- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Assessing Boeing Shares After a 40% Surge and Fresh Aircraft Order Optimism

Reviewed by Bailey Pemberton

If you are holding or eyeing Boeing stock, you are certainly not alone. Investors have reason to pay close attention, with shares finishing at $217.77 and notching a 2.8% gain in the past week alone. If we widen the lens to this year, returns soar to an impressive 26.7%, and over the past 12 months, Boeing has delivered a stellar 40.3% jump. These numbers signal something is stirring, and it is not just market momentum at play.

Much of Boeing’s lift lately can be traced to a wave of optimism over renewed aircraft orders and regulatory clarity following past safety concerns. News of larger airlines ramping up their investment in new fleets has certainly helped boost sentiment. There is also a shift in how investors perceive Boeing's risk, as operational progress and a steadier order book drive more confidence into the stock.

Of course, strong price moves have people questioning the company’s value right now. Based on a composite of valuation methods, Boeing currently earns a value score of 3 out of 6. This means it checks the box for being undervalued in half of the key measures investors use. But valuation is rarely as simple as tallying up a score. Next, we will break down the different ways analysts assess what Boeing is really worth. We will also explore a smarter perspective on valuation that could give you an edge by the end of this article.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This method helps investors get a sense of what a business is really worth today, based on its ability to generate cash over time.

For Boeing, the DCF analysis uses the 2 Stage Free Cash Flow to Equity approach, and all cash flows are presented in US dollars. Presently, Boeing's Free Cash Flow (FCF) sits at a loss of roughly $8.1 billion, reflecting the company's ongoing recovery from recent challenges. However, analysts expect a turnaround. By the end of 2029, projections have Boeing generating $12.8 billion in annual Free Cash Flow. Over the next decade, FCF is forecasted to continue climbing. It is worth noting that projections after 2029 are extrapolated beyond what analysts directly estimate.

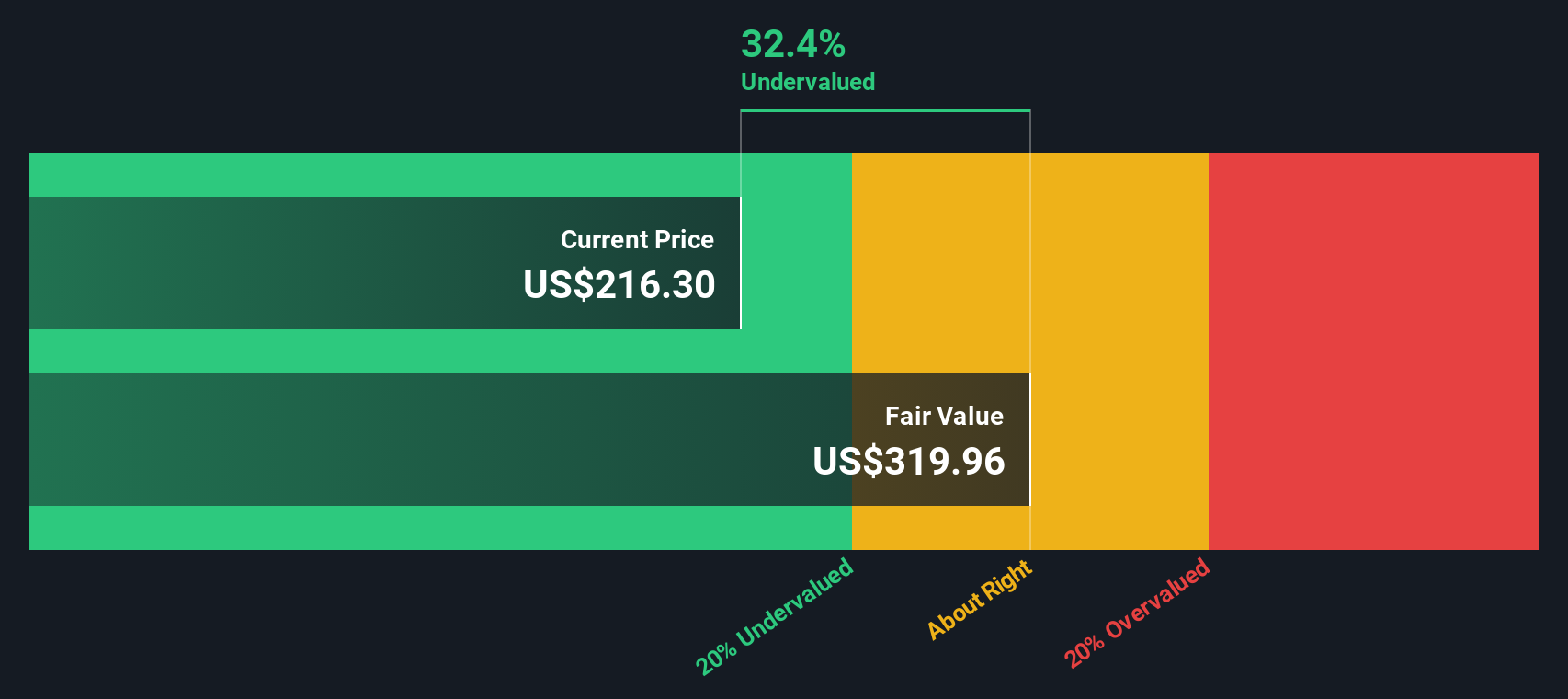

Based on these cash flow projections and the DCF methodology, Boeing's estimated intrinsic value comes out to $320.65 per share. With the recent share price at $217.77, this implies the stock is trading at a 32.1% discount compared to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 32.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Boeing Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is an especially helpful valuation tool for companies like Boeing, particularly when profits are volatile or the company is transitioning back to profitability. Since the P/S ratio compares a company’s market value to its sales, it provides a perspective less influenced by temporary earnings swings and offers a more reliable metric during recovery phases.

In theory, growth expectations and risk both affect what is considered a “normal” or “fair” multiple. Companies with faster sales growth, higher margins, or lower perceived risk may justify higher P/S ratios. Conversely, companies facing uncertain demand or higher risks typically trade at lower ratios.

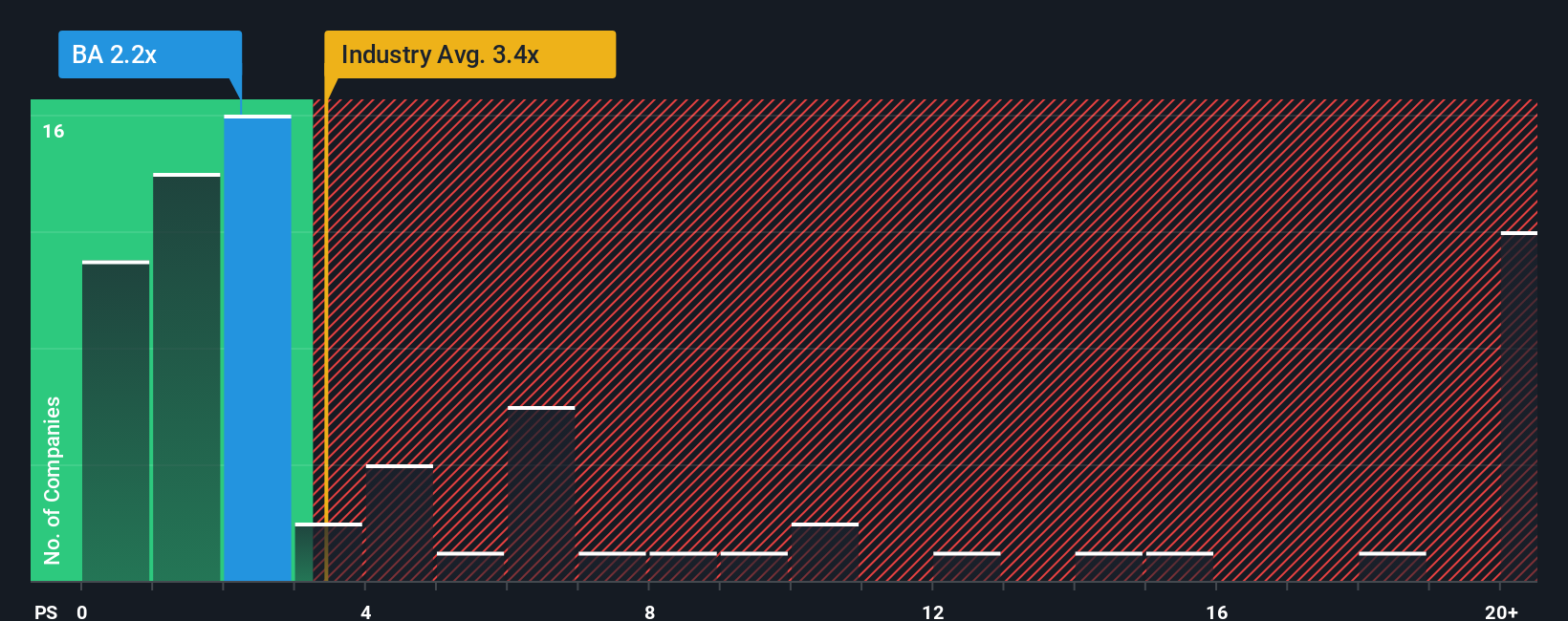

Boeing’s current P/S ratio stands at 2.19x, just above the peer average of 2.07x and below the industry average of 3.06x. To move beyond simple comparisons, Simply Wall St uses a proprietary “Fair Ratio” metric, which for Boeing is currently 1.92x. The Fair Ratio incorporates factors such as Boeing’s sales growth outlook, risk profile, industry characteristics, profit margins, and market capitalization to deliver a valuation benchmark tailored to the company’s unique situation.

This makes the Fair Ratio a step ahead of looking only at peer or industry averages and offers a more nuanced context for understanding value. Comparing Boeing’s current P/S of 2.19x with its Fair Ratio of 1.92x suggests the stock trades at a moderate premium, though not excessively so. Since the difference is less than 0.3x, this valuation appears broadly reasonable.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boeing Narrative

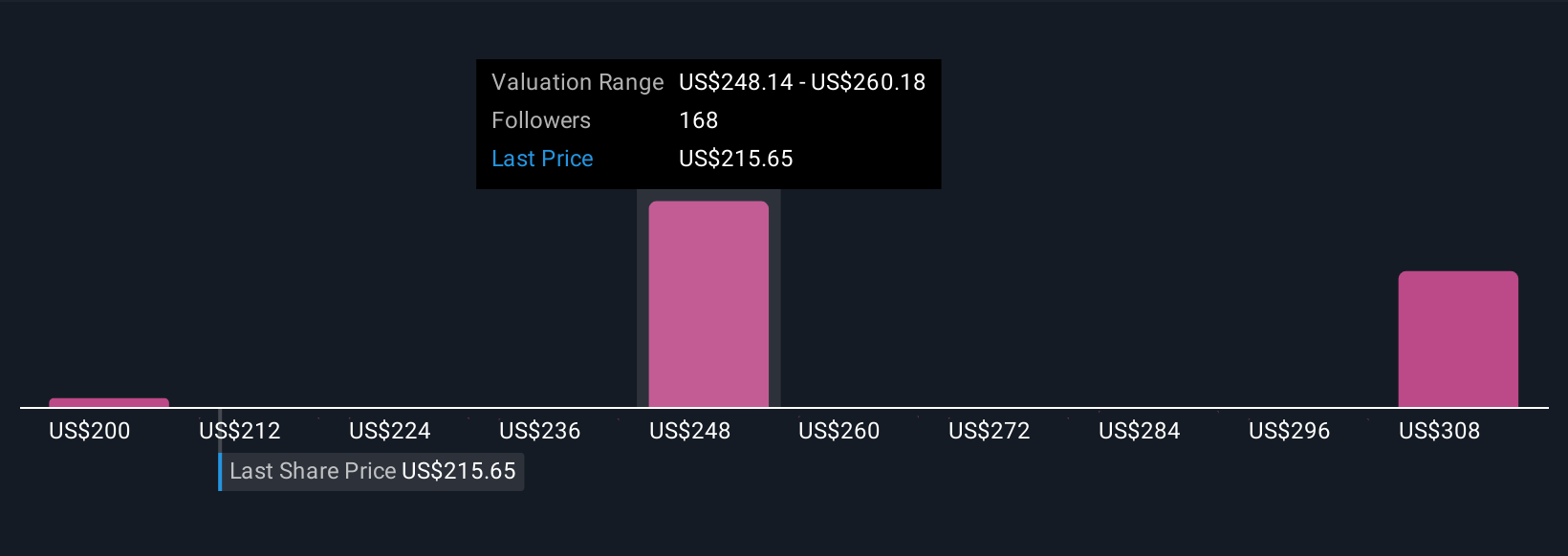

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective, a story you create about a company’s future, built on your own assumptions about revenue, earnings, and margins, and how these link to a fair value today.

Unlike traditional models, Narratives connect the dots between what’s happening in the business and where you think the numbers are heading, making your investment decisions more personal and informed. Simply Wall St’s platform makes creating or choosing a Narrative easy and accessible, with millions of investors sharing their outlooks and updates on each company's Community page.

Narratives help you decide when to buy or sell by letting you compare your fair value estimate to the market price, and they dynamically update as fresh news or earnings results are released, so you’re always investing with the latest information.

For Boeing, some investors see strong air travel demand and a record order backlog driving rapid revenue and margin recovery, targeting a fair value of $287 per share. Others focus on production delays and execution risks, leading to a much lower view around $150 per share. Your Narrative puts you in control of which story, and which price, makes the most sense for you.

Do you think there's more to the story for Boeing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives