- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (BA) Valuation in Focus as Airbus Surpasses 737 Deliveries and Turkish Airlines Considers Order Shift

Reviewed by Kshitija Bhandaru

Recent headlines are shining a spotlight on Boeing (BA) as Airbus’s A320 has now surpassed Boeing’s 737 in total deliveries. Turkish Airlines is also openly reconsidering a large 737 Max order due to ongoing engine supplier negotiations.

See our latest analysis for Boeing.

Boeing’s share price surge earlier this year reflected optimism as aircraft deliveries ramped up, but recent market jitters prompted by competitive leaps from Airbus and engine supply drama have fueled renewed uncertainty. Despite short-term volatility and a 7% dip over the past month, Boeing’s one-year total shareholder return is up nearly 40%, signaling strong long-term momentum.

Looking beyond Boeing, there’s a world of emerging opportunities in aerospace and defense. Explore the latest movers and hidden gems with our dedicated See the full list for free..

With Boeing’s shares currently trading at a notable discount to analysts’ price targets, but with signs of premium valuation on some metrics, is there still a buying opportunity here, or has the market already factored in the company’s future growth?

Most Popular Narrative: 16.6% Undervalued

Compared to Boeing's last close of $210.73, the most widely followed narrative puts fair value much higher, pointing to notable upside versus where the stock trades today. The stage is set for a major industry shift, driven by evolving fleet demands and global growth.

Boeing Global Services is expanding its high-margin, recurring-revenue offerings (aftermarket services and parts distribution), positioning the company for more stable and resilient profitability through airline fleet modernization cycles and rising demand for in-service support.

Curious about the math and mindset fueling that fair value? There is a bold forecast hiding in the growth assumptions and future profit margins. Only by reading the full narrative will you uncover the ambitious expectations that set Boeing’s valuation apart from the pack.

Result: Fair Value of $252.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent production delays and reputational challenges could still threaten Boeing’s earnings recovery and weaken confidence in its long-term outlook.

Find out about the key risks to this Boeing narrative.

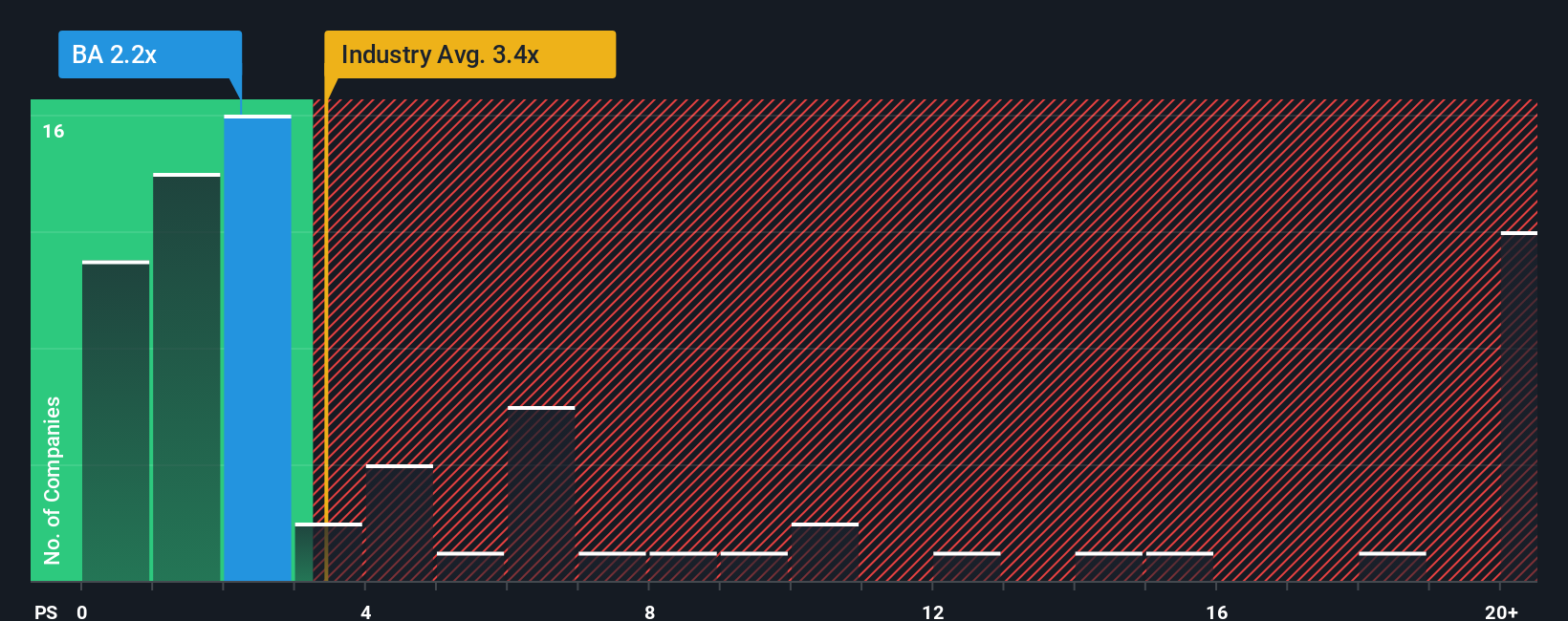

Another View: Multiples-Based Valuation

While the fair value narrative makes Boeing look attractive, a closer look at its price-to-sales ratio tells a different story. Boeing is trading at 2.1x sales, slightly above its fair ratio of 1.9x and higher than its peer average of 2x. However, it remains cheaper than the US Aerospace & Defense industry at 3.3x. This suggests the stock may actually be richly valued on this metric, even if headline forecasts look favorable. Is the market putting a premium on recovery, or could expectations be getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boeing Narrative

Feel free to dive into the numbers and shape your own view of Boeing’s outlook using our tools. It only takes a few minutes to craft your personal perspective. Do it your way

A great starting point for your Boeing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single opportunity slip past you. Supercharge your strategy with our screeners and uncover what most investors overlook. There are hidden gems out there waiting for your attention.

- Capture untapped potential by stepping into the world of small-caps with these 3580 penny stocks with strong financials poised for big gains and breakout moments.

- Boost your cash flow by targeting reliable payouts through these 19 dividend stocks with yields > 3% with standout yields and compelling fundamentals.

- Tap into game-changing sectors by following these 24 AI penny stocks that are real contenders in the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives