- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT): Evaluating Valuation as New Chief Strategy Officer Joins with Boeing and Northrop Experience

Reviewed by Simply Wall St

BWX Technologies (NYSE:BWXT) has just shaken up its executive team, naming Rik Geiersbach as its new chief strategy officer. Geiersbach steps into this critical role after a distinguished tenure leading strategy and corporate development at Boeing, where he oversaw sizable defense and space initiatives. His appointment signals BWXT’s intent to accelerate its strategic growth roadmap, and investors are watching closely to see how his track record in launching new business directions will play out here.

While the focus is on this leadership change, the bigger picture for BWX Technologies also matters. After powering through a 71% gain over the past year, with momentum remaining strong and up 24% in the past three months, the stock has caught attention for its ability to outpace both its sector and broader market rivals. This performance has come alongside solid annual revenue and earnings growth, giving optimism to anyone considering the stock’s potential for further upside.

With such a strong run and a fresh strategy leader at the helm, is BWX Technologies still undervalued or is the market already baking in the next phase of growth?

Most Popular Narrative: 9.8% Undervalued

The most followed narrative currently suggests that BWX Technologies is undervalued at present prices, with analysts seeing notable upside potential based on its earnings growth outlook and strategic positioning.

Accelerating activity in advanced commercial nuclear (CANDU life extensions, international new builds, AP1000, SMRs) and acceptance of the first U.S. SMR construction permit have increased BWXT's addressable market. This positions the company to benefit from the global energy transition and policy incentives, which could drive significant, high-margin backlog and top-line growth.

Want to uncover the powerhouse projections fueling this valuation? The future value calculation relies on earnings momentum, powerful margin forecasts, and a profit multiple that hints at growth ambitions. What ambitious numbers are baked in? Dive deeper to uncover the financial engine behind this target.

Result: Fair Value of $181.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, reliance on long-term government contracts and fluctuations in commercial nuclear demand could quickly change the outlook and reduce the optimistic case.

Find out about the key risks to this BWX Technologies narrative.Another View: Are Market Comparisons Telling a Different Story?

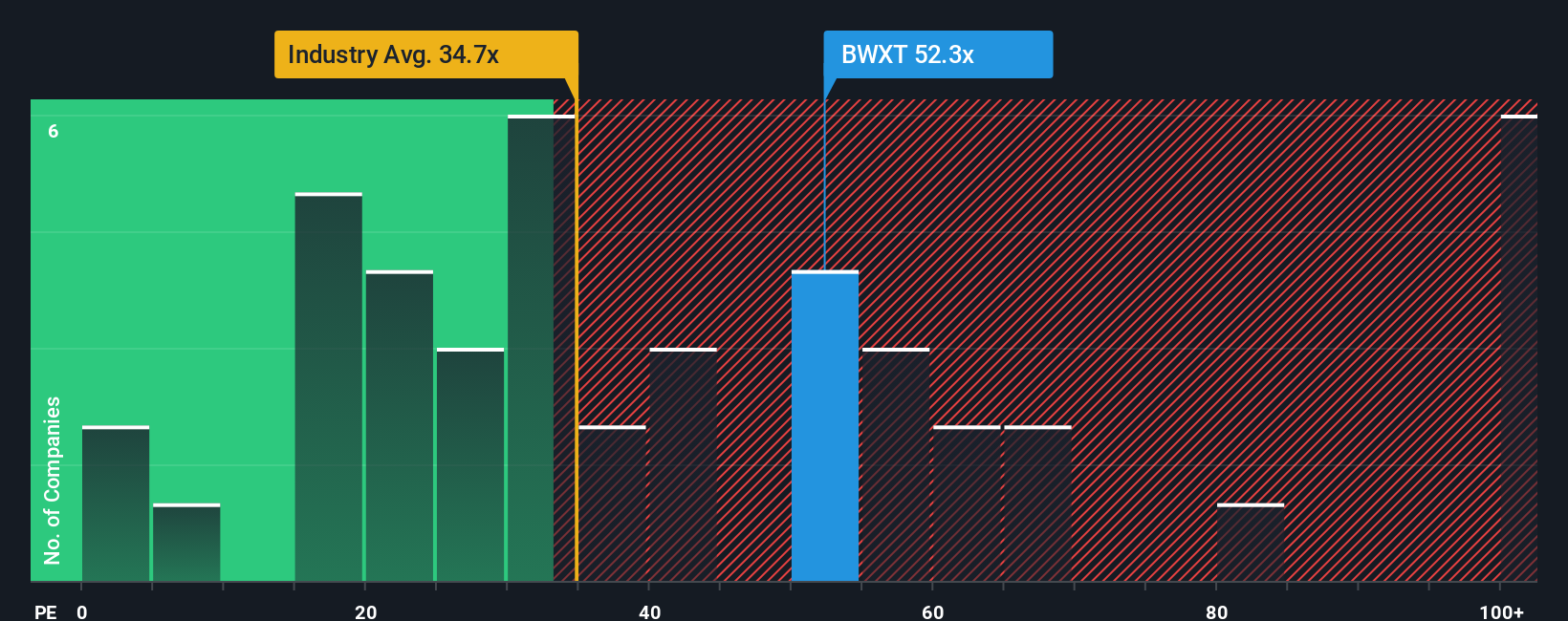

Looking at how the company trades relative to others in its industry brings a more cautious perspective. By this method, shares appear expensive for what the business currently delivers. Does this signal that future growth is already fully priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding BWX Technologies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own BWX Technologies Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can build your own perspective in just minutes. Do it your way

A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for Your Next Smart Move?

Opportunities are everywhere for investors who keep a sharp eye on the market. Don’t wait for the crowd to notice. Put yourself ahead with powerful stock ideas built with the Simply Wall Street Screener.

- Uncover tomorrow’s standout bargains with undervalued stocks based on cash flows and see which companies could be poised for a dramatic turnaround.

- Ride the wave of innovation by tapping into AI penny stocks where today’s tech leaders and disruptors are already shaping the future.

- Boost your income strategy by targeting long-term yields through dividend stocks with yields > 3% packed with strong, consistent dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives