- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT): Assessing Valuation Following Record Backlog and Upbeat Full-Year Outlook

Reviewed by Simply Wall St

BWX Technologies (BWXT) just posted its latest earnings report, highlighting a record $6 billion backlog, sizable year-over-year growth in both earnings and revenue, and an improved outlook for the rest of the year.

See our latest analysis for BWX Technologies.

BWX Technologies shares have been on a tear, with a 71.5% year-to-date share price return and a stellar 56.8% total shareholder return over the past twelve months. Momentum is clearly building, fueled by the company’s record government contracts, progress in advanced space-nuclear projects, and an upbeat outlook. However, today’s post-earnings pullback puts the latest share price at $191.17.

If BWX’s string of wins has you curious about what else is making moves in the sector, now is the perfect time to scan the landscape of companies with strong defense and aerospace credentials—See the full list for free.

With such impressive results and strong guidance, is BWXT still an attractive buy at these levels, or is the market already factoring in all the future upside?Most Popular Narrative: 13.1% Undervalued

According to clillz, BWX Technologies shares may have more room to run, with a fair value estimate that sits comfortably above the latest closing price. The narrative argues that recent moves in mergers, industry positioning, and government contracts could support much stronger long-term growth than the current market seems to expect.

Having a ‘monopoly’ on government contracts regarding nuclear reactor engines on submarines and aircraft carriers helps position BWXT for all government related news in the industry. Being the only contractor that develops, manufactures and maintains the engines for those vehicles almost guarantees consistent multi-billion dollars in contracts from the DoD.

Want to know what drives this lofty valuation? It’s not just the backlog or recent acquisitions. The heart of this narrative is a bullish view on profit margins and consistent long-term government spending. Wondering how these projections stack up against sector norms? Dive deeper to find out—there’s more than one surprise in the numbers that build this fair value.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in government funding or increased regulatory scrutiny could quickly dampen the positive outlook and present challenges for BWXT's long-term growth prospects.

Find out about the key risks to this BWX Technologies narrative.

Another View: Market Multiples Tell a Different Story

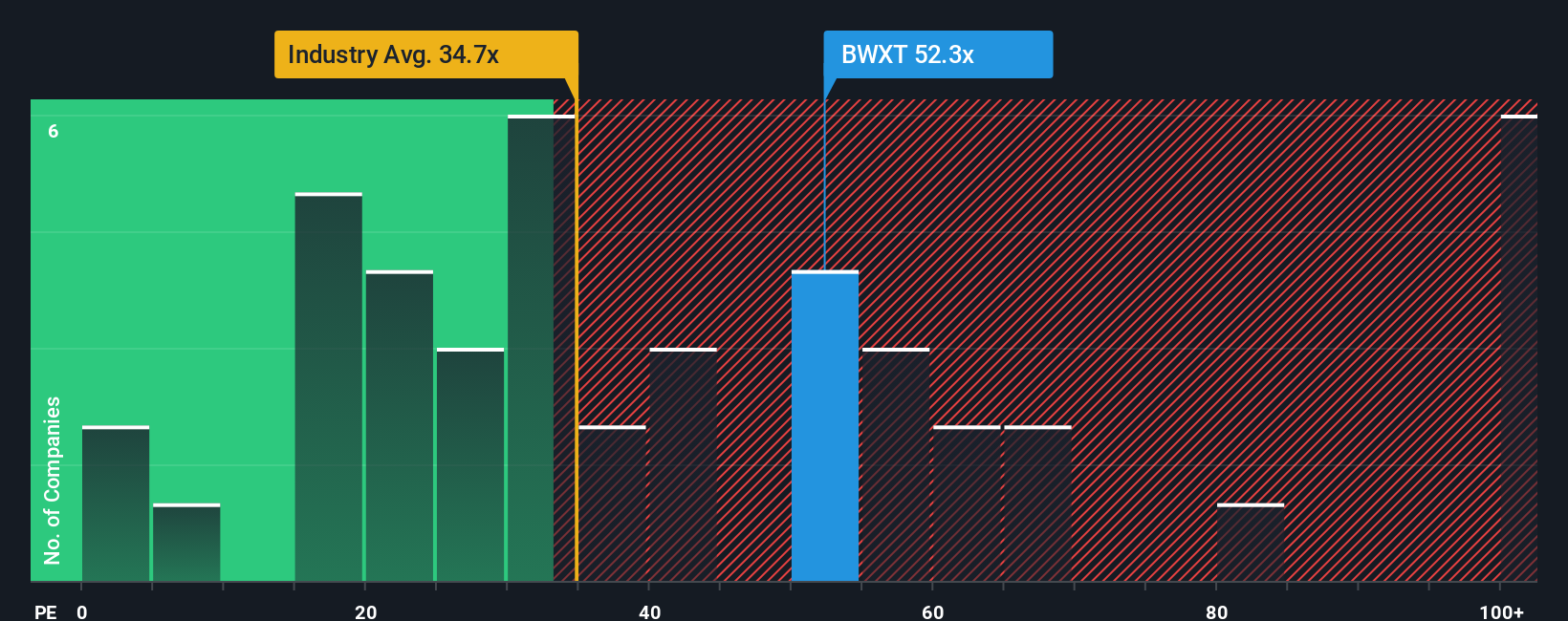

While the popular narrative spotlights long-term growth and a higher fair value, market multiples paint a much less forgiving picture. BWXT trades at a price-to-earnings ratio of 59.4 times, far above both its industry average of 39 times and a calculated fair ratio of 29.2. That premium suggests investors are already baking in a lot of optimism, which raises the stakes if results or growth underwhelm. Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

If you see things differently or trust your own analysis more, it takes less than three minutes to build your own perspective on BWX Technologies. Do it your way

A great starting point for your BWX Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop growing their watchlist. Access fresh opportunities that many others miss by using the Simply Wall Street Screener, your shortcut to smarter stock picks and long-term gains.

- Uncover high-yield potential by checking out these 17 dividend stocks with yields > 3% now paying returns above market averages and rewarding shareholders with reliable income.

- Spot emerging trends early as you browse these 26 AI penny stocks driving breakthroughs in AI solutions and transforming major industries before the broader market catches on.

- Boost your value strategy by tapping into these 874 undervalued stocks based on cash flows hidden gems trading below their intrinsic worth, waiting to be recognized by savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives