- United States

- /

- Building

- /

- NYSE:AZZ

The Bull Case for AZZ (AZZ) Could Change Following Strong Q2 Results and Raised Dividend

Reviewed by Sasha Jovanovic

- AZZ Inc. recently reported its second-quarter results, revealing sales of US$417.28 million and net income of US$89.35 million, with full-year revenue guidance for 2026 maintained at US$1.625 billion to US$1.725 billion.

- The company's Metal Coatings segment delivered strong growth offsetting softer demand elsewhere, and AZZ reaffirmed its commitment to shareholder returns by increasing its quarterly cash dividend to US$0.20 per share.

- We'll examine how AZZ's reaffirmed full-year guidance and resilient segment performance could shape its investment case going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AZZ Investment Narrative Recap

To own AZZ, an investor needs to believe in the company’s ability to drive long-term growth by balancing expansion in its core Metal Coatings unit with ongoing capacity investments and disciplined capital allocation. The reaffirmation of full-year guidance and recent earnings signal resilience in key segments, although persistent weakness in Precoat Metals and ongoing execution risks at new facilities remain front of mind as the biggest short-term catalyst and potential risk. This news largely maintains the status quo, rather than shifting the narrative in a material way.

The company’s decision to raise its quarterly dividend to US$0.20 per share reinforces management’s confidence in stable cash flows and commitment to shareholder returns, which is especially relevant when short-term catalysts such as new plant ramp-ups face efficiency hurdles. Dividend consistency, in this context, serves as a signal of underlying financial strength despite segment-level variability.

However, investors should be aware that the combination of softer Precoat Metals demand and execution risk at the Washington facility could...

Read the full narrative on AZZ (it's free!)

AZZ's narrative projects $1.8 billion in revenue and $195.5 million in earnings by 2028. This requires 5.0% yearly revenue growth and a decrease in earnings of $64.6 million from the current $260.1 million.

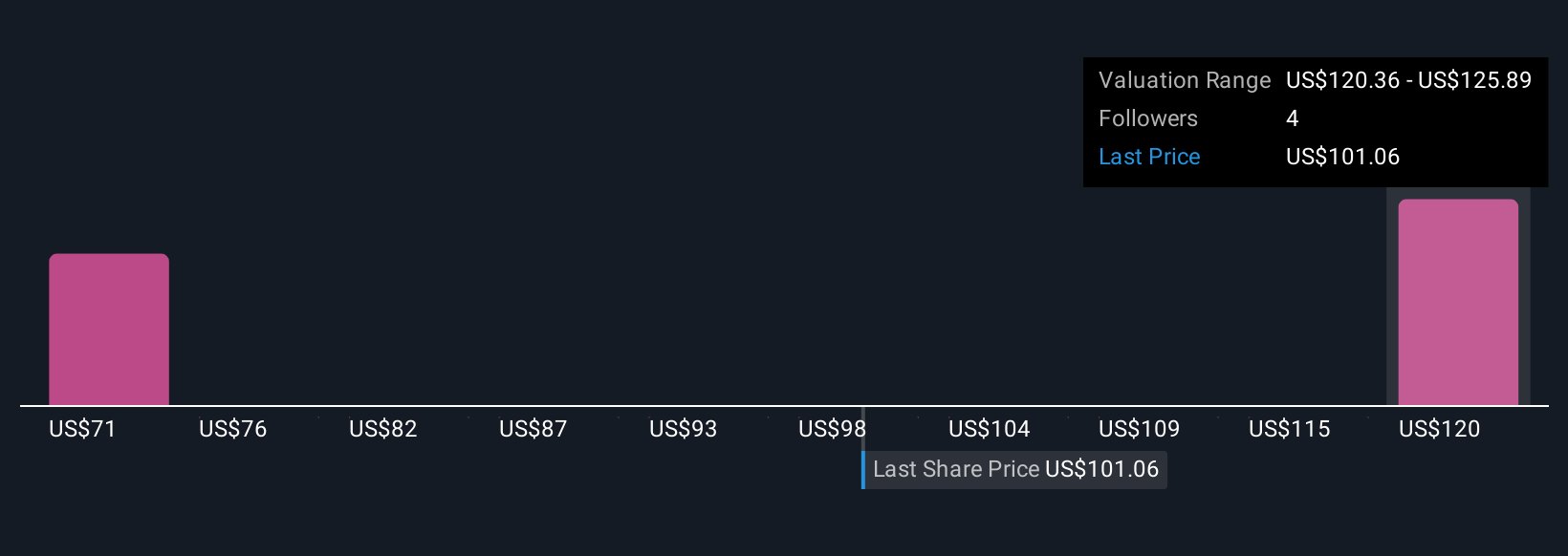

Uncover how AZZ's forecasts yield a $125.89 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two fair value estimates for AZZ, ranging from US$83.57 to US$125.89 per share. Against this diverse backdrop, ongoing risks tied to new facility ramp-up could influence how multiple market participants assess the company’s ability to maintain profitability. Explore several viewpoints to see how opinions diverge.

Explore 2 other fair value estimates on AZZ - why the stock might be worth 21% less than the current price!

Build Your Own AZZ Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AZZ research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AZZ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AZZ's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZZ

AZZ

Provides hot-dip galvanizing and coil coating solutions in North America.

Outstanding track record and fair value.

Similar Companies

Market Insights

Community Narratives