- United States

- /

- Electrical

- /

- NYSE:AME

AMETEK (NYSE:AME) Sees 10% Fall Over Last Week Amid Escalating Trade Tensions

Reviewed by Simply Wall St

AMETEK (NYSE:AME) experienced a 10% decline last week amid significant market sell-offs driven by escalating trade tensions. The sharp market downturn saw the Dow and S&P 500 plummet by 6%, with the Nasdaq entering bear market territory. The overall market drop of 9.5% reflected the turbulence as tariffs announced by President Trump raised fears of a slowing economy and resurgent inflation. Although the broader market experienced a substantial dip, AMETEK's stock decline mirrors the widespread investor uncertainty affecting equities across sectors, contributing to its weekly performance.

Buy, Hold or Sell AMETEK? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

AMETEK has seen its total shareholder return reach 101.69% over the past five years. This strong performance was underpinned by a combination of robust acquisition strategies, significant R&D investments, and strategic share repurchase programs. Notable milestones during this period included the company's substantial $85 million investment in R&D in 2025, signaling a focus on innovation and market capture. AMETEK's successful integrations, such as with Kern Microtechnik, further enhanced its Ultra Precision Technologies segment, contributing to its competitive positioning and growth trajectory.

Despite a recent underperformance relative to the U.S. market and the electrical industry over the past year, AMETEK's commitment to returning capital to shareholders remains strong. The announcement of a share repurchase program of up to $1.25 billion and an 11% dividend increase in early 2025 highlights confidence in its financial health and future prospects. These financial strategies, alongside a focus on expanding its high-tech industry presence, have been pivotal in driving the company's stock performance over the longer term.

Gain insights into AMETEK's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AMETEK, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

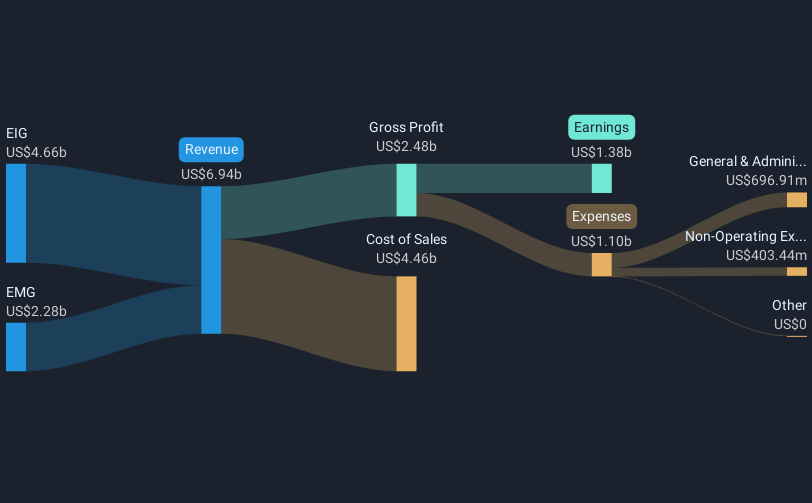

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives