- United States

- /

- Machinery

- /

- NYSE:ALG

How Investors May Respond To Alamo Group (ALG) CEO Share Buying After Mixed Q3 Earnings

Reviewed by Sasha Jovanovic

- Earlier this week, Alamo Group’s President & CEO Robert Paul Hureau bought 304 company shares for about US$49,697, shortly after the firm posted mixed third-quarter 2025 results marked by strong Industrial Equipment sales but softer Vegetation Management performance.

- This insider purchase, coming as earnings outpaced revenue expectations in some areas but lagged in profit forecasts, highlights management’s confidence in the business amid uneven momentum across its core segments.

- We’ll now examine how the CEO’s insider buying, set against mixed Q3 earnings, could reshape Alamo Group’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Alamo Group Investment Narrative Recap

To own Alamo Group, you need to believe its Industrial Equipment strength and healthy balance sheet can offset choppy Vegetation Management demand and municipal spending cycles. The CEO’s US$49,697 insider purchase following mixed Q3 2025 results does not materially change the near term catalyst, which remains execution in turning around Vegetation Management, or the key risk of prolonged softness in that higher margin business.

The most relevant recent announcement here is Q3 2025 earnings, where revenue grew to US$420.0 million but EPS slipped year over year and fell short of forecasts. That mix of top line resilience and margin pressure is exactly where management execution, capital deployment, and the Vegetation Management recovery thesis intersect, giving context to both the insider buying and the operational picture investors are weighing.

Yet behind the CEO’s share purchase, investors should also be aware of the risk that prolonged weakness in Vegetation Management could...

Read the full narrative on Alamo Group (it's free!)

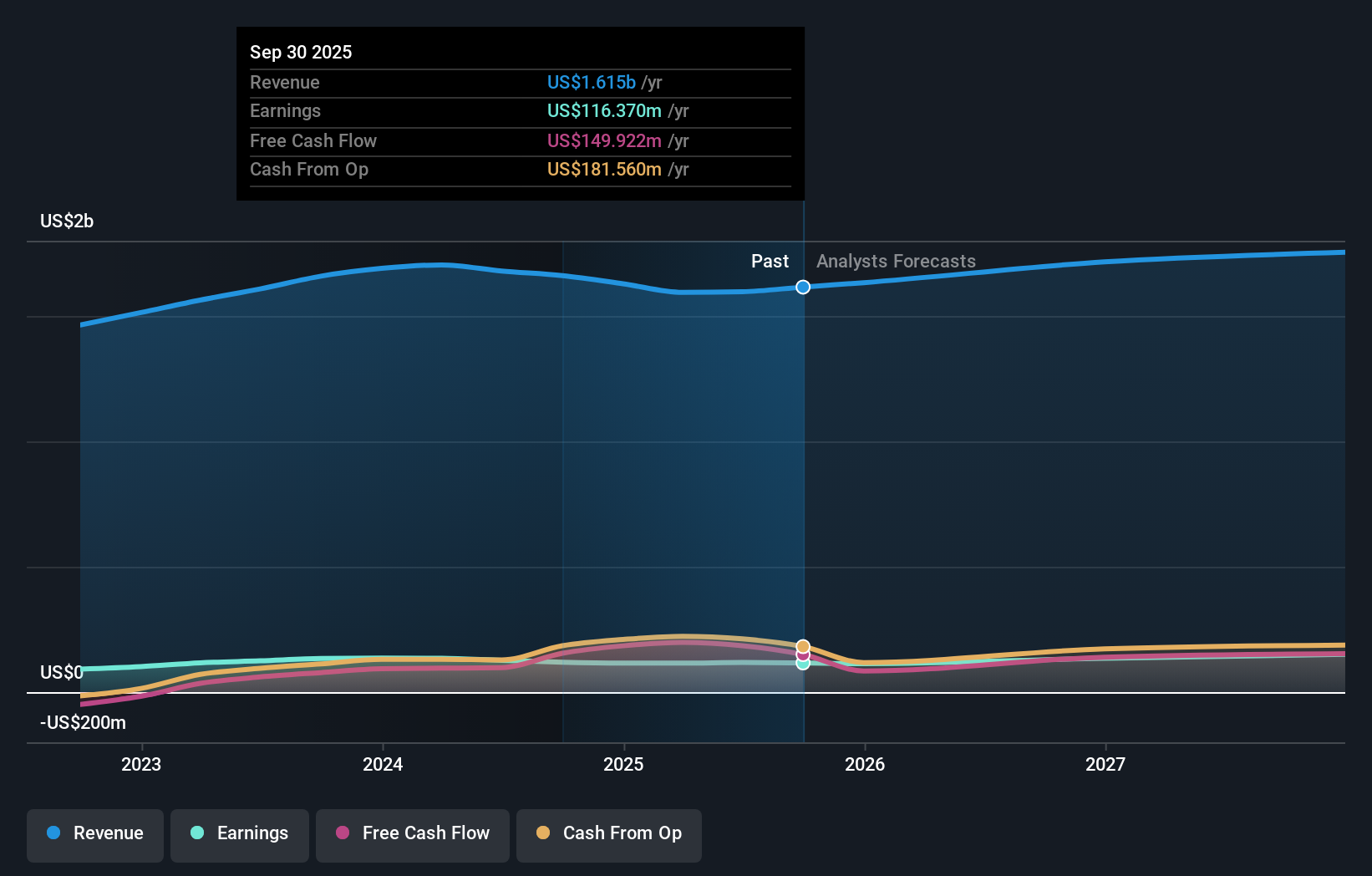

Alamo Group's narrative projects $1.9 billion revenue and $179.9 million earnings by 2028. This requires 5.3% yearly revenue growth and about a $61.5 million earnings increase from $118.4 million today.

Uncover how Alamo Group's forecasts yield a $212.75 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently place Alamo Group’s fair value between US$164.78 and US$212.75, highlighting a broad spread of expectations. You should weigh these against the risk that ongoing Vegetation Management underperformance could continue to pressure group margins and temper how quickly any perceived undervaluation might close.

Explore 3 other fair value estimates on Alamo Group - why the stock might be worth just $164.78!

Build Your Own Alamo Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alamo Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alamo Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alamo Group's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALG

Alamo Group

Designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026