- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE): Assessing Valuation After a Sharp Year-to-Date Share Price Rerating

Reviewed by Simply Wall St

Recent performance and what is driving interest

Bloom Energy (BE) has quietly turned into a strong momentum story, with the stock up nearly 3% over the past week and almost tripling so far this year, far outpacing broader clean energy peers.

See our latest analysis for Bloom Energy.

Zooming out, Bloom Energy’s 294.78% year to date share price return and 281.24% one year total shareholder return show strong, building momentum as investors reprice its growth and risk profile.

If Bloom’s surge has you thinking more broadly about clean and tech enabled energy, it could be worth exploring fast growing stocks with high insider ownership for other fast moving opportunities.

But after such a sharp rerating, is Bloom Energy still trading at a meaningful discount to its fundamentals and analyst targets, or has the market already priced in most of the company’s future growth potential?

Most Popular Narrative Narrative: 18% Undervalued

With Bloom Energy last closing at $92.26 versus a narrative fair value of $112.50, the most followed view sees meaningful upside still on the table.

Ongoing product cost reductions and digital-twin-enabled operational improvements, fueled by AI-driven analytics from a large installed base, are lowering cost per watt and raising manufacturing efficiency, poised to drive continued operating margin and net margin expansion.

Want to see what kind of growth runway and profit transformation justify that higher value, plus the earnings multiple it assumes the market will pay?

Result: Fair Value of $112.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in manufacturing expansion or faster adoption of cheaper zero emissions alternatives could squeeze Bloom’s margins and challenge the current growth narrative.

Find out about the key risks to this Bloom Energy narrative.

Another Lens On Valuation

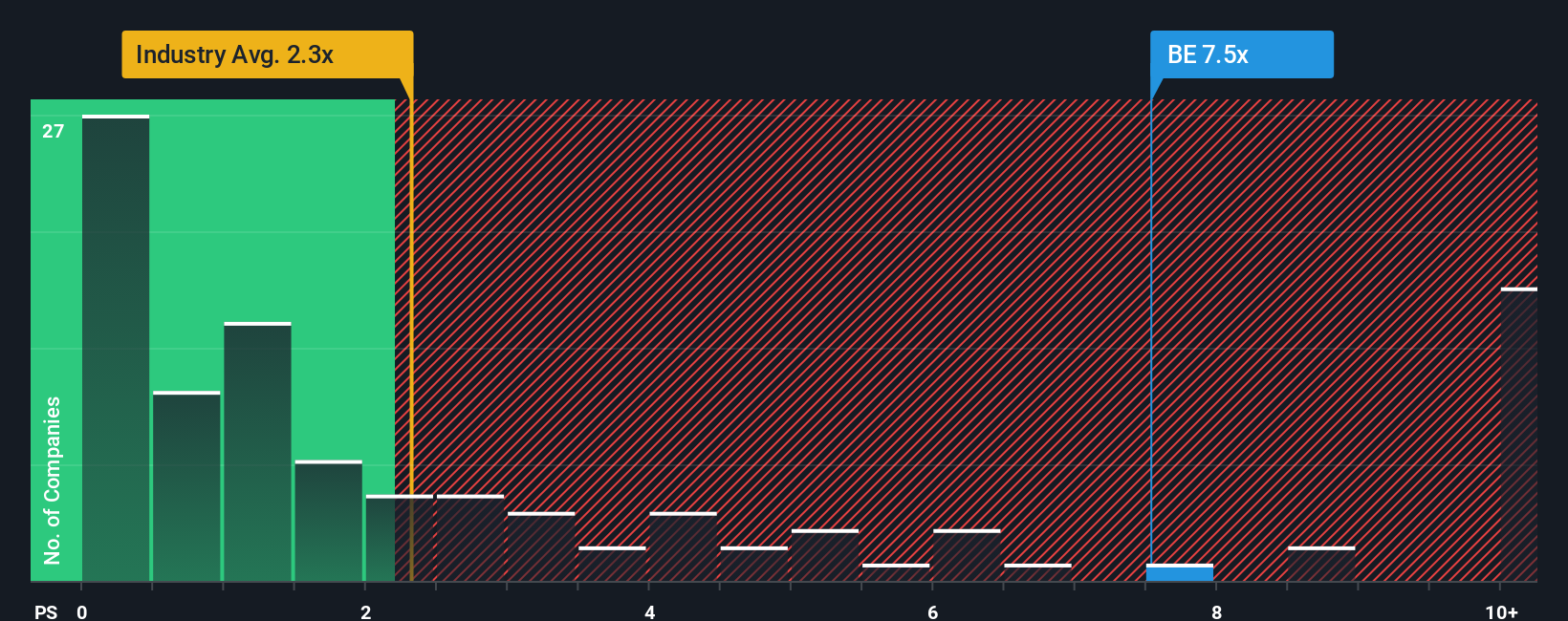

On simple sales based metrics, Bloom looks stretched. It is trading on a 12x price to sales ratio versus 5.2x for peers and 2.3x for the broader US Electrical industry, which is well above a fair ratio of 8.5x and leaves far less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bloom Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Put your momentum from Bloom Energy to work now, or you risk missing other standout opportunities that fit your strategy on Simply Wall Street.

- Capture potential mispricings by targeting quality companies trading below intrinsic value through these 907 undervalued stocks based on cash flows before the market catches up.

- Capitalize on breakthroughs at the intersection of medicine and algorithms by using these 29 healthcare AI stocks to target innovation shaping the future of care.

- Position yourself for the next wave of digital finance by filtering listed innovators in decentralized technology with these 79 cryptocurrency and blockchain stocks while the story is still early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion