- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore (ATKR): Reassessing Valuation After a 28% One-Year Share Price Decline

Reviewed by Simply Wall St

Atkore (ATKR) has quietly fallen about 5% over the past month and nearly 28% in the past year, even as revenue and earnings have grown. This sets up an interesting disconnect for value focused investors.

See our latest analysis for Atkore.

Despite the recent pullback and a year to date share price return of negative 18.60%, Atkore’s 90 day share price return of 13.86% suggests sentiment may be stabilising as investors reassess its growth and risk profile.

If Atkore’s mixed momentum has you reassessing your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling growth stories.

With shares down sharply over the past year, even as earnings surge and the stock now trades slightly above analyst targets, investors may be asking whether Atkore is a mispriced value opportunity or whether the market is already discounting its future growth.

Most Popular Narrative: 4.2% Overvalued

With Atkore last closing at $66.28 against a narrative fair value of $63.60, the story leans slightly cautious on today’s pricing.

High tariffs on imported steel and PVC conduit are reducing foreign competition and leading to significantly lower import volumes, positioning Atkore to recapture market share in domestically sourced steel conduit over time. This supports increased revenue potential and sustained or improved net margins.

Curious how flat top line expectations can still support rising profits and a lower future earnings multiple than the industry norm? Want to see the full playbook behind those assumptions and how they add up to that fair value? The projections may surprise you.

Result: Fair Value of $63.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and unpredictable mega project timing could easily derail those margin and earnings assumptions, which could force a rethink of today’s cautious optimism.

Find out about the key risks to this Atkore narrative.

Another View: Sales Multiple Signals Value

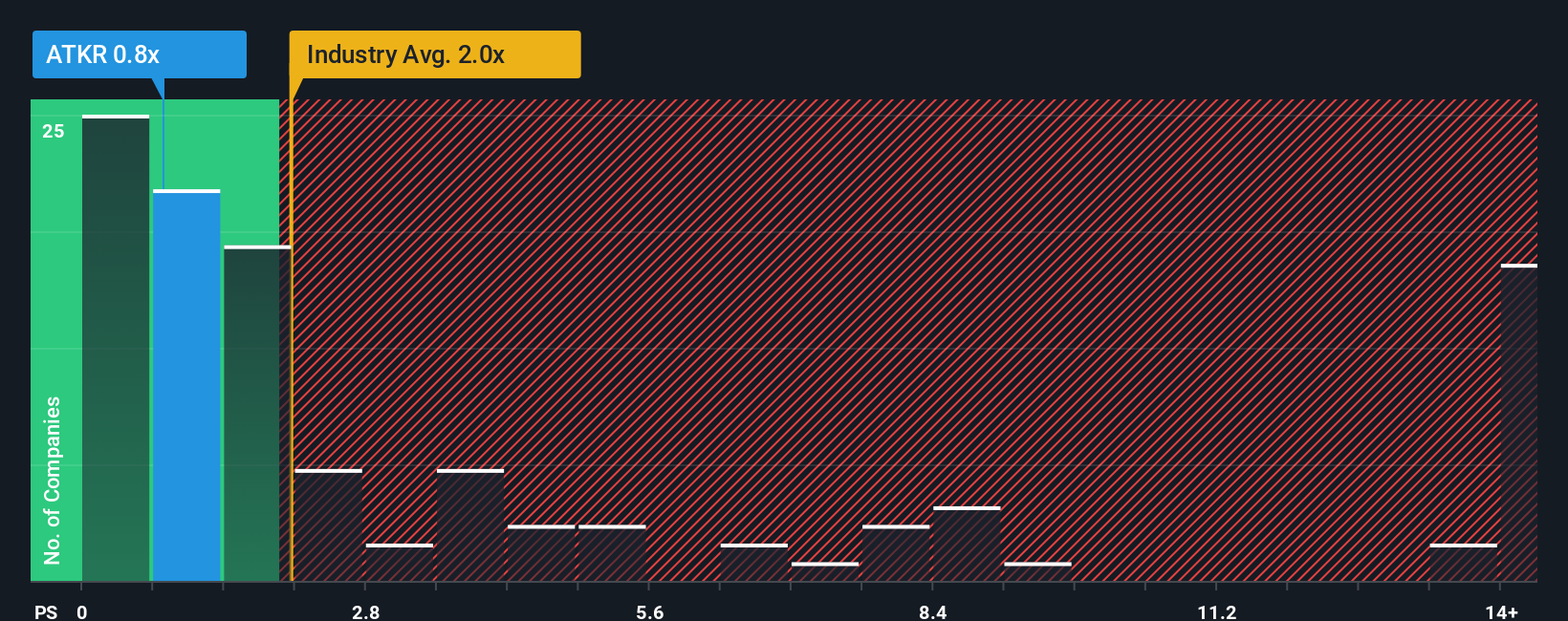

While the narrative fair value suggests Atkore is slightly overvalued, its current price to sales ratio of 0.8 times looks cheap against peers at 4.4 times and a fair ratio of 1.1 times. If sentiment normalizes toward that fair ratio, could today’s discount narrow meaningfully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atkore Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Atkore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, lock in your next opportunity by using the Simply Wall St Screener to pinpoint stocks that truly fit your strategy.

- Capture potential mispricings by scanning these 915 undervalued stocks based on cash flows that could offer stronger upside relative to their intrinsic value and cash flow strength.

- Ride the wave of intelligent automation by targeting these 25 AI penny stocks that sit at the intersection of rapid innovation and scalable business models.

- Strengthen your income stream by reviewing these 14 dividend stocks with yields > 3% that may provide reliable yields alongside solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026