- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT) Is Up 5.4% After Winning $1.6 Billion DOE Uranium Plant Contract Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- BWX Technologies, Inc. recently announced it has secured a 10-year contract valued at US$1.6 billion from the Department of Energy’s National Nuclear Security Administration to build and operate a high purity depleted uranium manufacturing plant in Jonesborough, Tennessee, expected to produce up to 300 metric tons annually for national security purposes.

- This contract establishes BWXT’s Jonesborough site as the only active facility in the country capable of producing this critical material for the government, while also creating approximately 175 highly skilled jobs and supporting ongoing advancements in environmental sustainability.

- We’ll explore how BWXT’s role as the government’s exclusive HPDU supplier could reshape its long-term revenue visibility and competitive advantages.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

BWX Technologies Investment Narrative Recap

To be a shareholder in BWX Technologies, you need to believe in the long-term stability and growth potential arising from its critical role in U.S. national security and advanced nuclear solutions. While the recent US$1.6 billion Department of Energy contract enhances long-term revenue visibility, it does not materially change the most important short-term catalyst, ongoing execution of major Navy propulsion contracts, or fully eliminate the key risk of sharp revenue and earnings swings tied to changes in government contract cycles.

Among the company’s announcements, the earlier September win of a US$1.5 billion NNSA contract to establish domestic uranium enrichment capability is highly relevant. Together with the new HPDU plant, this positions BWXT at the center of multiple high-value, multi-decade government nuclear programs, shaping both its catalyst profile and future competitive standing.

However, against this promising outlook, investors should also be aware of the potential consequences if BWXT's revenue concentration in government defense contracts ...

Read the full narrative on BWX Technologies (it's free!)

BWX Technologies' outlook anticipates $3.9 billion in revenue and $494.7 million in earnings by 2028. This implies an annual revenue growth rate of 11.1% and a $200.3 million increase in earnings from the current $294.4 million.

Uncover how BWX Technologies' forecasts yield a $190.00 fair value, in line with its current price.

Exploring Other Perspectives

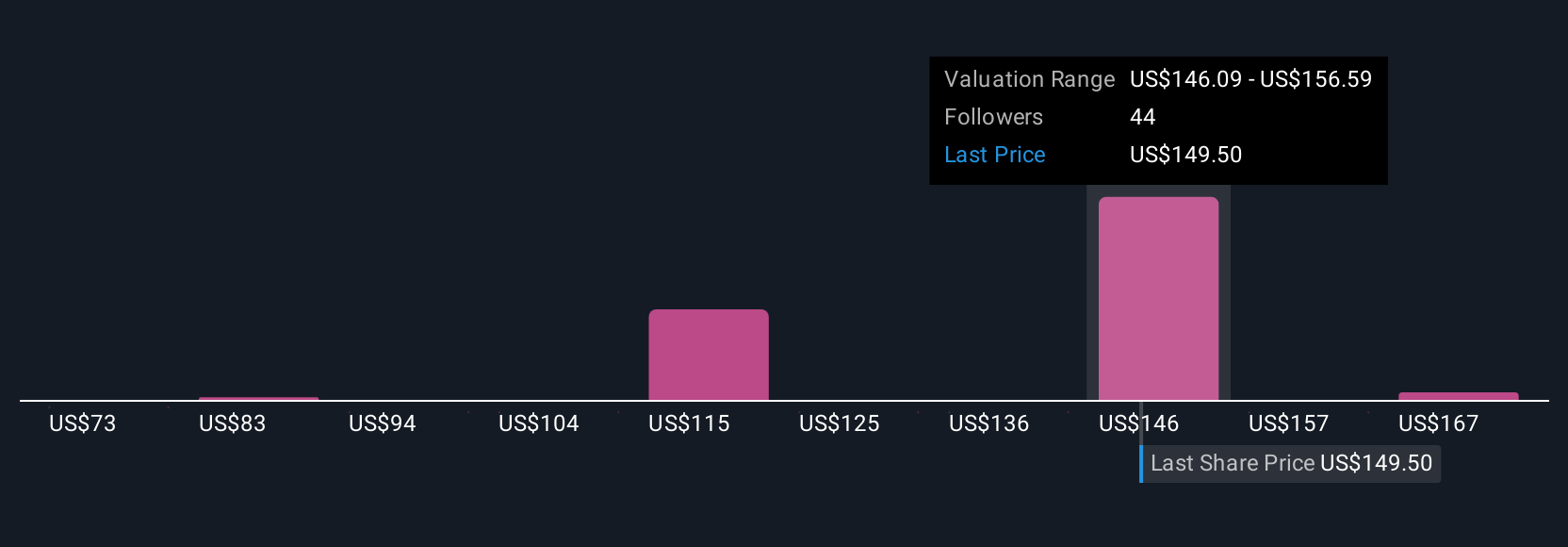

Ten retail investors in the Simply Wall St Community pegged BWX Technologies’ fair value between US$84.62 and US$250. Major government contract wins remain crucial for BWXT, highlighting how diverse outlooks reflect real business dependencies driving performance today.

Explore 10 other fair value estimates on BWX Technologies - why the stock might be worth as much as 35% more than the current price!

Build Your Own BWX Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free BWX Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWX Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives