- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Does Record Backlog and Raised Guidance Change the Bull Case for BWX Technologies (BWXT)?

Reviewed by Simply Wall St

- BWX Technologies reported strong second quarter 2025 results, including US$764.04 million in sales and US$78.39 million in net income, alongside an increase in its full-year revenue guidance to US$3.1 billion and the announcement of a US$0.25 per share dividend.

- The company’s backlog reached a record US$6 billion after recent contract wins, highlighting exceptional demand momentum across both government and commercial segments.

- We'll explore how BWXT's raised annual guidance and record backlog affect its long-term growth outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

BWX Technologies Investment Narrative Recap

To be a BWX Technologies shareholder, you need confidence in the company's ability to capitalize on growing demand for advanced nuclear technologies and maintain a strong flow of government and commercial contracts. The recent surge in the backlog to US$6 billion and upward revision of revenue guidance amplify the near-term growth catalyst: robust project wins and expanded opportunities. However, dependency on government contracts remains the biggest risk, and recent results do not materially change this dynamic.

Among the recent announcements, the start of fabrication for the Pele microreactor core stands out. This aligns with demand drivers in the government segment and highlights the relevance of BWXT’s pipeline of advanced nuclear projects to its growth outlook. For investors, the pace and reliability of government-related initiatives continue to play a crucial part in the investment case.

Yet, despite all this momentum, investors should not overlook that changes in government funding or policy could quickly disrupt even the largest of backlogs...

Read the full narrative on BWX Technologies (it's free!)

BWX Technologies' outlook anticipates $3.7 billion in revenue and $445.4 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 10.2% and a $156.5 million increase in earnings from the current level of $288.9 million.

Uncover how BWX Technologies' forecasts yield a $148.30 fair value, a 4% downside to its current price.

Exploring Other Perspectives

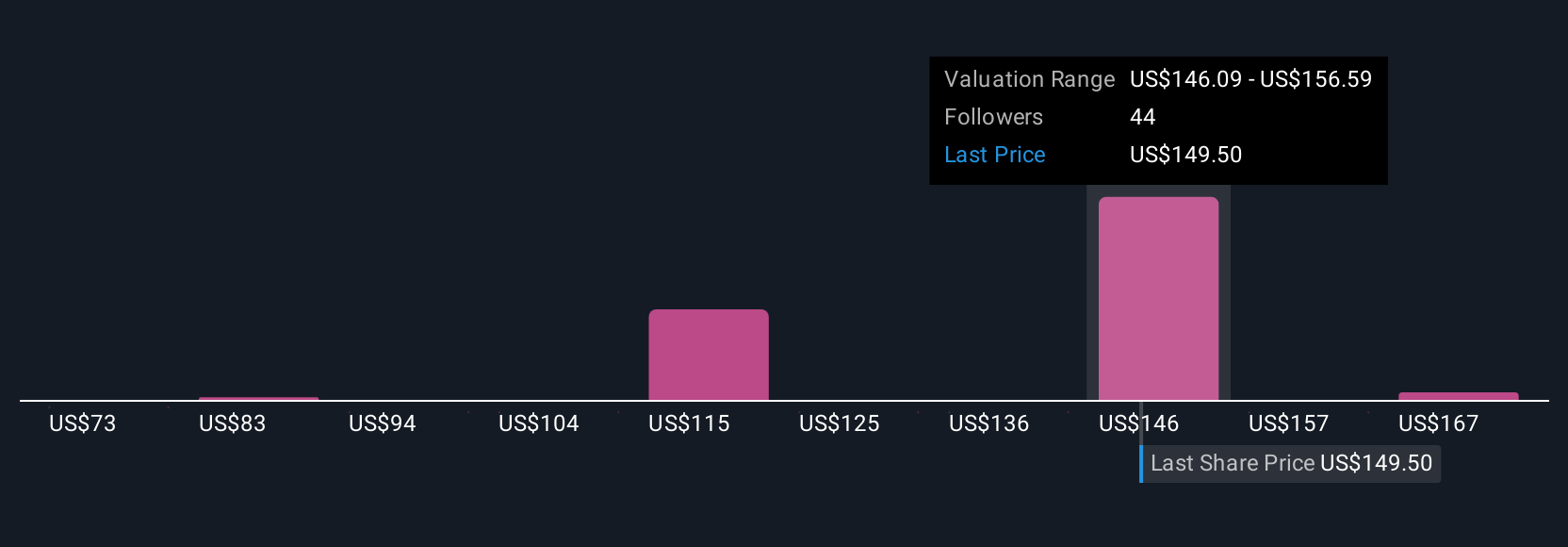

Seven fair value estimates from the Simply Wall St Community span US$72.55 to US$177.60 per share, reflecting wide perspectives on BWXT’s earnings growth potential. With government contract dependency still a central risk, you can see how opinions can vary and why it pays to consider multiple viewpoints.

Explore 7 other fair value estimates on BWX Technologies - why the stock might be worth as much as 15% more than the current price!

Build Your Own BWX Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free BWX Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWX Technologies' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.