- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (BA): Exploring Valuation as Shares Show Modest Gains and Long-Term Returns Build

Reviewed by Kshitija Bhandaru

Boeing (BA) shares have shown some movement recently, and many investors are taking a closer look at the company to gauge its prospects. After seeing mild gains over the past week, the focus has shifted to what could drive future performance.

See our latest analysis for Boeing.

Boeing’s share price has held relatively steady in recent months, but when you zoom out to the bigger picture, its long-term total shareholder returns are still building gradually. The returns are up about 44% over the past year and nearly 65% for the past three years. Recent modest gains could reflect renewed investor optimism about the company navigating industry challenges and finding growth opportunities ahead.

Curious to see how other aerospace and defense stocks are performing? Take the next step and explore See the full list for free.

With Boeing’s stock outpacing many peers over the past year, investors now face a familiar dilemma: is today’s price a bargain that underestimates Boeing’s future, or are expectations already fully reflected in the current valuation?

Most Popular Narrative: 13.9% Undervalued

Boeing's most closely followed narrative suggests the stock is trading below its fair value, with a fair value that exceeds its last closing price. This outlook is influenced by sector-wide trends and recent events that support its long-term financial prospects.

Production stabilization and planned rate increases for key aircraft models (737 MAX, 787) position Boeing to benefit directly from robust global demand for air travel. Driven by expanding middle-class populations and urbanization in emerging markets, these demand tailwinds are expected to support significant revenue growth and potential operating margin expansion as fixed costs are spread over higher unit volumes.

What exactly is fueling this bullish valuation? Strong demand projections, ambitious turnaround expectations, and a bold earnings trajectory are central to this narrative. Curious about which specific numbers justify such a meaningful upgrade? Unlock the details that challenge market consensus and reveal how high Boeing’s revenue and profits could reach.

Result: Fair Value of $252.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued production delays or supply chain strains could quickly undermine these bullish projections and challenge Boeing’s path to sustained margin recovery.

Find out about the key risks to this Boeing narrative.

Another View: Discounted Cash Flow Perspective

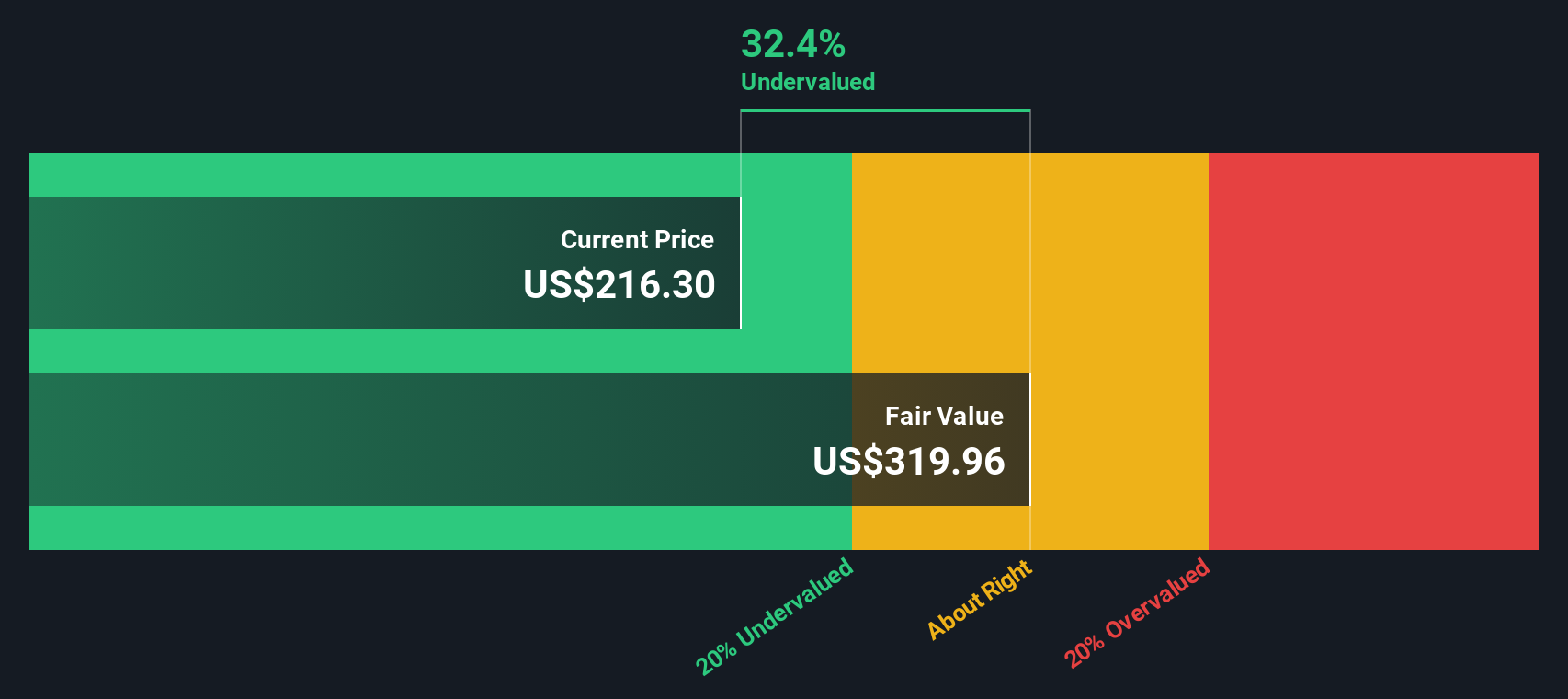

While multiples suggest Boeing may be trading close to fair value, the SWS DCF model presents a different perspective. According to this method, Boeing's intrinsic value is estimated at $320.49 per share, which is roughly 32% higher than its current price. This signals the stock could be undervalued. Can a long-term cash flow outlook really outweigh ongoing near-term risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boeing Narrative

If you want to dig into the numbers yourself or tell a story that fits your own outlook, you can quickly put together your own view. Do it your way

A great starting point for your Boeing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead on your investment journey by using these unique stock ideas hand-picked for different strategies. Don’t let standout opportunities pass you by. Review these today before the next big move catches the market by surprise.

- Capitalise on future tech by tapping into these 24 AI penny stocks that are harnessing AI breakthroughs for rapid growth and smarter business models.

- Catch rising stars early with these 3563 penny stocks with strong financials featuring under-the-radar companies showing robust financial health and real potential for multibagger returns.

- Unlock reliable income streams with these 19 dividend stocks with yields > 3% offering strong yields above 3 percent and steady performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives