- United States

- /

- Machinery

- /

- NYSE:ALSN

Does Allison’s New $97 Million U.S. Army Deal Reinforce Its Defense Edge for ALSN Investors?

Reviewed by Sasha Jovanovic

- Allison Transmission announced in the past week that it has been awarded a US$97 million contract to support the U.S. Army's Abrams Main Battle Tank program, continuing its multi-decade role as the supplier of the X1100 cross-drive transmission for this critical defense platform.

- This contract highlights Allison's integration into long-term military programs and reflects the ongoing importance of maintainability, modularity, and lifecycle support in defense procurement.

- We'll examine how this significant U.S. Army contract win strengthens Allison Transmission's investment narrative through enhanced defense sector exposure.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Allison Transmission Holdings Investment Narrative Recap

To have confidence in Allison Transmission Holdings as a shareholder, you need to believe the company's exposure to defense and infrastructure programs, especially long-term contracts like the new US$97 million Abrams Main Battle Tank agreement, helps offset cyclical downturns in commercial vehicle demand. While this defense win reinforces Allison's defense sector foothold, the most important short-term catalyst remains the pace and trajectory of recovery in the North America On-Highway market; continued OEM production cuts and elevated inventories still represent the most significant risk. This new contract, while positive for sector mix, is not likely to materially shift near-term demand headwinds in the company's core markets.

Among recent company announcements, the successful integration of Allison's 4500 RDS transmission with the Cummins X15N natural gas engine for Kenworth T880 tractors stands out. This pairing opens growth opportunities in sustainable transportation, underscoring how Allison is positioning itself to benefit from increasing demand for lower-emission vehicles, a trend that could provide resilience if legacy drivetrain sales falter due to regulatory or competitive shifts.

However, investors should be aware that, despite a robust defense pipeline, the ongoing softness in on-highway demand signals...

Read the full narrative on Allison Transmission Holdings (it's free!)

Allison Transmission Holdings is expected to reach $5.1 billion in revenue and $983.8 million in earnings by 2028. This outlook assumes a 16.9% annual revenue growth rate and a $221.8 million increase in earnings from the current $762.0 million.

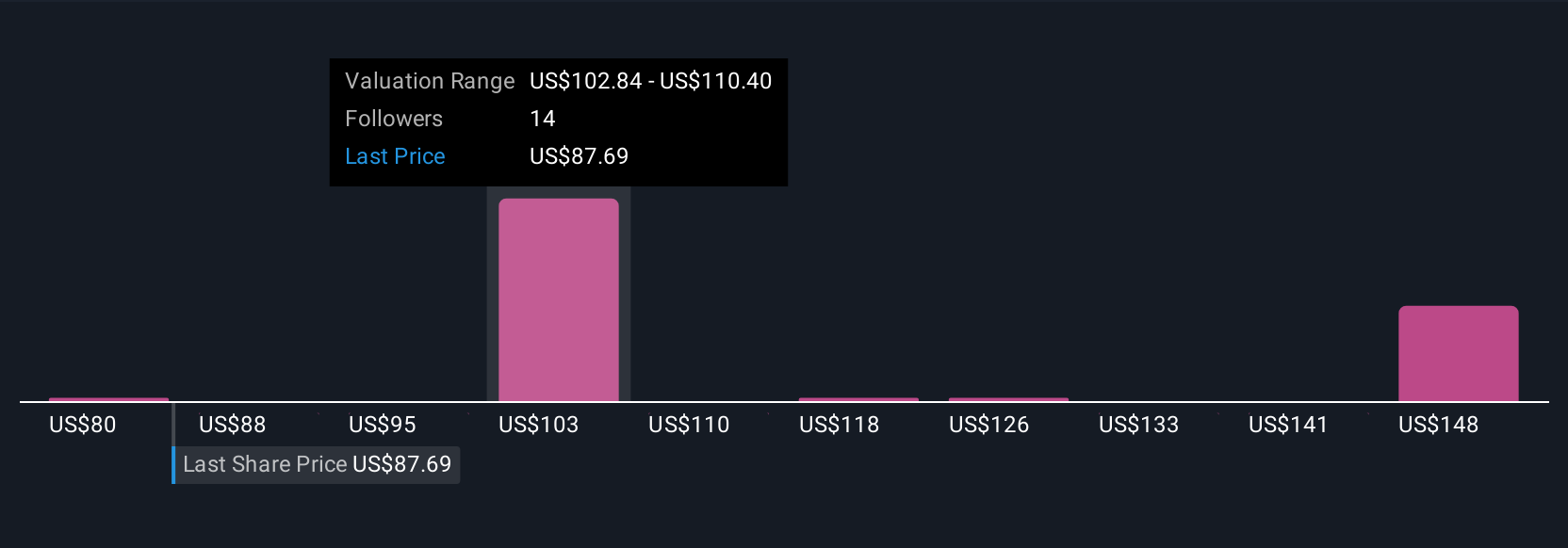

Uncover how Allison Transmission Holdings' forecasts yield a $103.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six different fair value estimates from the Simply Wall St Community range from US$84 to a high of US$242.87, capturing widely different expectations. Against this backdrop, continued softness in the commercial vehicle segment remains a concern and may sway long-term outcomes for margin and growth, explore these contrasting viewpoints for deeper context.

Explore 6 other fair value estimates on Allison Transmission Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Allison Transmission Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allison Transmission Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allison Transmission Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allison Transmission Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives