- United States

- /

- Machinery

- /

- NYSE:AGCO

The Bull Case For AGCO (AGCO) Could Change Following Precision Ag Expansion and Linnavuori Investment

Reviewed by Sasha Jovanovic

- In recent weeks, AGCO Corporation unveiled new production facilities at its Linnavuori, Finland plant, expanding manufacturing of engine and transmission components and boosting remanufacturing capabilities as part of a EUR54 million investment within its AGCO Power division. The company’s annual Tech Day also highlighted precision agriculture advancements, new digital platforms, and autonomous technologies aimed at enhancing efficiency and integrating equipment fleets.

- These developments underscore AGCO’s commitment to sustainable manufacturing practices and a circular economy, while positioning the company as an innovator in AI-driven precision agriculture technology that supports cross-brand and mixed-fleet solutions for global farmers.

- We'll examine how AGCO’s expansion in precision ag platforms and manufacturing capacity could reshape its investment narrative and growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AGCO Investment Narrative Recap

For AGCO shareholders, the central thesis rests on the company's ability to capture accelerating demand for precision agricultural solutions amid a backdrop of cautious farmer sentiment and industry headwinds, especially in Europe and North America. While the €54 million Linnavuori facility expansion highlights operational progress, the announcement does not meaningfully address the most immediate risk: persistently high dealer inventories and underproduction in North America, which continue to weigh on operating margins.

Among recent developments, AGCO’s annual Tech Day announcement stands out for its focus on AI-driven, cross-brand precision agriculture technologies, an effort closely tied to the company’s key catalysts around digital transformation and higher-margin revenue streams. Such initiatives may help offset some cyclical risks, but overcoming regional demand softness and margin pressure remains the immediate challenge.

Yet in contrast to these growth ambitions, investors should be aware of the ongoing risks associated with elevated dealer inventories and...

Read the full narrative on AGCO (it's free!)

AGCO's narrative projects $12.1 billion revenue and $800.1 million earnings by 2028. This requires 5.9% yearly revenue growth and a $700.5 million earnings increase from $99.6 million today.

Uncover how AGCO's forecasts yield a $123.77 fair value, a 13% upside to its current price.

Exploring Other Perspectives

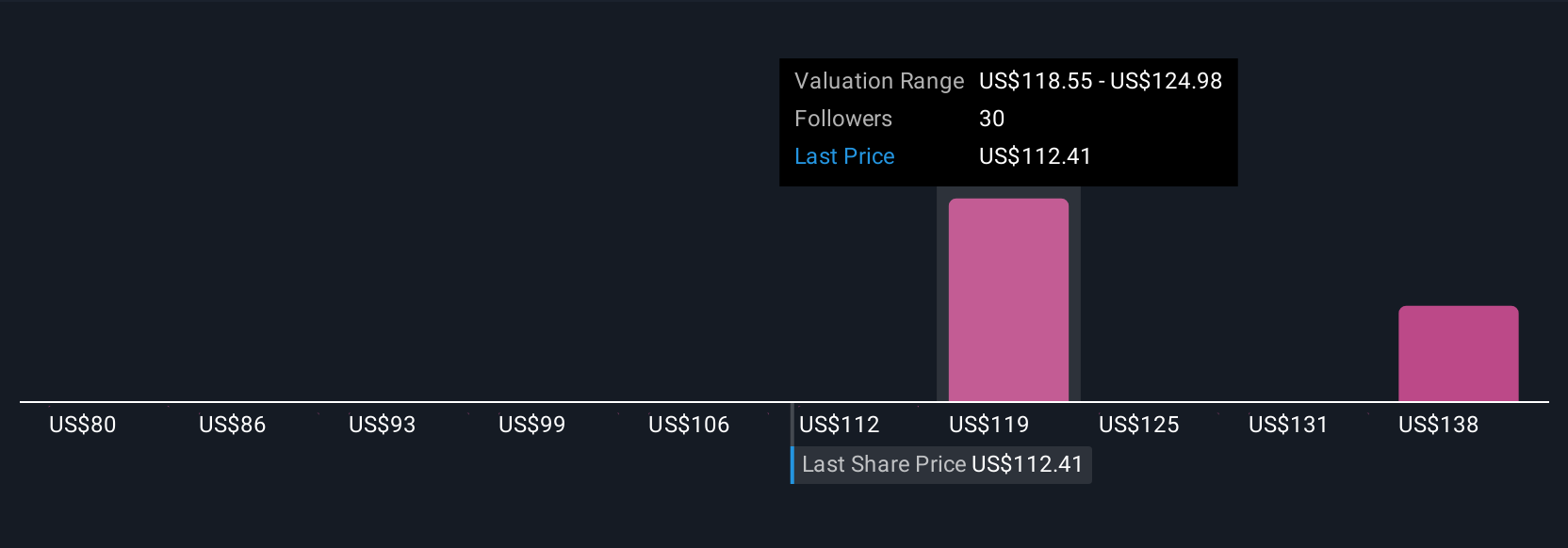

Simply Wall St Community members estimate AGCO’s fair value between US$80 and US$139, reflecting broad differences across just four analyses. In the context of persistent dealer inventory risks, it is clear that market participants weigh supply chain headwinds very differently.

Explore 4 other fair value estimates on AGCO - why the stock might be worth as much as 27% more than the current price!

Build Your Own AGCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free AGCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AGCO's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives