- United States

- /

- Trade Distributors

- /

- NYSE:BCC

Boise Cascade's (NYSE:BCC) Dividend Will Be Increased To $5.21

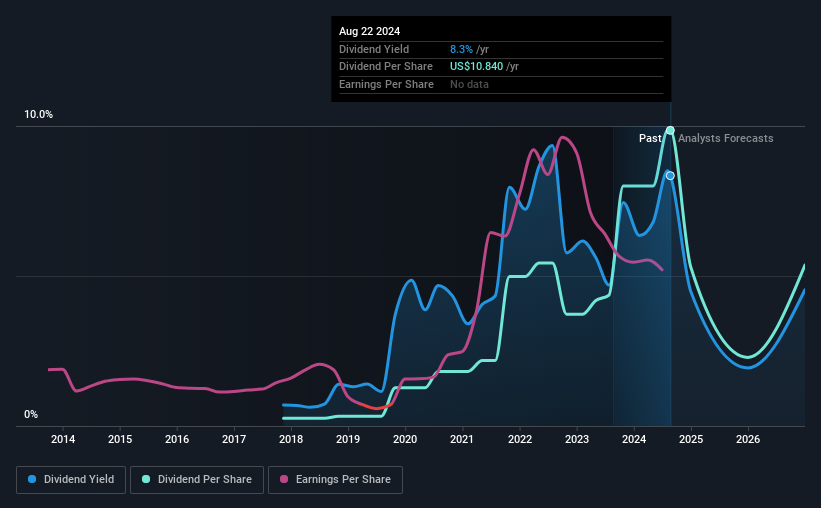

Boise Cascade Company (NYSE:BCC) has announced that it will be increasing its dividend from last year's comparable payment on the 16th of September to $5.21. This makes the dividend yield 8.3%, which is above the industry average.

View our latest analysis for Boise Cascade

Boise Cascade Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Boise Cascade's dividend was only 6.9% of earnings, however it was paying out 122% of free cash flows. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Over the next year, EPS is forecast to fall by 4.0%. If the dividend continues along recent trends, we estimate the payout ratio could reach 114%, which could put the dividend in jeopardy if the company's earnings don't improve.

Boise Cascade's Dividend Has Lacked Consistency

Boise Cascade has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. The dividend has gone from an annual total of $0.28 in 2017 to the most recent total annual payment of $10.84. This works out to be a compound annual growth rate (CAGR) of approximately 69% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Boise Cascade has impressed us by growing EPS at 30% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Boise Cascade will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Boise Cascade (1 is a bit concerning!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Boise Cascade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BCC

Boise Cascade

Engages in the manufacture and sale of engineered wood products and plywood and wholesale distribution of building materials in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026