- United States

- /

- Building

- /

- NYSE:BLDR

Will Analyst Downgrades and Weak Earnings Forecasts Change Builders FirstSource's (BLDR) Narrative?

Reviewed by Simply Wall St

- In the past week, Builders FirstSource has seen increased analyst pessimism amid expectations of a significant decline in upcoming earnings per share and revenue.

- The company's current Zacks Rank of #5 (Strong Sell) highlights a shift in analyst sentiment that could influence investor expectations ahead of its earnings announcement.

- With analysts forecasting a substantial drop in earnings, we'll assess how this development could shift Builders FirstSource's investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Builders FirstSource Investment Narrative Recap

To hold Builders FirstSource shares, investors must believe in a cyclical recovery in U.S. home construction and the company’s ability to grow through market share gains and digital initiatives. The recent analyst pessimism, citing expected significant declines in earnings and revenue, challenges confidence in a near-term earnings rebound and highlights the ongoing risk of housing market softness and unpredictable demand. While this negative sentiment may influence short-term momentum, the core investment thesis centered on longer-term housing trends remains largely intact for now.

Among recent announcements, Builders FirstSource’s July 2025 reduction in earnings guidance, from prior expectations of US$16.05–17.05 billion in sales to US$14.8–15.6 billion, stands out as having immediate relevance. This guidance cut directly aligns with analysts' downgraded estimates, reinforcing concerns around softness in housing starts and commodity-driven margin pressures, which are currently the biggest headwinds for the business.

However, what’s less clear is how ongoing volatility in single-family housing starts could affect...

Read the full narrative on Builders FirstSource (it's free!)

Builders FirstSource's narrative projects $16.4 billion in revenue and $684.5 million in earnings by 2028. This requires a 0.9% yearly revenue decline and a $71.9 million decrease in earnings from $756.4 million.

Uncover how Builders FirstSource's forecasts yield a $140.32 fair value, in line with its current price.

Exploring Other Perspectives

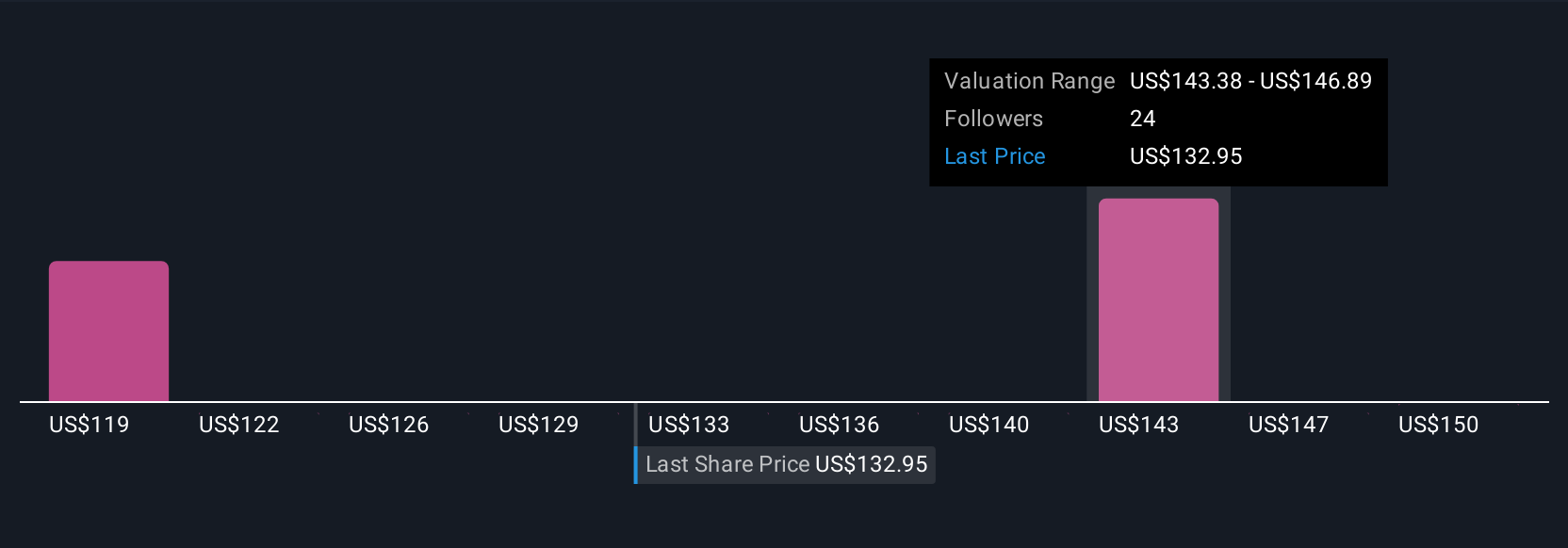

Three private investors in the Simply Wall St Community provided fair value estimates for Builders FirstSource ranging from US$119.86 to US$153.90. With recent analyst downgrades and reduced company guidance reflecting concerns about slower housing starts, now is an important time to see how investor opinions can widely differ and explore several alternative viewpoints.

Explore 3 other fair value estimates on Builders FirstSource - why the stock might be worth 16% less than the current price!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

No Opportunity In Builders FirstSource?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives