- United States

- /

- Aerospace & Defense

- /

- NYSE:BETA

BETA Technologies (BETA) Deepening Losses Undercut High-Growth Narrative Heading Into Q3 2025

Reviewed by Simply Wall St

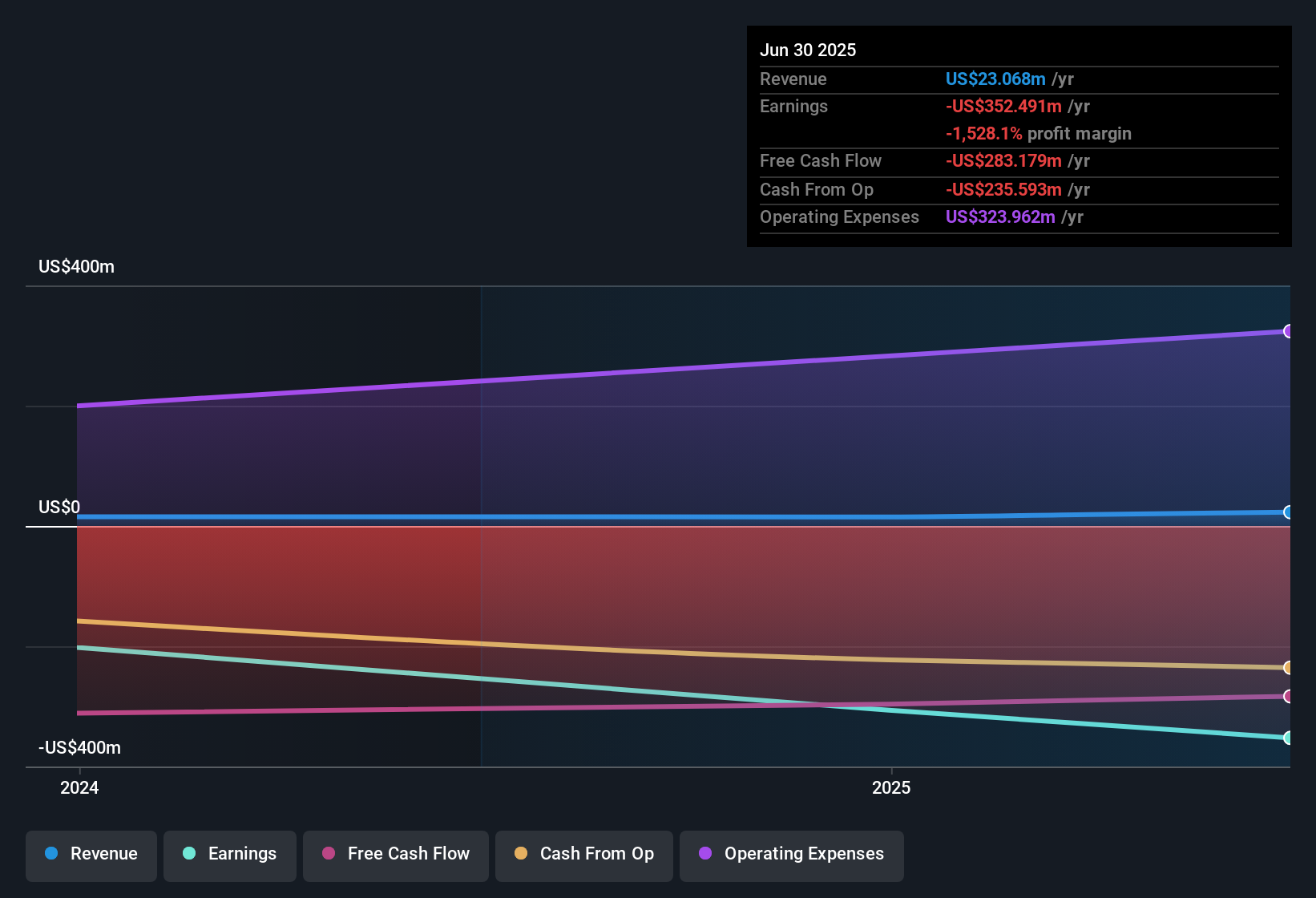

BETA Technologies (BETA) just posted another loss-making quarter, with Q2 2025 revenue of about $7.8 million and basic EPS of roughly -$12.78, setting the tone for investors heading into the Q3 2025 update at a share price of $29.84. The company has seen revenue climb from around $3.8 million in early 2024 to $7.8 million in early 2025, while EPS deteriorated from about -$9.69 to -$12.78 and trailing twelve month net income slid from roughly -$201.9 million to -$352.5 million. This combination highlights both rapid top line expansion and deepening losses. With revenue increasing but margins still heavily negative, this earnings season focuses on whether investors believe that growth can eventually offset the burn.

See our full analysis for BETA Technologies.With the headline numbers on the table, the next step is to compare them with the most common market narratives around BETA Technologies and evaluate which stories still hold and which ones the latest results start to undermine.

Curious how numbers become stories that shape markets? Explore Community Narratives

51.5% revenue growth, losses deepen

- Over the last 12 months, revenue reached about $23.1 million while trailing net losses widened to roughly $352.5 million and basic EPS over that period fell to about negative $49.39.

- Consensus narrative notes a strong growth story, with revenue up 51.5% year over year and forecast to grow about 63.9% annually, yet

- the same data set shows the company is expected to remain unprofitable for at least the next three years with earnings forecast to decline around 1.8% per year, which leans against the idea that scale is quickly improving economics,

- and the combination of higher revenue and larger trailing losses highlights how growth so far has not yet translated into improving margins, which is an important check on any simple high growth equals easy upside argument.

Cash runway under one year

- Analysis flags less than 12 months of cash runway on top of trailing 12 month net losses of about $352.5 million and negative equity signaled by a negative price to book multiple of roughly negative 5.9 times compared with peers at 4.3 times and the industry at 3.4 times.

- Bears argue that limited cash and ongoing losses dominate the story, and the numbers give that view real weight because

- continued unprofitability is forecast over at least the next three years, so that sub one year runway sits alongside no near term path to positive earnings in the current projections,

- and highly illiquid trading conditions mean raising equity or absorbing large new investors could be more difficult, which fits a cautious take that financing risk is central to how this stock trades.

26.9% upside vs share price

- Analysts’ average target of about $37.88 sits roughly 27% above the current share price of $29.84 even as trailing losses of about $352.5 million keep EPS at roughly negative $49.39 on a 12 month basis.

- What is striking is how a more optimistic, growth focused narrative coexists with stressed fundamentals because

- the same analysis that points to approximately 26.9% upside also acknowledges forecast earnings declining around 1.8% per year and persistent losses over the next three years,

- while revenue growth expectations of roughly 63.9% per year imply that analysts are effectively betting that the top line trajectory will eventually matter more than today’s negative margins, a tension that long term holders need to be comfortable with.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BETA Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

BETA Technologies combines rapid revenue growth with deepening losses, a short cash runway and negative equity, leaving investors heavily exposed to balance sheet and financing risk.

If those fragilities concern you, use our solid balance sheet and fundamentals stocks screener (1940 results) today to quickly filter for businesses with stronger finances, better liquidity and resilience that can better withstand prolonged uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BETA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BETA

BETA Technologies

Designs, develops, and manufactures electric aircraft platform and propulsion systems for the aviation industry in the United States.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026