- United States

- /

- Construction

- /

- NYSE:AMRC

Is Ameresco’s (AMRC) School Solar Deal Deepening Its Recurring Revenue Moat?

Reviewed by Sasha Jovanovic

- Ameresco, Inc. and Orange Unified School District recently completed a solar rooftop and carport project across seven campuses, under a 25-year power purchase agreement expected to generate US$6.30 million in energy cost savings for the district.

- By owning and maintaining the systems while OUSD buys power at a fixed rate, Ameresco secures long-term contracted revenue as the district gains insulation from future utility price swings and pursues greater energy independence.

- Next, we’ll explore how this long-term school district power purchase agreement influences Ameresco’s investment narrative around recurring, contracted revenue.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ameresco Investment Narrative Recap

To own Ameresco, you need to believe that demand for long-dated clean energy contracts and owned assets will continue to build a base of recurring, contracted revenue. The Orange Unified School District solar PPA reinforces this narrative but is not large enough on its own to change the key near term catalyst, which remains turning a growing project backlog into higher margin earnings, or the main risk around supply chain and equipment constraints pressuring project timing and costs.

Among recent announcements, the new clean energy projects at Klickitat Valley Health stand out alongside the OUSD deal, because both add long duration customer relationships and service obligations that can support more stable, higher quality revenue over time. Together, these types of projects can help offset some of the uncertainty linked to policy shifts and competitive pricing pressures, which are central to Ameresco’s current risk and catalyst profile.

Yet, while these long term contracts can support visibility, investors should still be aware of how persistent supply chain pressures could...

Read the full narrative on Ameresco (it's free!)

Ameresco’s narrative projects $2.4 billion revenue and $87.4 million earnings by 2028. This requires 8.8% yearly revenue growth and about a $25 million earnings increase from $62.0 million today.

Uncover how Ameresco's forecasts yield a $41.89 fair value, a 19% upside to its current price.

Exploring Other Perspectives

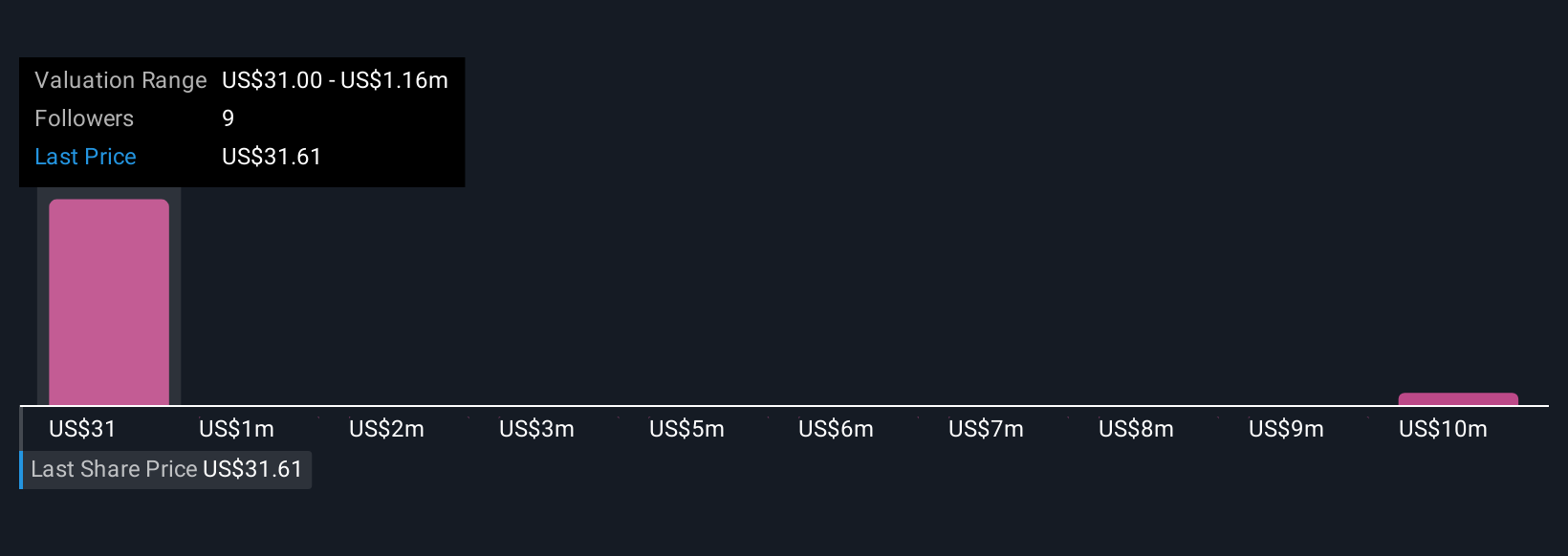

Three fair value estimates from the Simply Wall St Community span roughly US$36 to US$84 per share, showing how far apart individual views can be. When you compare that spread with the importance of Ameresco’s ability to convert its contracted backlog into higher margin earnings while managing project execution risks, it underlines why examining several independent perspectives can be useful before forming your own view.

Explore 3 other fair value estimates on Ameresco - why the stock might be worth over 2x more than the current price!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026