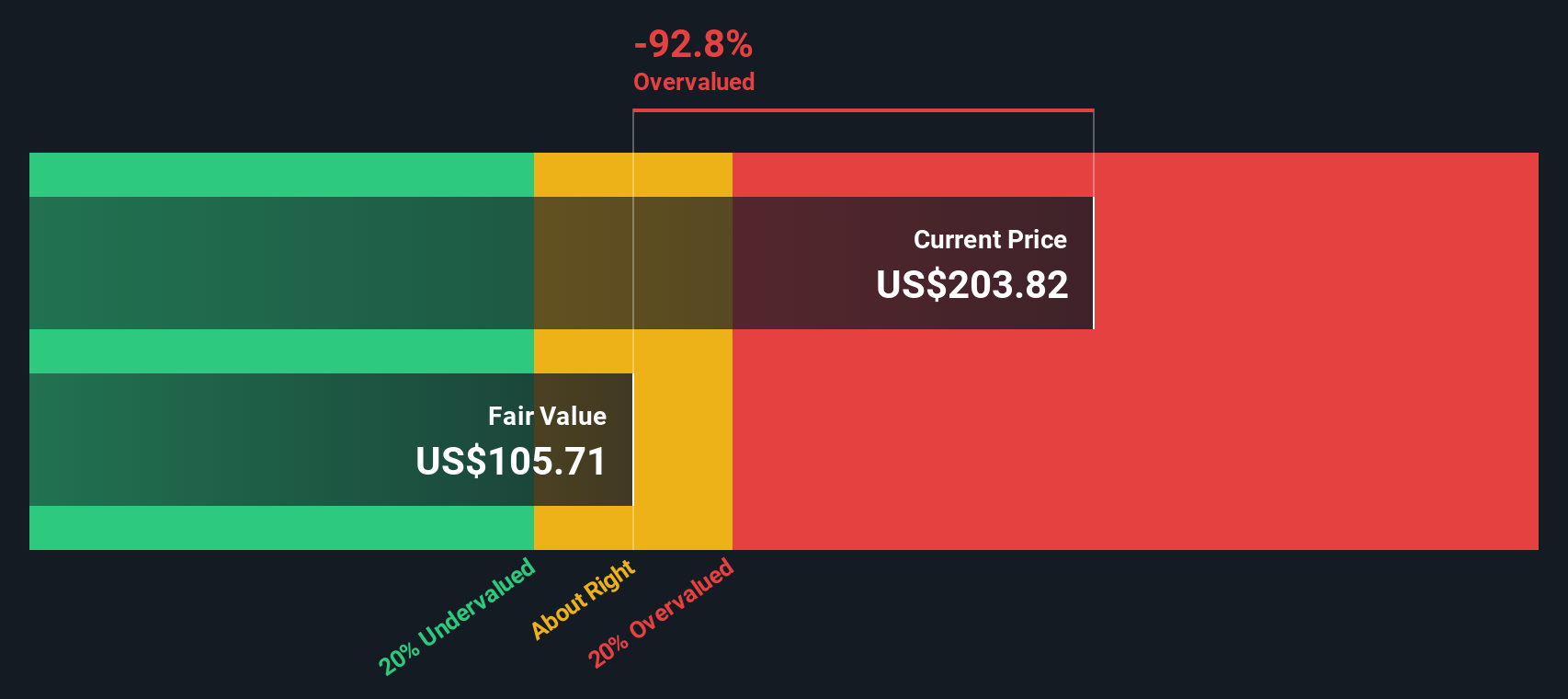

For BWX Technologies, the DCF analysis starts with the latest reported Free Cash Flow, which is $344.8 million. Analysts provide direct estimates for the next several years, and these projections suggest growth in the near term. Notably, by 2028, cash flow is expected to reach about $419.3 million. Beyond these five-year projections, further Free Cash Flow increases are extrapolated, ultimately estimating $641.4 million by 2035, based on reasonable growth assumptions.

Using these numbers, the DCF model calculates a fair value for the shares at $105.88 each. However, the current share price sits almost 92% above this intrinsic value. In clear terms, the stock is trading at a significant premium according to what its cash flow growth can reasonably support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BWX Technologies may be overvalued by 91.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BWX Technologies Price vs Earnings

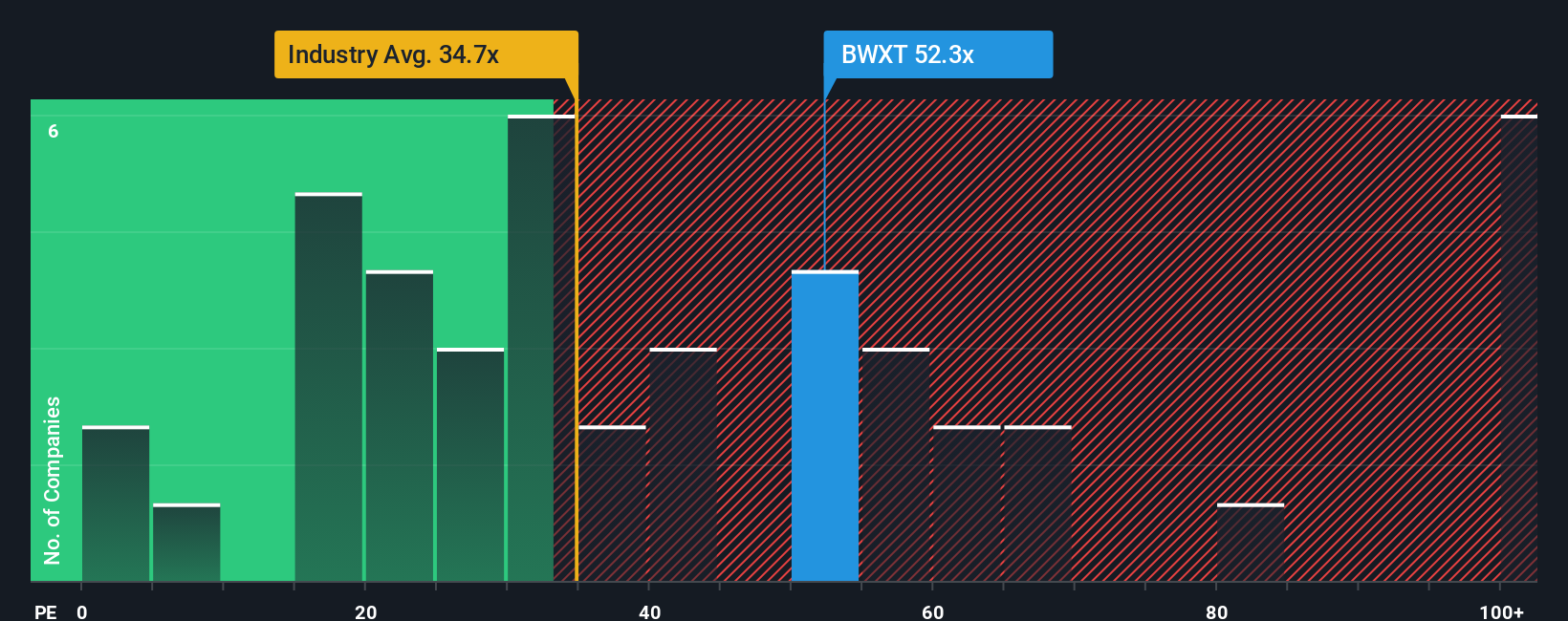

For profitable companies like BWX Technologies, the Price-to-Earnings (PE) ratio is a favored valuation metric. The PE ratio measures how much investors are willing to pay per dollar of company earnings, making it an effective tool for comparing established businesses with strong profit records. Growth expectations and risk play a key role in what a "normal" or "fair" PE should be. Generally, faster-growing or less risky companies can warrant higher PE ratios. Slower-growing or riskier shares typically command lower ones.

Currently, BWX Technologies trades at a PE of 63.1x, which stands out compared to its industry average of 37.5x and a peer average of 35.9x. At a glance, this suggests the stock is priced at a considerable premium relative to both its sector and similar companies.

This is where Simply Wall St's "Fair Ratio" comes in. Unlike basic comparisons with peers or industry averages, the Fair Ratio is a more tailored benchmark. It factors in not only the company’s growth outlook and margins but also its specific industry, risk profile, and market capitalization. For BWX Technologies, the Fair Ratio is calculated at 29.1x, which is significantly below today’s market multiple.

Given the sizable difference between BWX Technologies' current PE and its Fair Ratio, the stock appears substantially overvalued when measured by this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BWX Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful way for you to connect your personal view or story about a company with real financial forecasts and an estimated fair value. This makes your investment decisions more tailored and meaningful.

By creating a Narrative, you can map out what you believe about BWX Technologies’ market position, future revenue, earnings, and margins, and then see how those beliefs translate into a fair value for the stock. This process helps anchor your outlook to specific numbers and gives you context for whether the current share price represents a bargain or a risk.

Best of all, Narratives are easy to use and available now on Simply Wall St’s Community page, where millions of investors regularly share their views. When you set up your own Narrative, it dynamically updates as new data, news, or company results come in. This provides you with an always-fresh perspective.

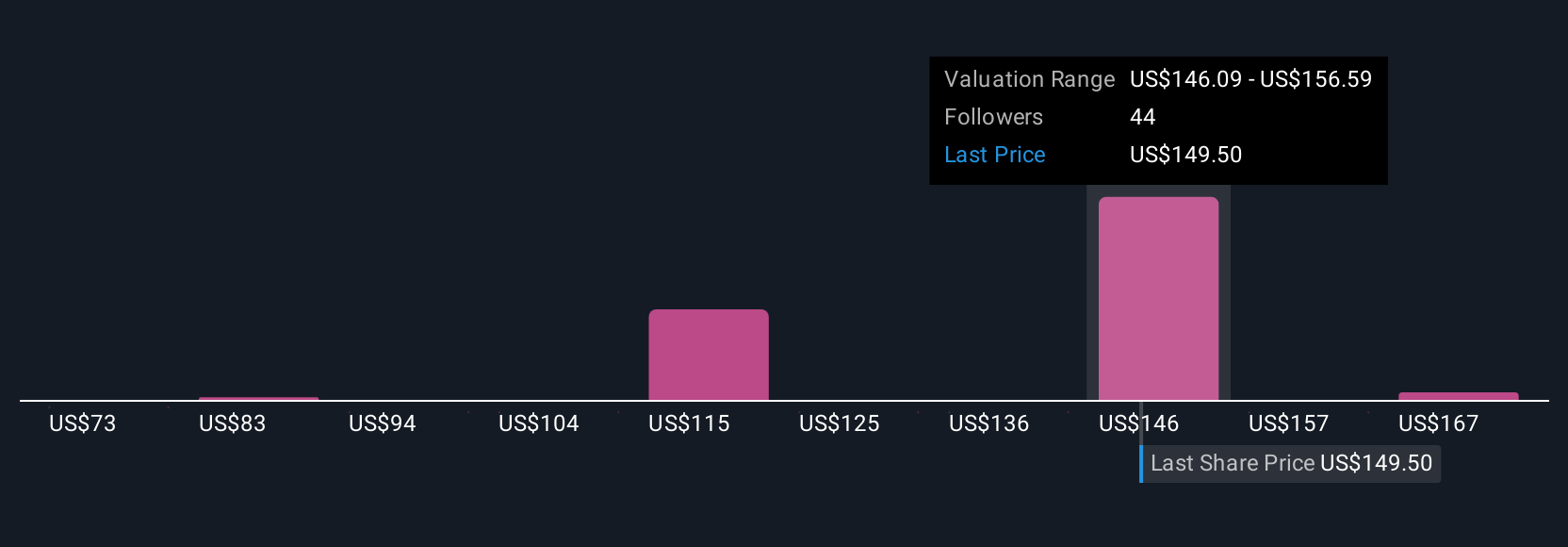

Different investors can have widely different Narratives. For example, some see BWX Technologies' fair value as high as $220 based on robust contract pipelines and acquisitions, while others estimate it as low as $120 due to risks around government funding and margin pressure.

For BWX Technologies, we will make it really easy for you with previews of two leading BWX Technologies Narratives:

Fair Value: $220.00

Current Discount to Fair Value: -7.7%

Revenue Growth Rate Assumed: 16.4%

- The bull case sees sustained long-term growth driven by strong demand for small modular reactors (SMRs) in North America and a government policy tailwind for nuclear energy.

- BWXT’s near monopoly on nuclear propulsion contracts for submarines and aircraft carriers ensures reliable, recurring government revenue. This is further supported by new commercial ventures and acquisitions in medical isotopes.

- Key short-term risks revolve around government funding uncertainties as well as regulatory or public perception hurdles affecting nuclear energy expansion.

Fair Value: $192.10

Current Premium to Fair Value: 5.7%

Revenue Growth Rate Assumed: 11.4%

- The bear case highlights strong government and energy demand driving recurring revenue but notes risks from overreliance on multi-year defense contracts and commercial sector volatility.

- Significant contract wins, nuclear fuel advancements, and expansion into new markets are offset by ongoing margin pressure in commercial operations and reliance on a skilled workforce.

- Analysts’ price targets rely on forecasting high future earnings and sustained valuation multiples, but there is disagreement. Any changes in defense spending or the regulatory environment could impact future returns.

Do you think there's more to the story for BWX Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives