- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT): Evaluating Valuation After $1.6 Billion Department of Energy Nuclear Contract Announcement

Reviewed by Kshitija Bhandaru

BWX Technologies (NYSE:BWXT) is making headlines after securing a 10-year, $1.6 billion contract from the Department of Energy. This agreement positions the company to build and manage the nation’s only facility producing high-purity depleted uranium.

See our latest analysis for BWX Technologies.

BWX Technologies’ share price momentum has been steady this year, supported by recent contract wins such as the $1.6 billion Department of Energy deal and anticipation for its upcoming Q3 results. Over the past year, the company delivered a 0.6% total shareholder return, reflecting investor confidence in its growth potential and ongoing national security projects.

If BWXT’s contract-driven progress has you thinking bigger, now is a great time to discover See the full list for free.

With shares up nearly 60% over the past year and analyst targets just above current levels, investors may wonder if BWX Technologies' strong prospects leave room for further upside or if the market has already priced in future growth.

Most Popular Narrative: 15.2% Undervalued

According to clillz, BWX Technologies' fair value sits well above the latest closing price, suggesting room for investor optimism despite recent highs. This narrative points out industry trends and consolidations as key forces that may shape future gains.

Having a ‘monopoly’ on government contracts regarding nuclear reactor engines on submarines and aircraft carriers helps position BWXT for all government related news in the industry. Being the only contractor that develops, manufactures and maintains the engines for those vehicles almost guarantees consistent multi-billion dollars in contracts from the DoD.

Curious about what’s fueling this bullish valuation? One crucial forecast anchors the narrative: there are aggressive assumptions for future growth and margins that hinge on government spending and industry consolidation. Discover the surprising scenario that backs this fair value and see if you agree with the narrative’s bold predictions.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any cuts to defense spending or regulatory pressures could quickly undermine BWX Technologies’ growth forecasts and prompt market volatility.

Find out about the key risks to this BWX Technologies narrative.

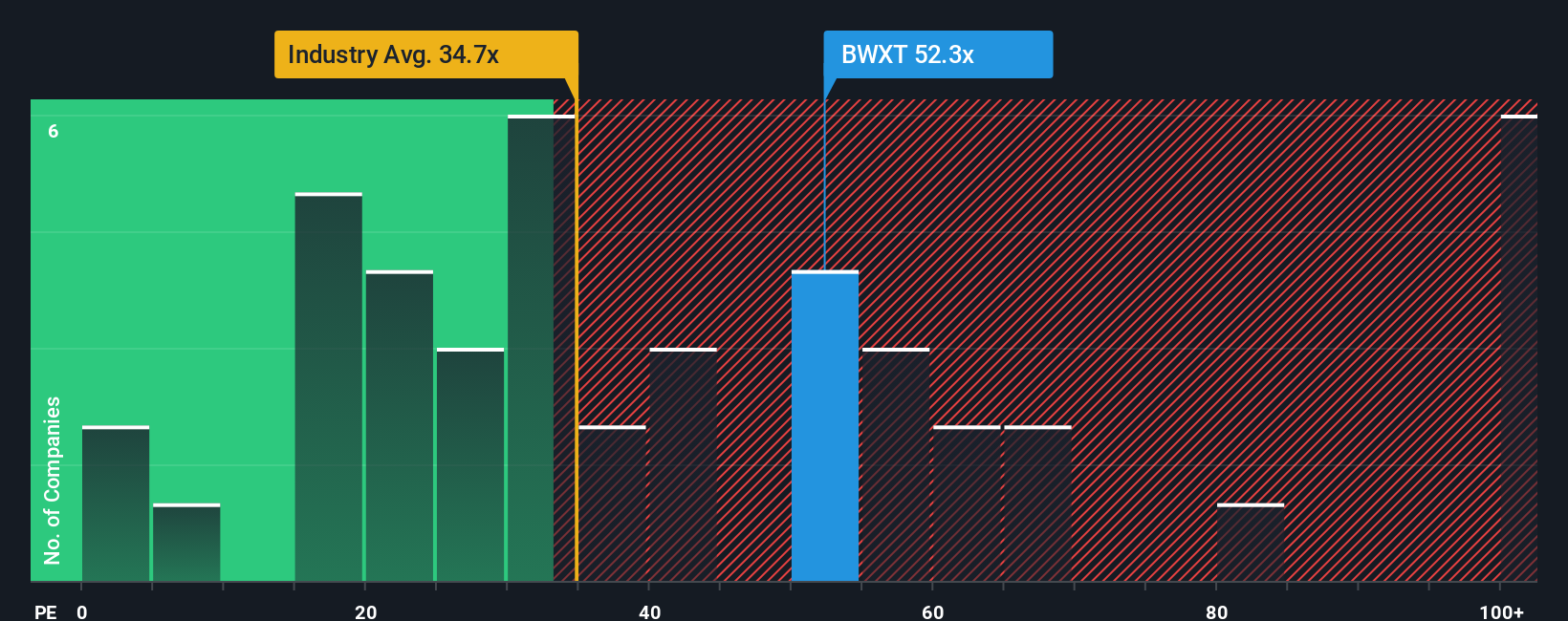

Another View: Market Ratios Flash a Caution Light

Looking from another angle, the company’s price-to-earnings ratio stands at 58x, which is significantly higher than both the US Aerospace and Defense industry average of 39.1x and the estimated fair ratio of 29.9x. This elevated premium suggests investors are paying up for future growth, but it also introduces added valuation risk if expectations are not met. Has the surge in optimism pushed share prices too far, too fast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

There’s always more to the story. If you want to dig into the numbers or craft your own perspective, you can build a narrative in just a few minutes: Do it your way.

A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for just one winning idea? Expand your horizons and set yourself up for greater success by exploring new trends through these exclusive investment opportunities:

- Tap into stocks redefining AI in healthcare by checking out these 32 healthcare AI stocks. This screener highlights innovative companies at the forefront of medical technology.

- Unlock the potential of steady income streams by scanning these 19 dividend stocks with yields > 3%, which features high-yield picks for strong, reliable dividend growth.

- Kickstart your search for undervalued gems that might be flying under the radar with these 896 undervalued stocks based on cash flows and get an edge in finding bargains before they break out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.