- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI Valuation in Focus Following Board Appointments and Leadership Transition News

Reviewed by Simply Wall St

Strategic Board Appointments and Leadership Changes Spark Fresh Attention for ATI

If you’ve been watching ATI (ATI) recently, you’re likely aware the company has pulled off a double play that’s drawing renewed interest among investors. Just as aerospace and defense demand becomes a key narrative in industrial markets, ATI announced the addition of two heavyweight aerospace executives: Elizabeth Lund, formerly of Boeing, and Jean Lydon-Rodgers, once at the helm of GE Aviation Services. Both are joining its Board of Directors effective November 1. In parallel, plans were unveiled for longtime CFO Don Newman to retire in early 2026, with a careful transition already underway. These developments not only signal ATI’s intent to deepen its expertise and strategic focus in high-growth sectors but also showcase the company’s commitment to leadership stability.

Against this backdrop, ATI’s stock price is reflecting these shifts. Shares have surged nearly 38% year-to-date, and the trailing 1-year return stands at 23%, outpacing many of its peers and the broader market. There is a sense of momentum building, especially given the optimism about upcoming earnings and the company’s recently reaffirmed financial outlook, despite the leadership changes. Short-term moves have been more mixed, but the long-term narrative has been one of solid expansion and upward progress.

So now the critical question is whether these moves are paving the way for further gains, or if this is a case of the market already pricing in a more ambitious future for ATI.

Most Popular Narrative: 24.5% Undervalued

According to the most widely followed narrative, ATI's shares are trading well below their estimated fair value. Analysts highlight a combination of strong industry positioning and growth secured by recent strategic contracts as reasons for optimism over the company's future potential.

Recent long-term contract expansions with both Boeing and Airbus, including new titanium alloy sheet supply and broader product offerings, lock in higher volumes and minimums. These contracts expand ATI's share, feature inflation pass-through and attractive pricing, and directly support reliable, higher-margin revenue growth as well as a structurally improved earnings base through the decade.

Want to know how ATI’s big aerospace moves could unlock a valuation gap? The narrative’s fair value math is built on bold growth assumptions and margin upgrades, but the full story hides the real drivers. Craving the detailed projections and the one financial factor that could tip the scales? Unpack the full narrative to see the numbers behind the optimism and what could make or break ATI’s future price target.

Result: Fair Value of $100.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain localization and slowing demand in non-aerospace industries could quickly dampen ATI’s momentum if these trends continue to intensify.

Find out about the key risks to this ATI narrative.Another View: DCF Model Perspective

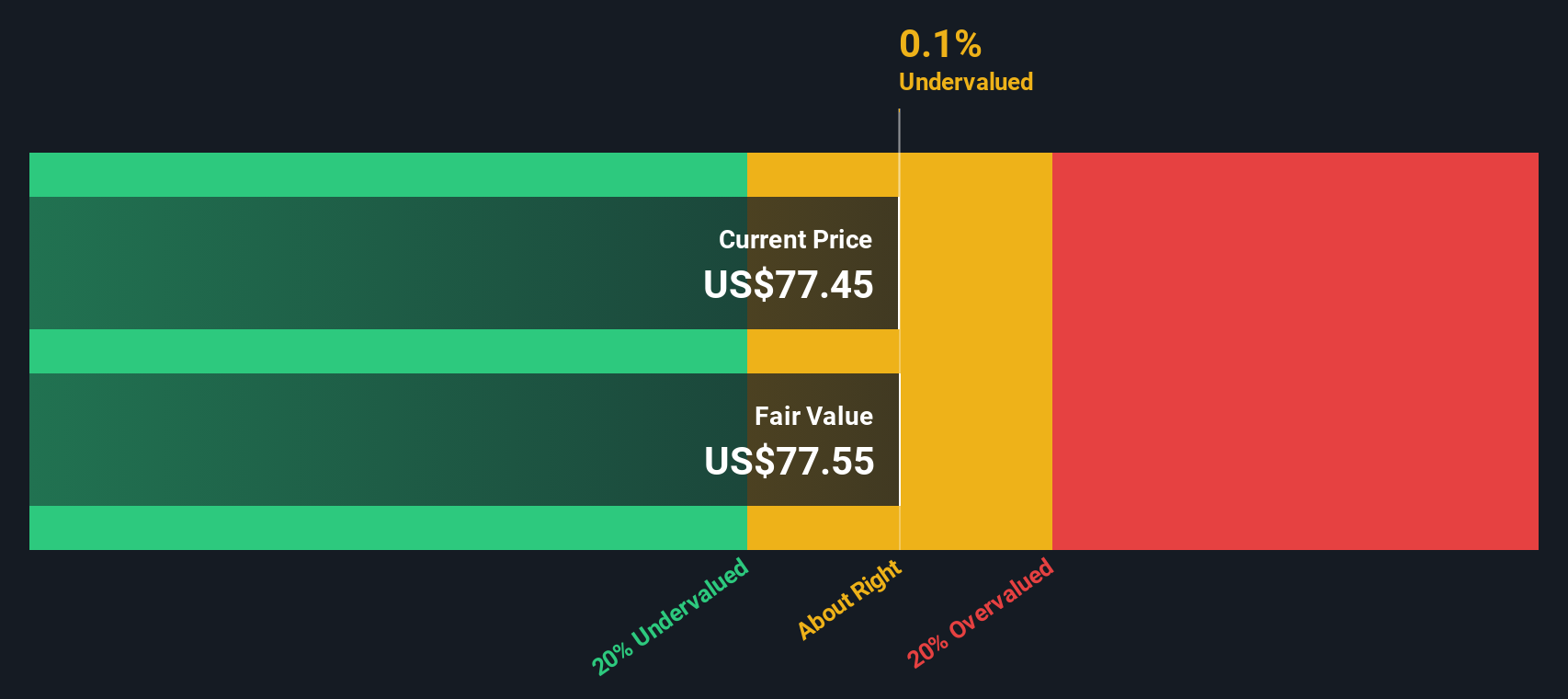

Looking from a different angle, our DCF model suggests ATI is trading just below its estimated fair value. This reinforces the undervalued story, but with less upside. Does this approach give you new confidence or fresh doubts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If you see things differently or want to dive into the numbers on your own terms, you can craft your own take in just a few minutes: Do it your way.

A great starting point for your ATI research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Gain an edge on your next move with the Simply Wall Street Screener. Don’t let fresh trends and big opportunities pass you by. Your next smart investment could be just a click away.

- Capture growth with companies applying artificial intelligence breakthroughs in ways that change entire industries by checking out the latest AI penny stocks.

- Boost your income strategy by finding market leaders offering reliable payouts through our handpicked list of dividend stocks with yields > 3%.

- Spot undervalued gems primed for a rebound by using our tool to surface potential winners with strong cash flow via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives