- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

What AAR (AIR)'s $85 Million Defense Logistics Win Means For Shareholders

Reviewed by Simply Wall St

- On September 4, 2025, AAR CORP. announced it was awarded an indefinite-delivery/indefinite-quantity contract by the Defense Logistics Agency Troop Support, with a base period of one year and four optional years, valuing up to US$85 million for specialized shipping and storage solutions.

- This long-term government contract provides AAR with expanded access to recurring federal orders, potentially supporting revenue stability across multiple years.

- We'll explore how this significant win in the defense sector could reinforce AAR’s strategy to buffer commercial aviation cyclicality.

Find companies with promising cash flow potential yet trading below their fair value.

AAR Investment Narrative Recap

To own shares in AAR, you need to believe the company can balance the cyclical nature of its commercial aviation business by expanding in government and defense markets. The newly announced US$85 million Defense Logistics Agency contract boosts visibility for recurring military revenue, but does not eliminate the risk that commercial aviation cycles could still impact near-term results, or that rising competition from OEMs could pressure margins.

A recent and highly relevant development is the multi-year distribution agreement with AmSafe Bridport, which further diversifies AAR’s portfolio for defense platforms. Partnerships like this build on AAR’s efforts to secure a steadier mix of commercial and government revenue streams, strengthening the very catalyst that the latest DLA contract supports.

In contrast, investors should also pay close attention to competitive pressure from aircraft OEMs, as this remains an area where...

Read the full narrative on AAR (it's free!)

AAR's outlook projects $3.2 billion in revenue and $293.3 million in earnings by 2028. This scenario assumes 4.8% annual revenue growth and a $280.8 million increase in earnings from the current $12.5 million.

Uncover how AAR's forecasts yield a $84.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

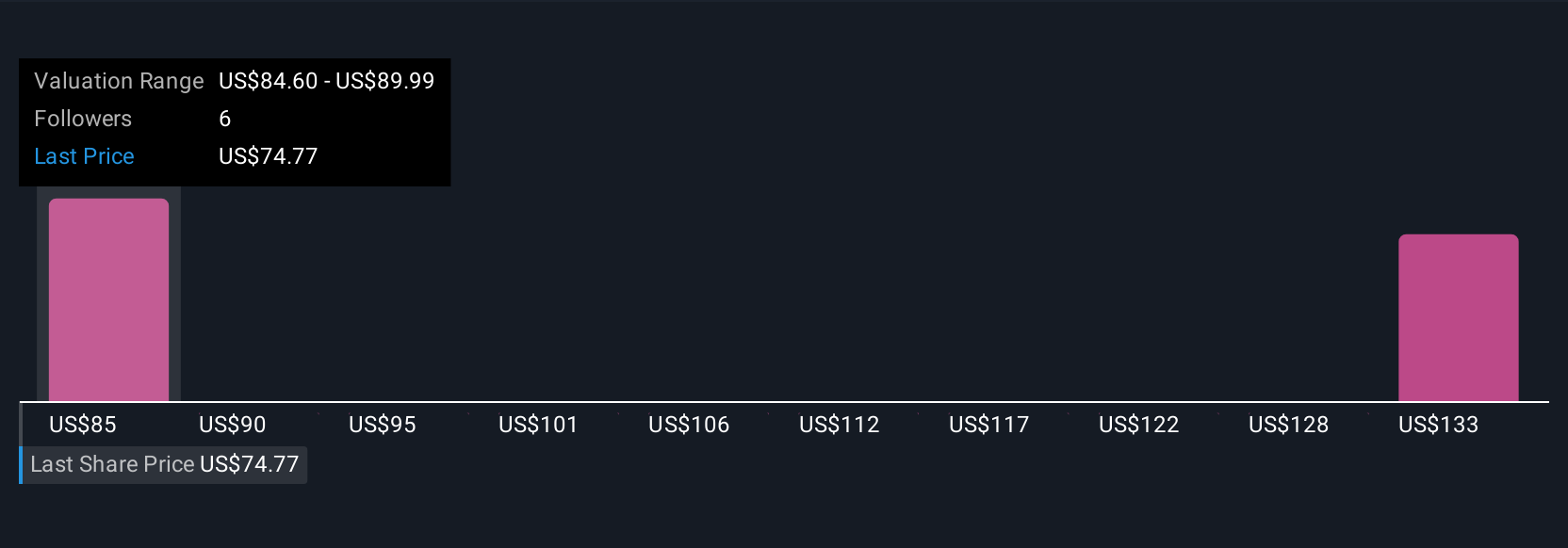

Two members of the Simply Wall St Community have outlined fair values from US$84.25 to US$138.47 per share. While views differ widely, many are considering how government wins may buffer AAR from commercial market swings, inviting you to weigh multiple opinions before sizing your risk.

Explore 2 other fair value estimates on AAR - why the stock might be worth just $84.25!

Build Your Own AAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAR research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAR's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives