- United States

- /

- Machinery

- /

- NYSE:ALSN

Is Allison Transmission a Bargain After Recent Trucking Partnership News?

Reviewed by Bailey Pemberton

- Ever found yourself wondering whether Allison Transmission Holdings is actually a bargain, or if the current price hides some bigger story? You are not alone. Let's dig in together.

- The stock has seen a swift recovery recently, jumping 6.1% in just the last week and climbing 9.6% over the past month, even though it is still down 16.9% year-to-date and 23.6% over the past year.

- Much of this movement has followed news of the company's expanded partnerships in North American trucking and positive momentum in commercial vehicle demand. Investors have taken notice as Allison announces new technology launches and further international distribution deals.

- When it comes to valuation, Allison Transmission Holdings currently scores a 5 out of 6 on our checklist for undervaluation. In the next section, we will break down each major valuation approach, but make sure to stick around. There is a smarter way to judge fair value that you will not want to miss at the end.

Approach 1: Allison Transmission Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today to reflect their present value. This approach is especially useful for businesses with predictable cash flows, such as Allison Transmission Holdings.

For Allison Transmission Holdings, the current Free Cash Flow stands at $653.7 million. Based on analyst estimates and further projections by Simply Wall St, annual free cash flow is forecasted to reach $1.18 billion by the end of 2029. While analysts provide estimates for the next 5 years, more distant figures are extrapolated for a longer-term view.

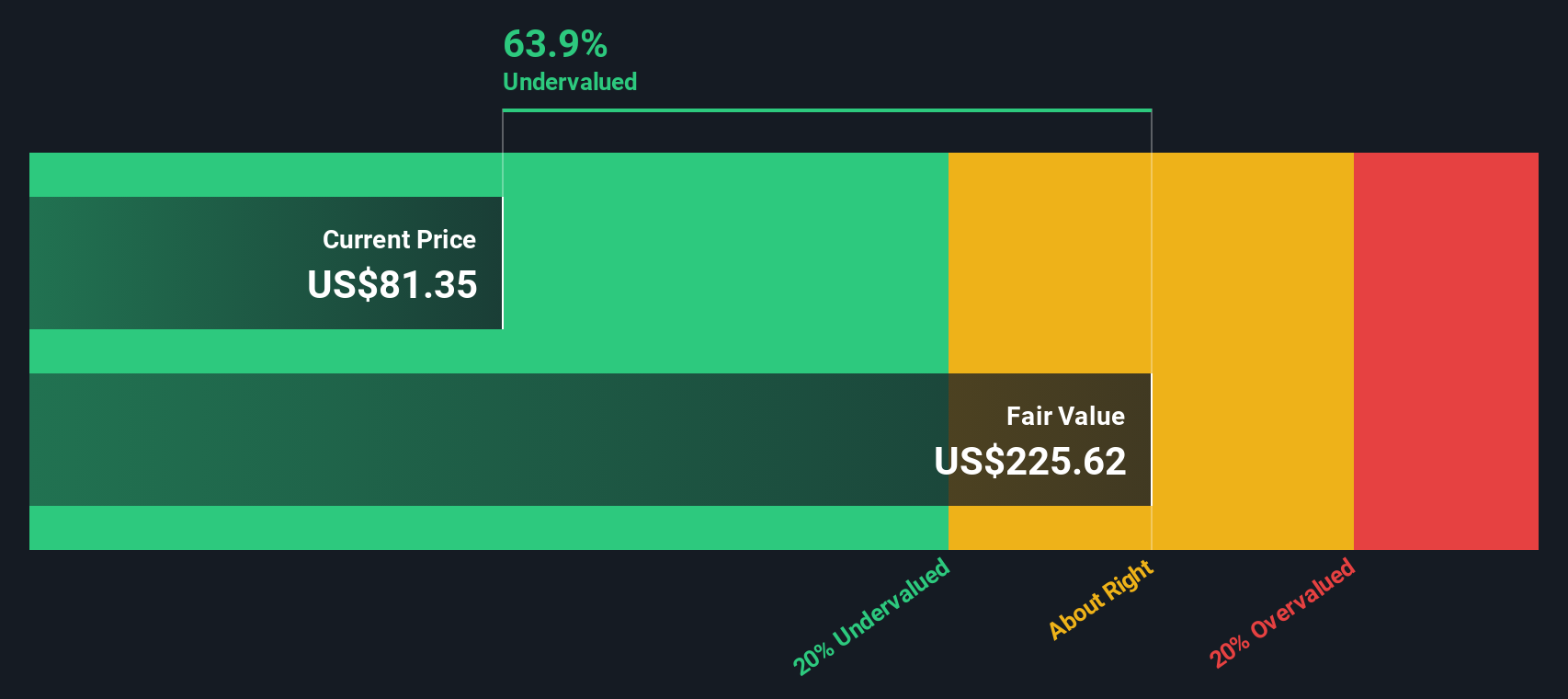

According to this DCF analysis, the fair value for Allison Transmission Holdings stock is $224.28. Compared to the current share price, the stock trades at a 60.1% discount, indicating that it is deeply undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Allison Transmission Holdings is undervalued by 60.1%. Track this in your watchlist or portfolio, or discover 922 more undervalued stocks based on cash flows.

Approach 2: Allison Transmission Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies, as it tells us how much investors are willing to pay for each dollar of earnings. Since Allison Transmission Holdings has consistent profits, the PE ratio offers a straightforward way to assess its value relative to earnings power.

Interpreting any PE ratio, however, depends not just on the number itself but also on what investors expect in terms of future growth and risk. Companies with higher growth prospects or lower risk typically command higher PE ratios, while those with slower growth or greater risk settle for lower multiples.

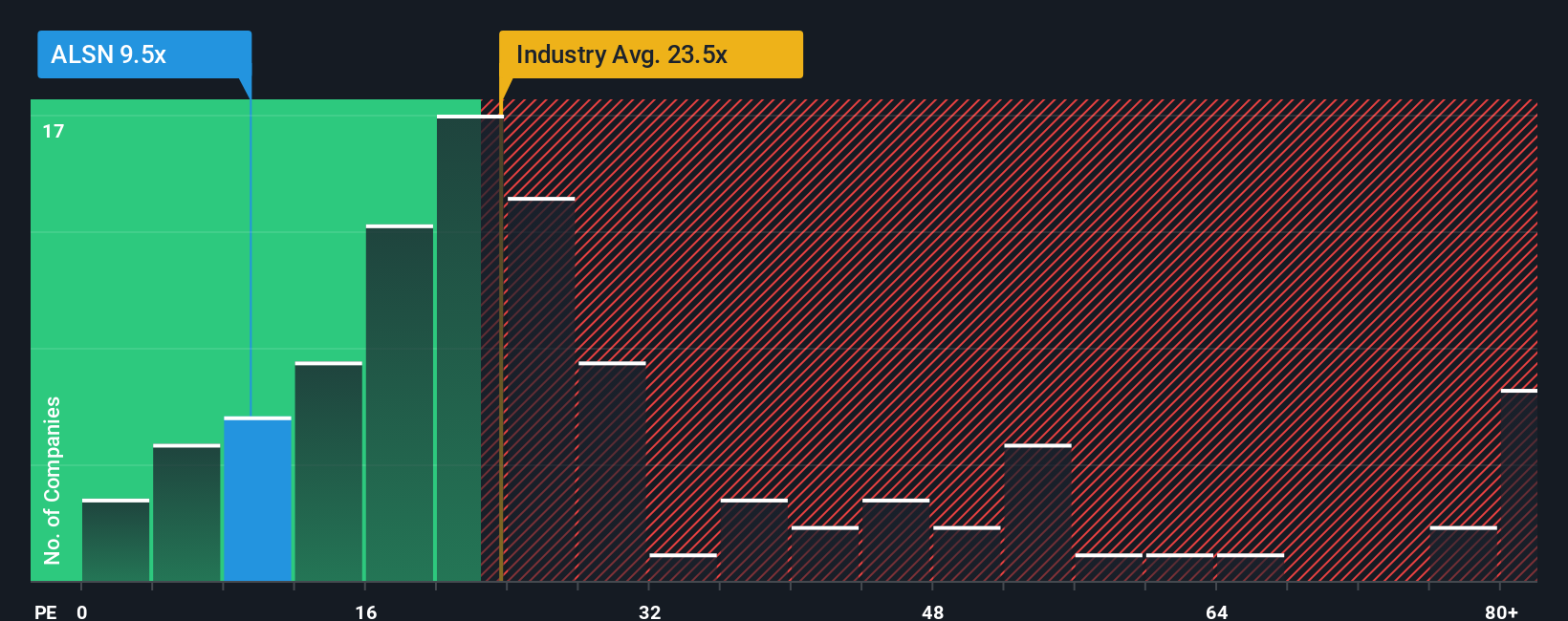

Currently, Allison Transmission Holdings trades at a PE ratio of 10.7x. That is significantly below the Machinery industry average of 24.8x and also well below the average of its peer group, which sits at 20.3x. However, rather than relying solely on industry or peer comparisons, Simply Wall St calculates a proprietary Fair Ratio for each company. For Allison, that Fair Ratio is 23.1x. This takes into account not just sector trends but also the company’s unique factors like earnings growth, margins, market cap, and specific risks.

Comparing Allison’s current PE to its Fair Ratio, the stock appears undervalued. The difference between the actual PE (10.7x) and the Fair Ratio (23.1x) is significant, suggesting the market may be underestimating its true worth.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Allison Transmission Holdings Narrative

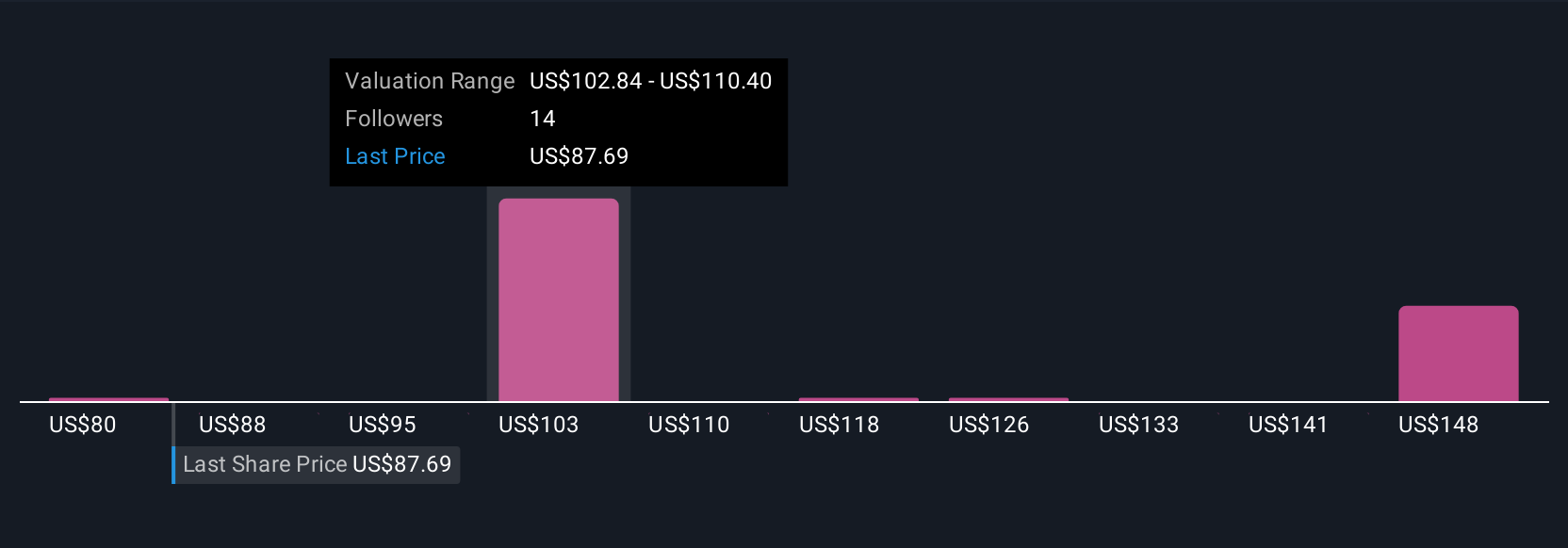

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own story about a company’s future. It connects your perspective (what you believe about Allison Transmission Holdings), your assumptions about its growth in revenue, earnings, and margins, and your fair value estimate, all in one place.

Narratives take the underlying data and forecasts and put them into context, turning static numbers into a living investment thesis. This approach links the company’s real-world story, current business trends, and risks directly to a dynamic financial forecast and ultimately a fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to test, share, and update their views as new events or news come to light. When news or earnings reports are published, your Narrative updates automatically, empowering you to make smarter, faster decisions about when to buy or sell by always comparing your updated Fair Value to the market Price.

For Allison Transmission Holdings, one investor’s Narrative might focus on expanding electrification and global defense deals, setting a bullish fair value near $129 per share. Another investor might focus on industry headwinds or potential integration risks and estimate just $84 per share. Both views are built on the same data but updated in real time and tailored to each individual’s beliefs.

Do you think there's more to the story for Allison Transmission Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.