- United States

- /

- Construction

- /

- NYSE:ACA

Arcosa (ACA) Declares Quarterly US$0.05 Dividend For October 2025 Payment

Reviewed by Simply Wall St

Arcosa (ACA) recently declared a regular quarterly cash dividend of $0.05 per share, reinforcing its commitment to shareholder returns. Over the last quarter, Arcosa's stock price increased by approximately 10%, closely mirroring the broader market's upward trend, buoyed by strong earnings growth and revised guidance. The company's earnings announcement highlighted a significant increase in sales and net income compared to the previous year, likely contributing to positive investor sentiment. Meanwhile, Arcosa's addition to multiple Russell indices may have enhanced its market visibility, further supporting the stock's rise amid an overall favorable market environment driven by anticipated interest rate cuts.

The recent dividend declaration by Arcosa underscores its strategic intent to solidify shareholder returns, resonating with investors. Over the last five years, Arcosa has recorded a substantial total return of 115.79%, highlighting its performance strength in the market. However, Arcosa's share price movement over the past year, where it underperformed both the US Market and the US Construction industry, implies potential volatility despite its long-term gains. The stock's 10% rise last quarter aligns closely with broader market trends, reflecting strong investor sentiment following earnings growth and revised guidance.

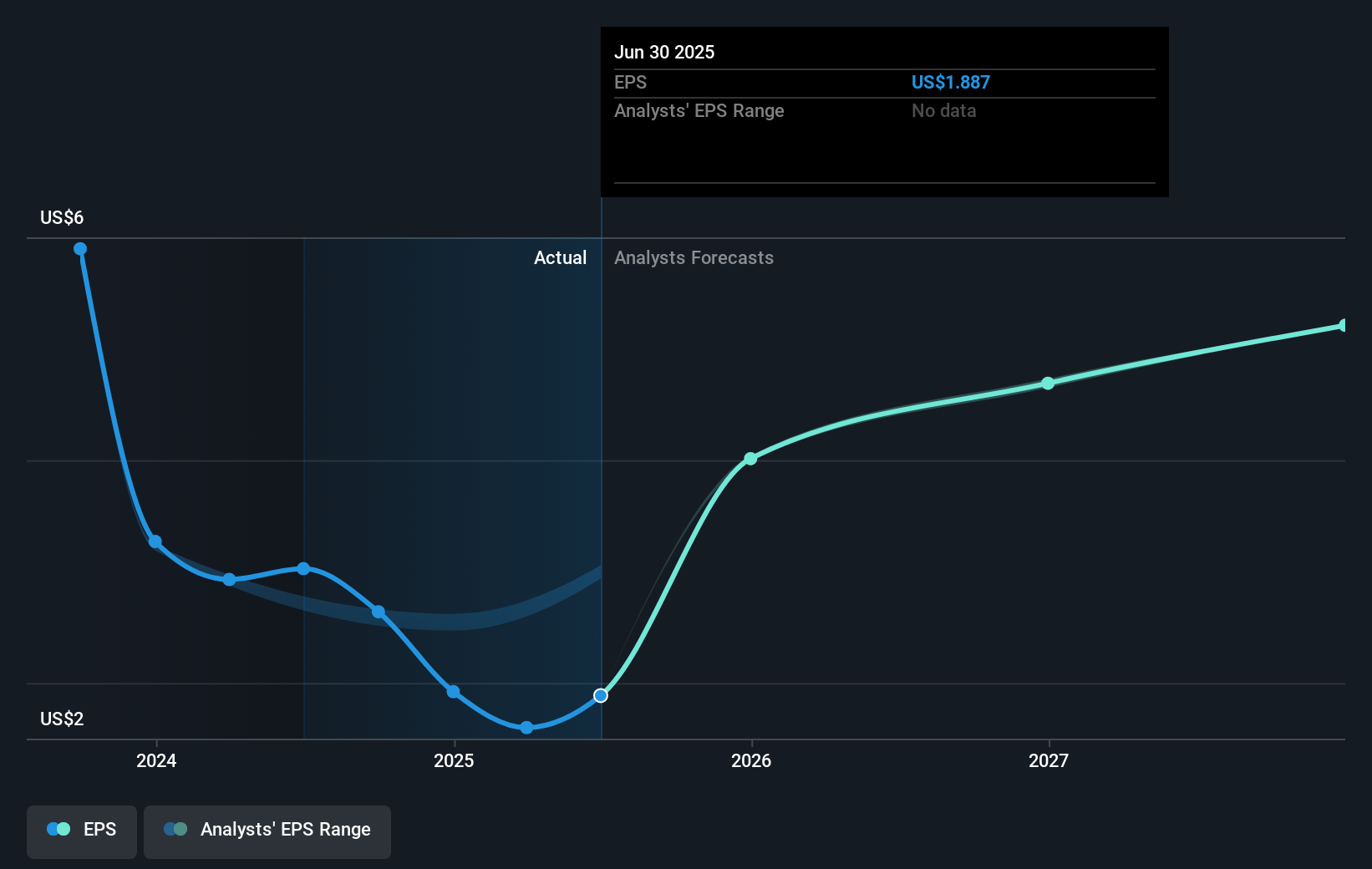

The dividend announcement, coupled with the recent quarter's market performance, may influence future revenue and earnings forecasts positively as it indicates a financially stable outlook. Significant US infrastructure spending and investment in renewables might bolster demand for Arcosa’s products and facilitate its revenue growth, forecasted at 7.7% annually. Despite its aggressive growth plans, achieving the analysts’ consensus price target of US$116.0 suggests an anticipated upside of 20.52% from the current US$96.25, showcasing confidence in the company’s long-term potential, although it trades above its estimated fair value of US$49.02.

Examine Arcosa's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACA

Arcosa

Provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives