- United States

- /

- Construction

- /

- NYSE:AGX

US Undiscovered Gems to Explore in April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.0% drop, yet it remains up by 4.6% over the past year with anticipated earnings growth of 14% per annum in the coming years. In this fluctuating environment, identifying stocks that are undervalued or overlooked can offer unique opportunities for investors seeking potential long-term rewards.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Reitar Logtech Holdings (NasdaqCM:RITR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reitar Logtech Holdings Limited, with a market cap of approximately $251.02 million, operates through its subsidiaries to offer construction management and engineering design services.

Operations: Reitar Logtech Holdings generates revenue primarily from its construction and engineering services segment, amounting to HK$358.56 million. The company's market cap is approximately $251.02 million.

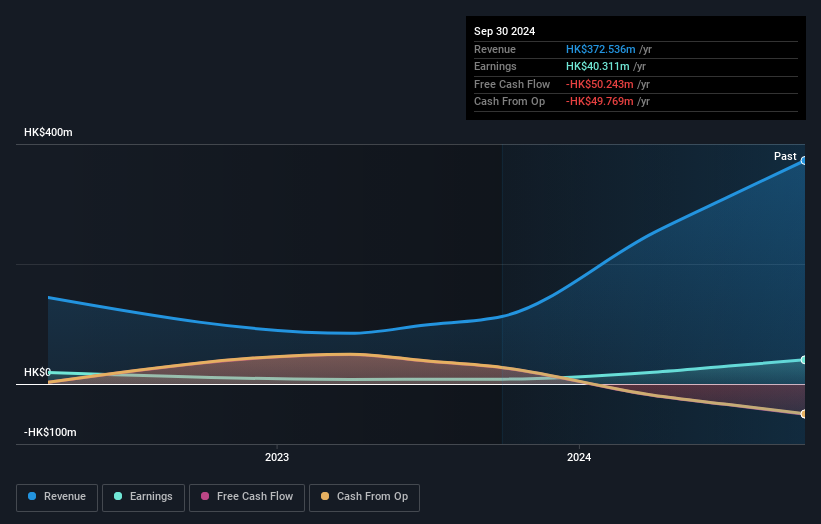

Reitar Logtech Holdings, a small cap player in the logistics tech arena, has seen its earnings skyrocket by 398.7% over the past year, outpacing the real estate industry's average growth of 6.7%. Despite this impressive growth, free cash flow remains negative at US$50.24 million as of September 2024. The company's net debt to equity ratio stands at a satisfactory 14.5%, with interest payments well covered by EBIT at a multiple of 35.7x. Recent results show revenue climbing to HKD194 million for half-year ending September 2024 from HKD73 million previously, while net income rose to HKD24 million from HKD3 million last year.

- Navigate through the intricacies of Reitar Logtech Holdings with our comprehensive health report here.

Explore historical data to track Reitar Logtech Holdings' performance over time in our Past section.

Argan (NYSE:AGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Argan, Inc. operates through its subsidiaries to offer comprehensive engineering, procurement, construction, and consulting services primarily for the power generation sector across the United States, Republic of Ireland, and the United Kingdom with a market cap of approximately $1.99 billion.

Operations: Argan generates revenue primarily from power services, contributing $693.04 million, with additional income from industrial and telecom services at $167.62 million and $13.52 million respectively. The company's cost structure is heavily influenced by its service operations across different sectors, impacting its overall profitability dynamics.

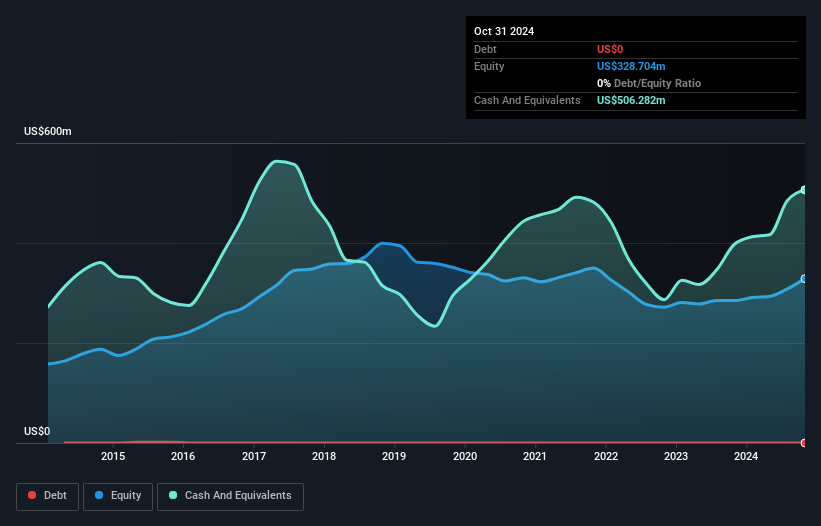

Argan, a nimble player in the construction space, is making waves with an 80% rise in project backlog to $1.4 billion as of January 2025. This growth is fueled by strategic contracts in natural gas and renewable energy sectors, including a Texas gas plant and an Illinois solar project. With no debt on its books and $525 million in cash, Argan has the flexibility for strategic investments under new leadership at its Telecommunications Infrastructure Services division. The company repurchased 6,251 shares recently for $0.94 million, reflecting confidence amid volatile share prices over the past three months.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company based in China, with a market cap of approximately $491.14 million.

Operations: Dingdong generates revenue primarily through its online retail segment, which reported CN¥22.15 billion. The company's financial performance is significantly influenced by this segment's contribution to overall revenue.

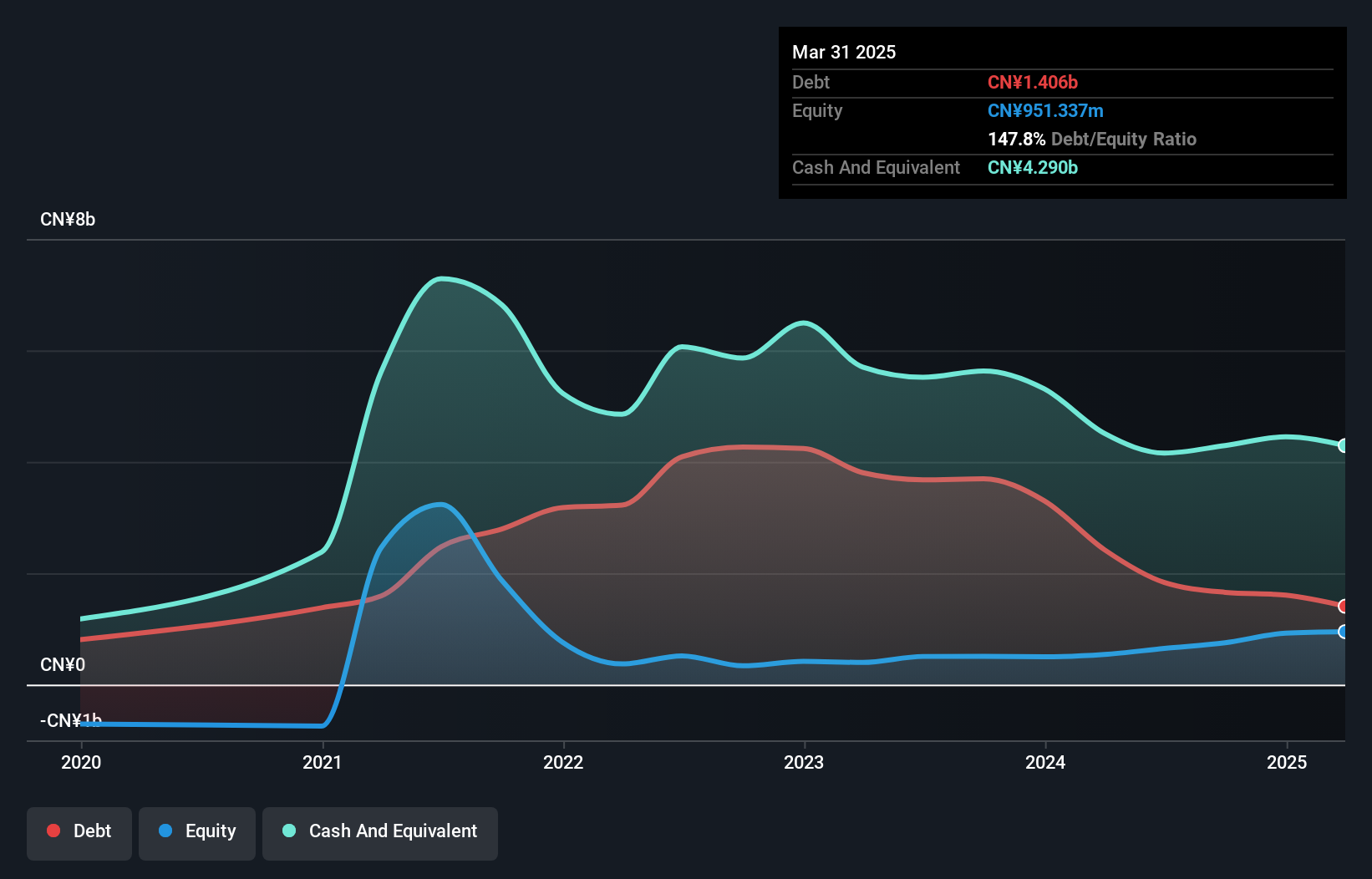

Dingdong (Cayman), an emerging e-commerce player, has shown promising growth with its recent profitability and strategic focus on supply chain efficiency. The company reported a revenue of CN¥5.91 billion for Q4 2024, up from CN¥4.99 billion the previous year, alongside a net income of CN¥89.18 million compared to a loss previously. Earnings per share improved to CNY 0.405 from a loss of CNY 0.03 last year, signaling robust financial health and operational improvements. A share repurchase program worth US$20 million reflects confidence in its market position and potential value creation for shareholders moving forward.

Seize The Opportunity

- Investigate our full lineup of 287 US Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives