- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Assessing Boeing’s Value After Recent Delivery Delays and Stock Moves in 2025

Reviewed by Bailey Pemberton

If you are trying to decide what to do with Boeing stock right now, you are far from alone. With every market twist, investors seem to come back to this iconic name, weighing its risks against its undeniable potential. Lately, Boeing’s share price movements have been anything but dull. Over the past week, the stock slipped by 2.2%, and it is down 5.8% over the past month. But step back, and the bigger picture looks far brighter. The stock is up 25.9% since the start of the year, and an impressive 39.5% over the last twelve months. Since mid-2019, Boeing has climbed 29.3%, with an even more striking 66.7% gain across three years.

Most of these moves have unfolded against a backdrop of shifting market sentiment and renewed optimism in the global travel industry. This environment has fueled periodic rallies in Boeing’s share price. Positive developments around airline demand and major aircraft orders have played a key part, hinting that the market still has faith in Boeing’s place in the future of aviation, even as it navigates supply chain bumps and regulatory scrutiny.

So where does that leave us when it comes to Boeing’s valuation? Using a checklist of six key measures of undervaluation (which we will break down shortly), Boeing scores a three. In other words, it passes half the undervaluation checks. As we run through the most common valuation approaches, you will see why that number matters, and why there may be an even smarter way to assess what Boeing is really worth before you make your next move.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method for estimating a company's true value by projecting its future cash flows and discounting them back to their present value. In Boeing's case, analysts and forecasters look ahead at expected Free Cash Flow (FCF) over the next decade to see what the company is likely to generate. They then factor in risks and the time value of money to decide what those future dollars are worth today.

Boeing’s latest twelve months of FCF show a negative $8.1 billion, underscoring some of the company’s well-publicized challenges. However, projections suggest a turnaround is coming. By 2026, analysts expect annual FCF to improve to roughly $5.0 billion. The model anticipates continued growth, with FCF rising to an estimated $12.8 billion in 2029 and as much as $18.5 billion by 2035. These longer-term forecasts beyond five years are extrapolations rather than direct analyst predictions, but they provide an indication of Boeing’s recovery trajectory.

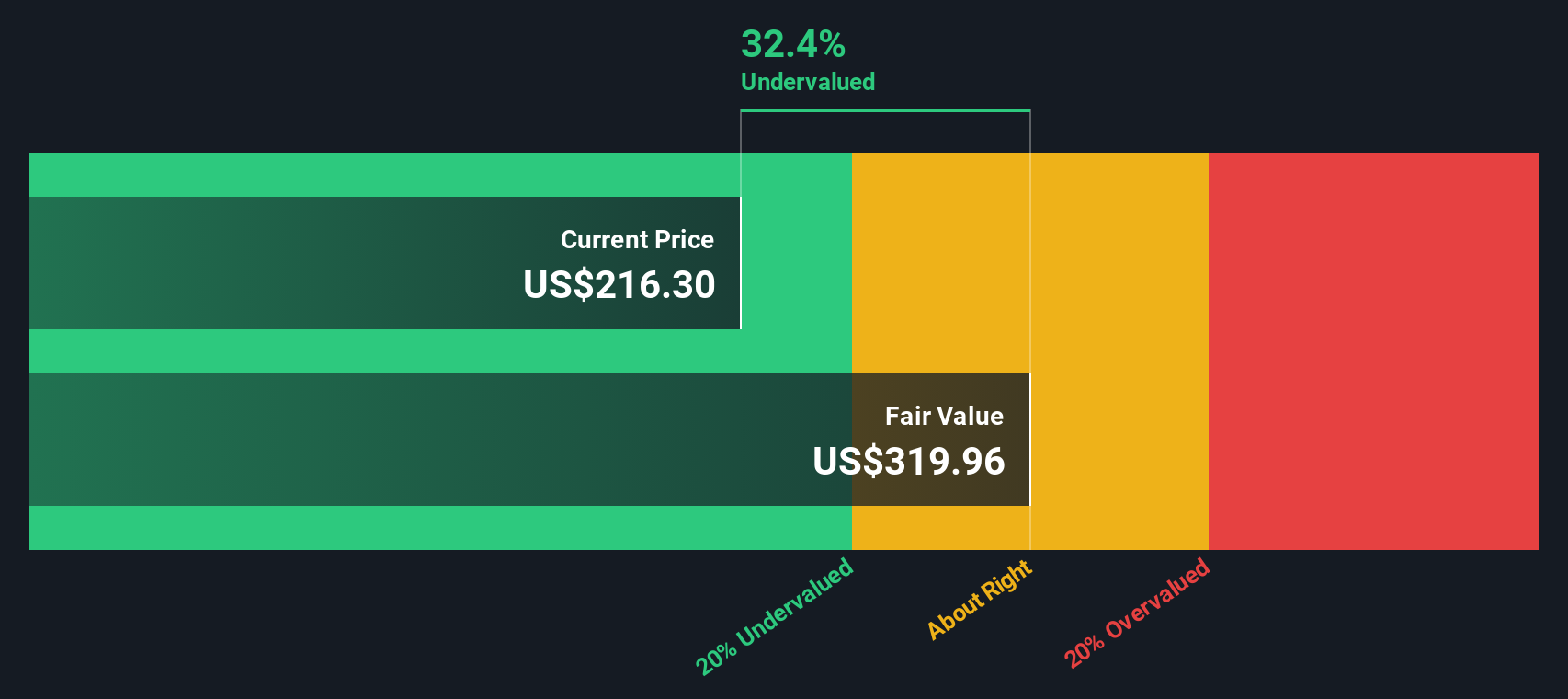

Bringing these future cash flows back to today with the DCF approach, Boeing’s intrinsic value is estimated at $320 per share. Given the implied discount of 32.4%, this suggests Boeing stock is currently undervalued based on expected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 32.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Boeing Price vs Sales

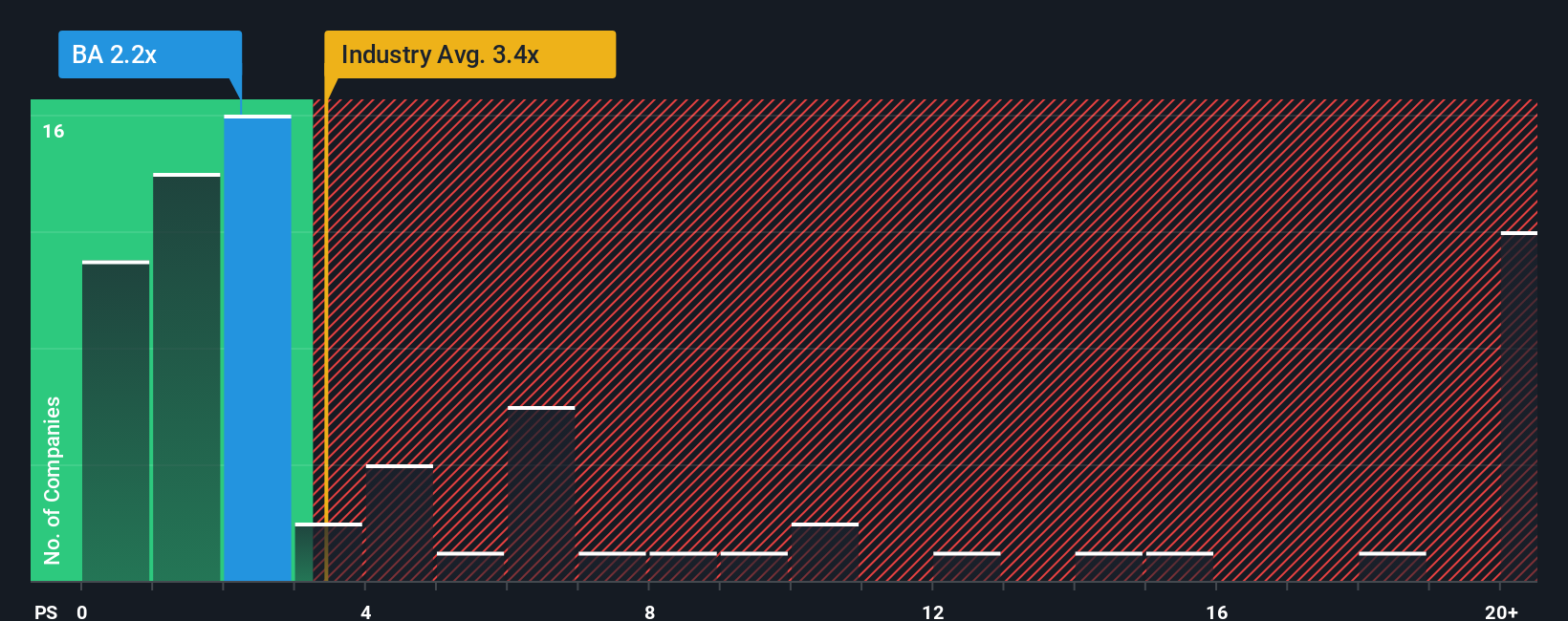

For companies like Boeing that are currently experiencing swings in profitability, the Price-to-Sales (P/S) ratio is often a more reliable valuation metric than ratios centered on earnings, which can be erratic or negative. The P/S ratio focuses on a company’s top-line revenue, providing a steadier reference point that is especially helpful when earnings are under pressure or temporarily distorted.

Growth expectations and risk levels also play a role in determining what a fair P/S multiple should be. Companies with higher growth potential or lower risk typically trade at higher multiples, while those facing challenges command lower ones. For this reason, context is important—a multiple only has meaning when you compare it against meaningful benchmarks.

Boeing’s current Price-to-Sales ratio sits at 2.17x, which is slightly higher than the peer group average of 2.07x but below the Aerospace & Defense industry average of 3.28x. Simply Wall St’s proprietary “Fair Ratio,” however, takes the analysis a step further. This Fair Ratio is set at 1.92x for Boeing, reflecting factors unique to the company, including its growth outlook, profit margins, risk profile, industry dynamics, and market capitalization.

Unlike broad comparisons using industry or peer averages, the Fair Ratio adapts specifically to Boeing’s circumstances. This makes it a much more targeted lens for valuation, as it accounts for the nuances that static averages miss. Comparing Boeing’s current P/S ratio of 2.17x to its Fair Ratio of 1.92x reveals a moderate premium. This is not particularly overdone, but it does suggest the stock is trading slightly above its fair value based on revenues and outlook.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Boeing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, combining what you believe about its business prospects with your own assumptions for future revenue, earnings, and margins. Instead of just crunching numbers, Narratives allow you to connect Boeing’s unique journey to your forecasts and then see what fair value comes out in an accessible format on Simply Wall St’s Community page, a feature used by millions of investors.

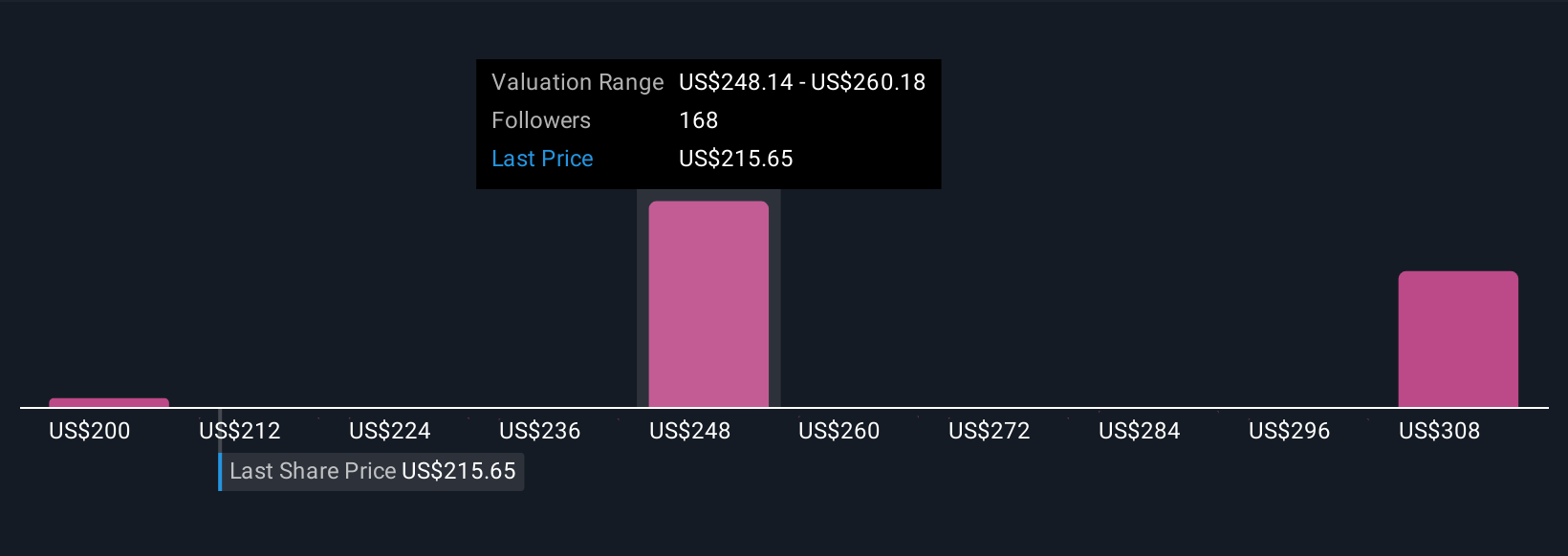

With Narratives, you can easily compare your estimate of Boeing’s fair value to its current price to help decide when to buy or sell. Since they update automatically as new news or earnings reports come out, your view always stays relevant. For example, some users believe robust air travel demand and a massive aircraft backlog give Boeing significant upside, setting their fair value as high as $287. Others see ongoing production delays and supply chain risks as key challenges, pegging the stock’s fair value much lower at $150. Narratives bring these different perspectives to life with numbers and context, helping you make investment decisions that actually fit your outlook.

Do you think there's more to the story for Boeing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives