- United States

- /

- Machinery

- /

- NYSE:ALSN

The Bull Case For Allison Transmission (ALSN) Could Change Following Breakthrough in Natural Gas Powertrain Integration

Reviewed by Sasha Jovanovic

- Earlier this month, Allison Transmission announced that its 4500 Rugged Duty Series fully automatic transmission has been successfully integrated with the Cummins X15N natural gas engine for use in Kenworth T880 tractors, with Ozinga Renewable Energy Logistics now deploying this advanced combination.

- This successful pairing demonstrates the viability of cleaner fuel solutions for heavy-duty fleets, combining high performance and sustainability while offering new options to major OEMs and fleet operators.

- We'll explore how Allison's latest progress in sustainable powertrain integration could influence its investment narrative and alternative-fuel strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Allison Transmission Holdings Investment Narrative Recap

To own shares of Allison Transmission Holdings, investors typically need to trust in the company’s ability to adapt its powertrain offerings as commercial fleet demand evolves, while navigating short-term cycles in North America’s on-highway market. The recent integration of Allison’s 4500 Rugged Duty Series transmission with the Cummins X15N natural gas engine is a promising advance in sustainable transport technologies, but is unlikely to be a material near-term catalyst given persistent OEM production cuts and dealer inventory overhang in the company’s largest segment.

Of the recent announcements, the July contract win for the Next Generation Electrified Transmission (NGET) program stands out as especially relevant, reflecting Allison’s ongoing push into electrified drivetrains. Developments like this are closely tied to analyst views that transitioning product portfolios toward alternative powertrains is among the company’s most compelling opportunities amid tightening emissions regulations.

Yet, in contrast to these growth opportunities, investors should be aware that if OEM demand remains soft for longer than expected...

Read the full narrative on Allison Transmission Holdings (it's free!)

Allison Transmission Holdings is projected to reach $5.1 billion in revenue and $983.8 million in earnings by 2028. This outlook is based on a forecast annual revenue growth rate of 16.9% and an earnings increase of $221.8 million from the current earnings of $762.0 million.

Uncover how Allison Transmission Holdings' forecasts yield a $104.89 fair value, a 30% upside to its current price.

Exploring Other Perspectives

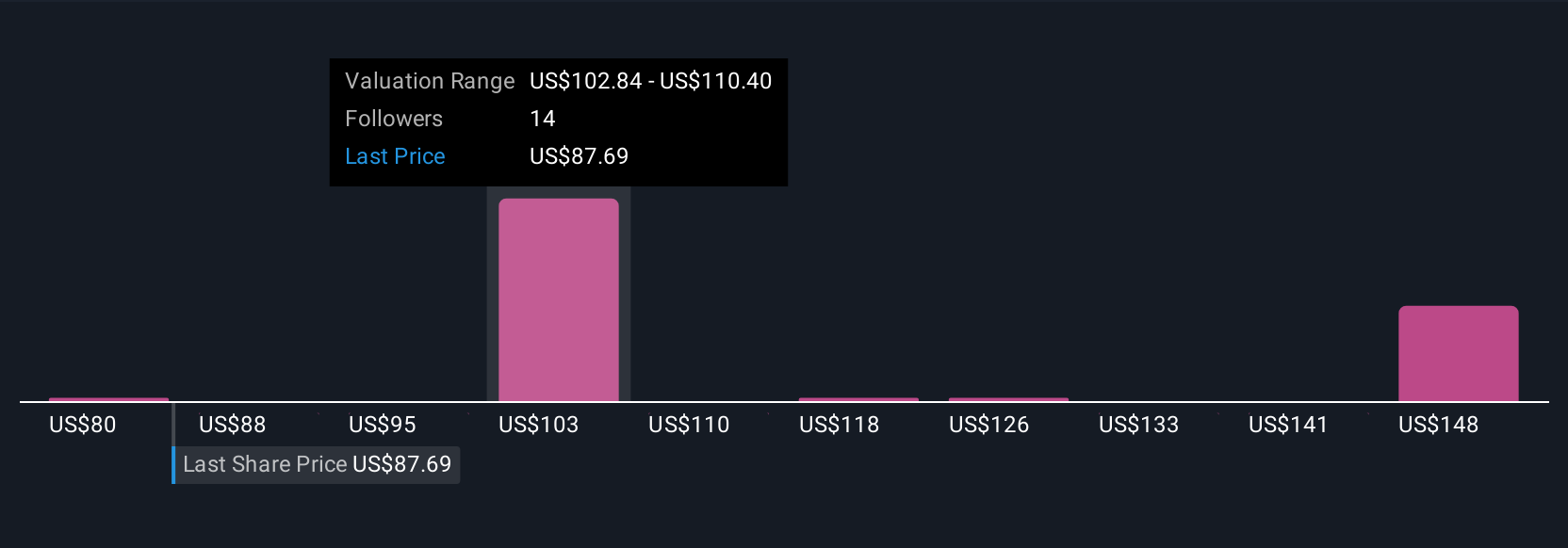

Six fair value estimates from the Simply Wall St Community range widely from US$80.18 up to US$244.48 per share. Many factor in Allison’s push into alternative and electrified drivetrains, suggesting that your outlook on these segments may significantly influence your own view of the company’s potential.

Explore 6 other fair value estimates on Allison Transmission Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Allison Transmission Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allison Transmission Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allison Transmission Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allison Transmission Holdings' overall financial health at a glance.

No Opportunity In Allison Transmission Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives