- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

FAA Approval to Lift 737 MAX Production Cap Might Change The Case For Investing In Boeing (BA)

Reviewed by Sasha Jovanovic

- Last week, the Federal Aviation Administration approved increasing Boeing 737 MAX production to 42 jets per month, following intensive safety reviews after the Alaska Airlines door plug incident.

- This regulatory decision, together with substantial new Dreamliner orders from major airlines, signals renewed confidence in Boeing's manufacturing quality and operational recovery.

- We'll explore how the FAA's production cap lift and surging aircraft orders could influence Boeing's long-term growth and earnings outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Boeing Investment Narrative Recap

To be a Boeing shareholder today, you need conviction in the company’s ability to restore disciplined production and quality control as it increases output, given ongoing scrutiny of its 737 MAX program. The FAA’s decision to lift the production cap is a key short-term catalyst for Boeing, as it directly supports higher deliveries, but risk remains elevated due to unresolved certification hurdles for the 737-7 and 737-10, which could still impede earnings recovery if delays persist.

Among the latest announcements, Boeing’s successful completion of the first digital 8130-3 certificate shipment in partnership with Southwest Airlines stands out. This move supports both operational efficiency and supply chain integrity, factors that underpin Boeing’s recovery by minimizing risk of unapproved parts and reinforcing quality, which are central to regaining regulatory and customer confidence amid efforts to boost production.

But while rising output is promising, investors should be aware that operational risks linger, especially if...

Read the full narrative on Boeing (it's free!)

Boeing's outlook anticipates $114.4 billion in revenue and $7.1 billion in earnings by 2028. Achieving this would require a 14.9% annual revenue growth rate and an $18 billion earnings increase from the current loss of $-10.9 billion.

Uncover how Boeing's forecasts yield a $252.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

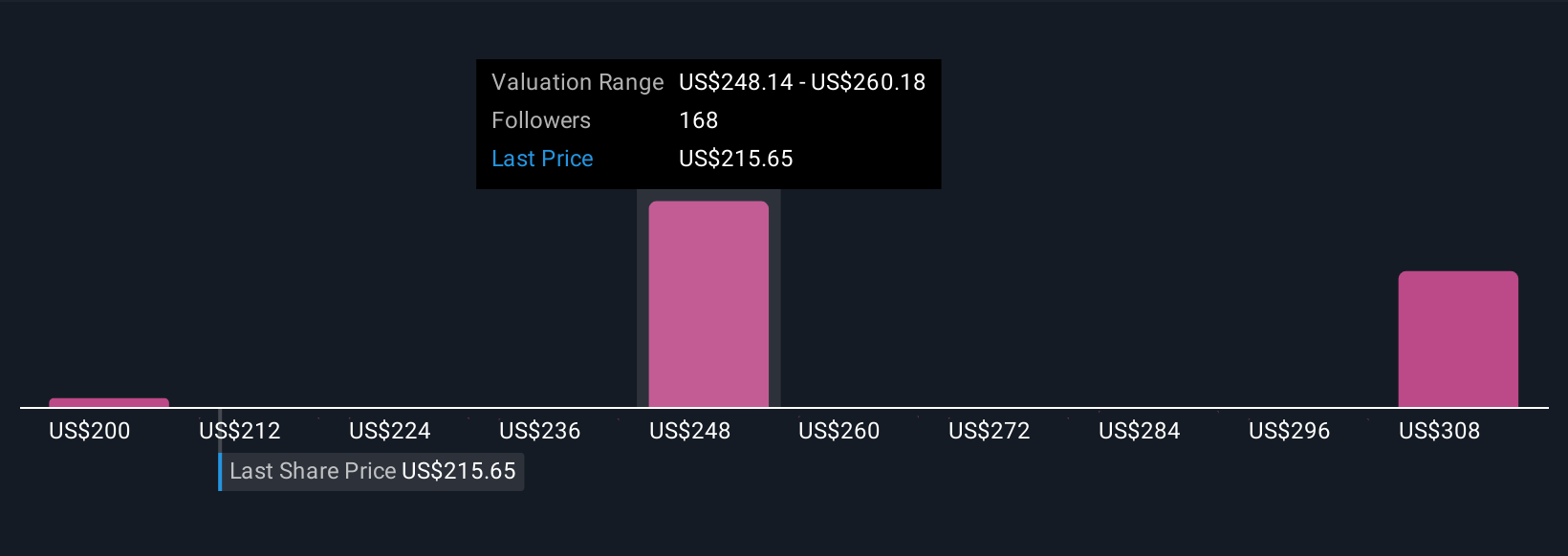

Seventeen Simply Wall St Community members estimate Boeing's fair value between US$206.79 and US$326.80. With the recent FAA production boost, the range highlights how future delivery rates and certification risks continue to divide opinion on Boeing’s outlook.

Explore 17 other fair value estimates on Boeing - why the stock might be worth as much as 50% more than the current price!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives