- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Will Boeing's (BA) $2.7 Billion PAC-3 Defense Contract Redefine Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Boeing announced it has secured multiyear contracts worth approximately US$2.7 billion to produce over 3,000 PAC-3 seekers, ramping up output to meet heightened global defense demand in response to recent conflicts across several regions.

- This contract reflects Boeing's increased investment in modernization and facility expansion, enabling record production rates and reinforcing its role within the global defense supply chain.

- We'll now explore how this major PAC-3 defense contract impacts Boeing's investment narrative, particularly in the context of expanding defense demand.

Find companies with promising cash flow potential yet trading below their fair value.

Boeing Investment Narrative Recap

To be a Boeing shareholder, you need to believe in the company's ability to stabilize production, recover margins, and leverage strong long-term demand for commercial and defense aerospace products. While the US$2.7 billion PAC-3 seekers contract highlights growing defense sector demand and strengthens Boeing's defense backlog, it does not materially address the short-term profitability and margin recovery challenges in the commercial airplane division, which remain the primary catalyst and risk for investors.

The recent collaboration between Boeing and Leonardo to pursue the U.S. Army's Flight School Next training contract is another relevant development. This alliance highlights Boeing's broader push to expand recurring, service-based revenue streams, an important catalyst as commercial airplane margins remain pressured and broader industry recovery is still underway.

However, all of this must be weighed against ongoing risks, especially if production challenges or further delays in certifying new aircraft models continue to...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion in revenue and $7.1 billion in earnings by 2028. This requires 14.9% yearly revenue growth and an $18.0 billion earnings increase from -$10.9 billion today.

Uncover how Boeing's forecasts yield a $252.57 fair value, a 18% upside to its current price.

Exploring Other Perspectives

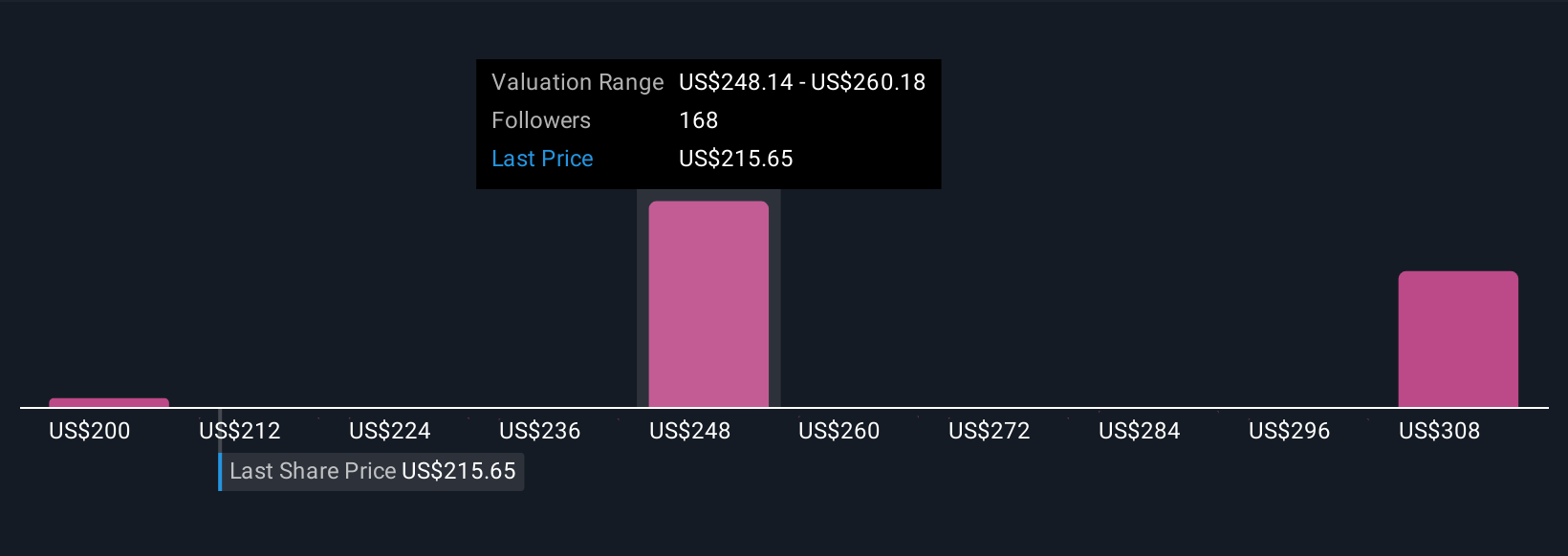

Nineteen participants in the Simply Wall St Community place Boeing’s fair value anywhere between US$200 and US$340.06 per share. With such varied outlooks and ongoing risks tied to profitability recovery, consider how these contrasting views might affect your own assessment.

Explore 19 other fair value estimates on Boeing - why the stock might be worth as much as 59% more than the current price!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

No Opportunity In Boeing?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives