- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

[ATI] (ATI) CFO Announces Retirement Set for March 2026 Retirement

Reviewed by Simply Wall St

ATI (ATI) recently announced that CFO Don Newman will retire in March 2026, continuing to serve as CFO and later in an advisory role to assist his successor's transition. The company's stock saw a 2.52% increase over the past month, possibly buoyed by this clear leadership transition plan. While this executive change may have influenced investor sentiment positively, it coincided with a period where the broader market also experienced gains, with the S&P 500 and Nasdaq reaching record highs, driven by declining inflation indicators and robust demand in the technology sector, providing additional support to ATI's stock performance.

We've discovered 2 possible red flags for ATI that you should be aware of before investing here.

The announcement of Don Newman's retirement could influence ATI's narrative, reflecting a commitment to smooth executive transition and continuity in leadership. This stability may appeal to investors, potentially supporting the stock's long-term performance, especially as ATI continues to secure high-margin growth in aerospace and related sectors.

Looking at the broader performance, ATI has achieved a very large total shareholder return over a five-year period, suggesting strong historical returns for long-term investors. In comparison, ATI underperformed the US Aerospace & Defense industry over the past year, highlighting a possible divergence in shorter-term performance versus peers.

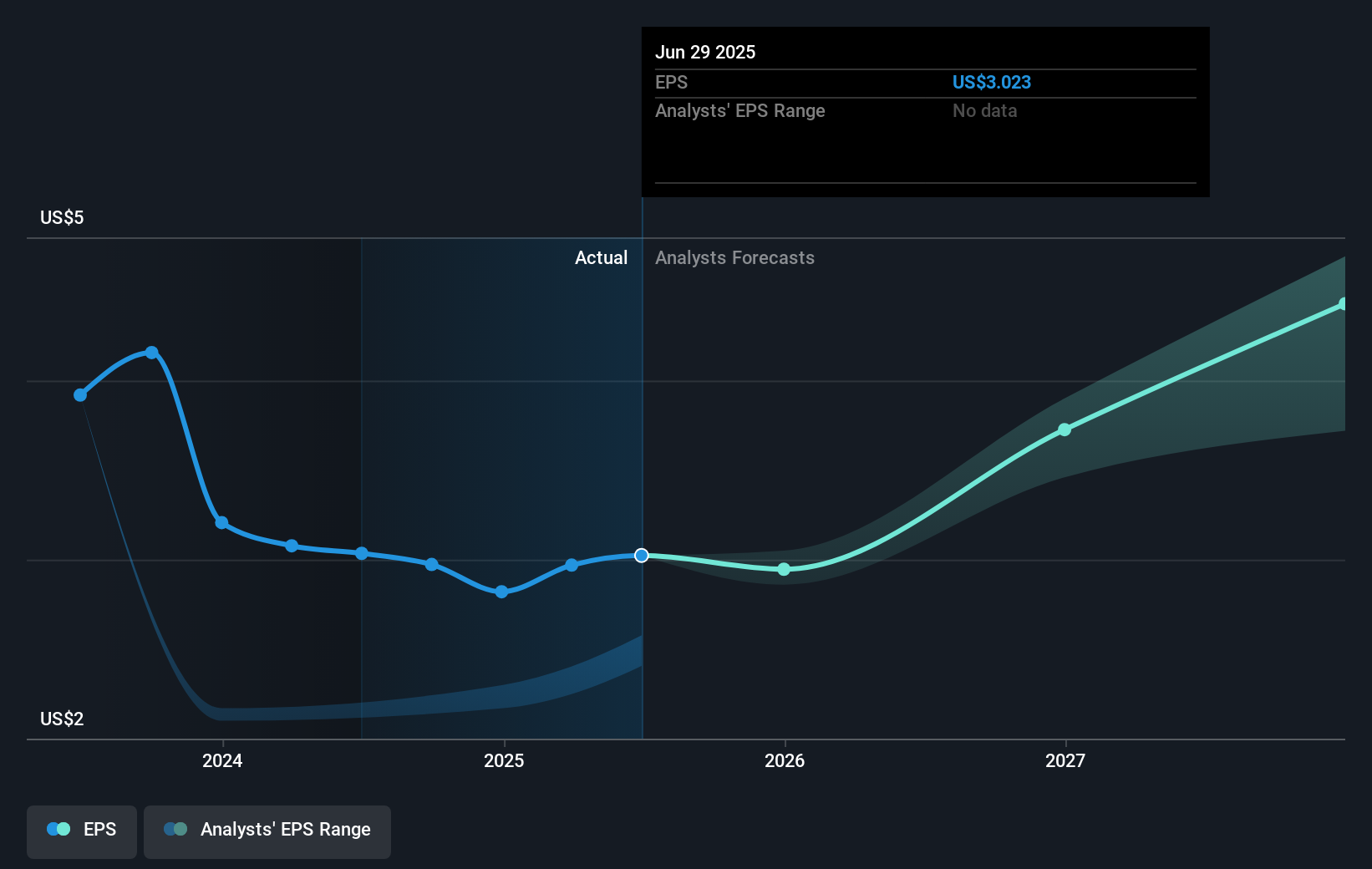

The news of the upcoming CFO change might not substantially impact revenue and earnings forecasts, given that analysts already expect revenue growth of 6.5% annually and earnings growth of 13.9% per year, driven by strategic partnerships like those with Boeing and Airbus. The company's current share price of $74.88, when considered against a consensus price target of $98.67, signals a potential upward movement of approximately 34.71%, contingent on achieving projected growth and efficiencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives