Stock Analysis

- United States

- /

- Building

- /

- NYSE:BLDR

Analysts Have Just Cut Their Builders FirstSource, Inc. (NYSE:BLDR) Revenue Estimates By 6.3%

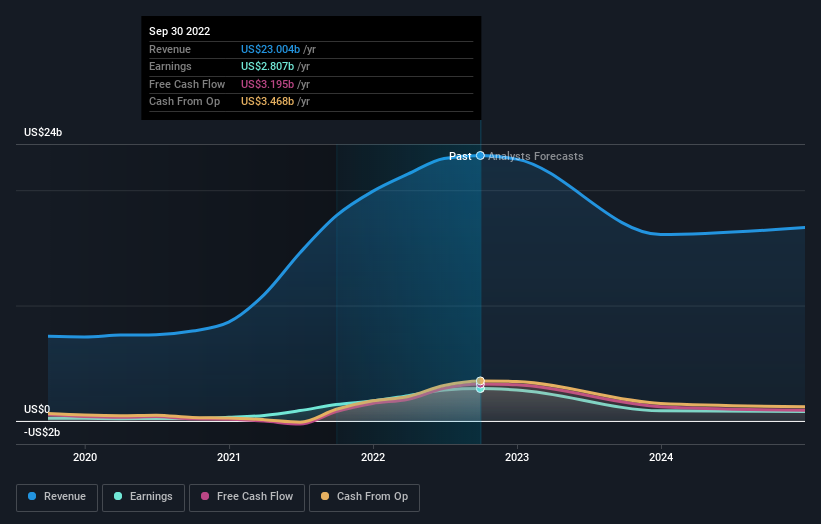

Today is shaping up negative for Builders FirstSource, Inc. (NYSE:BLDR) shareholders, with the analysts delivering a substantial negative revision to next year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Bidders are definitely seeing a different story, with the stock price of US$63.12 reflecting a 11% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

Following the latest downgrade, the 13 analysts covering Builders FirstSource provided consensus estimates of US$16b revenue in 2023, which would reflect a concerning 30% decline on its sales over the past 12 months. Before the latest update, the analysts were foreseeing US$17b of revenue in 2023. The forecasts seem less optimistic overall, with the slight decrease in revenue estimates in the latest consensus update.

Check out the opportunities and risks within the US Building industry.

The consensus price target fell 11% to US$78.36, with the analysts clearly less optimistic about Builders FirstSource's valuation following this update. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Builders FirstSource, with the most bullish analyst valuing it at US$95.00 and the most bearish at US$66.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 25% by the end of 2023. This indicates a significant reduction from annual growth of 29% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.0% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Builders FirstSource is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for next year. They also expect company revenue to perform worse than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Given the stark change in sentiment, we'd understand if investors became more cautious on Builders FirstSource after today.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Builders FirstSource, including a weak balance sheet. Learn more, and discover the 1 other flag we've identified, for free on our platform here.

We also provide an overview of the Builders FirstSource Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Valuation is complex, but we're helping make it simple.

Find out whether Builders FirstSource is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Very undervalued with adequate balance sheet.