- United States

- /

- Software

- /

- NYSE:TUYA

November 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As November 2025 unfolds, the U.S. stock market has experienced a turbulent week, with major indices closing lower despite a strong finish on Friday and growing optimism for an interest rate cut by the Federal Reserve. Amidst these fluctuations, investors are exploring diverse opportunities to navigate the shifting landscape. Penny stocks, often associated with smaller or emerging companies, continue to draw attention for their potential growth prospects at accessible price points. While the term may seem like a relic from past market eras, it remains relevant today as these investments can offer significant value when backed by strong financials and strategic positioning in their respective industries.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $257.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.77 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.65 | $596.74M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.495 | $588.08M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.74 | $1.2B | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.89 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.23 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.38 | $568.6M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.899505 | $6.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 360 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

ZJK Industrial (ZJK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZJK Industrial Co., Ltd. manufactures and sells precision fasteners, structural parts, and other precision metal products through its subsidiaries in various international markets, with a market cap of $150.62 million.

Operations: The company's revenue is primarily generated from its Metal Products - Fasteners segment, amounting to $46.28 million.

Market Cap: $150.62M

ZJK Industrial has demonstrated solid revenue growth, reporting US$24.7 million for the half year ended June 2025, up from US$16.23 million a year ago. The company benefits from strong short-term asset coverage over liabilities and maintains more cash than total debt, suggesting financial stability. However, its profit margins have decreased significantly to 8.9% from 29.2% last year, and it faces high share price volatility despite reduced weekly fluctuations recently. ZJK's innovative six-flap eccentric chuck positions it well in the expanding AI server market by enhancing production efficiency and capabilities for complex components manufacturing.

- Click to explore a detailed breakdown of our findings in ZJK Industrial's financial health report.

- Review our historical performance report to gain insights into ZJK Industrial's track record.

Nerdy (NRDY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nerdy, Inc. operates a platform for live online learning in the United States and has a market cap of approximately $192.95 million.

Operations: The company generates its revenue from the Tutoring segment, which brought in $177.87 million.

Market Cap: $192.95M

Nerdy, Inc. is navigating financial challenges as it remains unprofitable, with a net loss of US$12.29 million in Q3 2025 despite stable revenue streams from its tutoring segment. The company reported Q3 sales of US$37.02 million and anticipates full-year revenue between US$175 million and US$177 million. Nerdy recently secured a loan agreement for up to $50 million with Hercules Capital, providing potential liquidity support but introducing debt obligations after previously being debt-free. The management team is seasoned, and the new COO brings extensive experience from Amazon, potentially strengthening operational efficiency amidst ongoing losses.

- Navigate through the intricacies of Nerdy with our comprehensive balance sheet health report here.

- Learn about Nerdy's future growth trajectory here.

Tuya (TUYA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People's Republic of China, with a market cap of approximately $1.28 billion.

Operations: The company generates its revenue from the Internet Software & Services segment, amounting to $318.49 million.

Market Cap: $1.28B

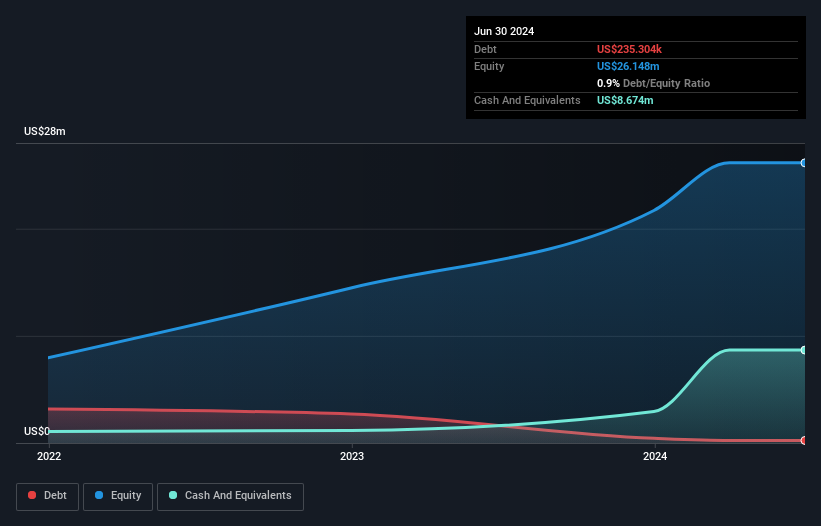

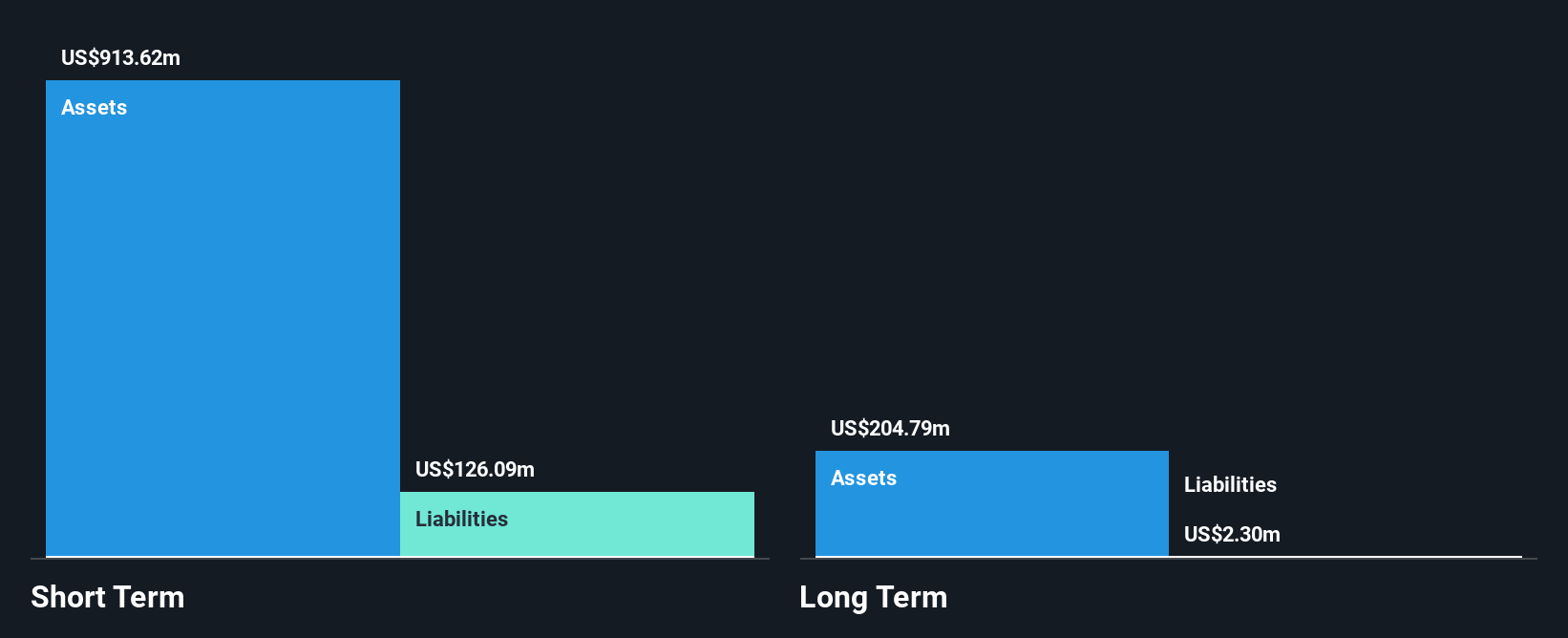

Tuya Inc. demonstrates financial stability with no debt and short-term assets of US$896.6 million exceeding liabilities, positioning it well among penny stocks. The company has transitioned to profitability, reporting a net income of US$23.6 million for the first half of 2025, though its Return on Equity remains low at 2.9%. Recent participation in the United Nations Solutions Hub highlights Tuya's commitment to sustainability through AIoT technologies, enhancing global energy management solutions. Despite these strengths, its dividend yield is not well-covered by earnings or free cash flows, suggesting cautious optimism for investors focused on income generation.

- Click here to discover the nuances of Tuya with our detailed analytical financial health report.

- Gain insights into Tuya's future direction by reviewing our growth report.

Key Takeaways

- Take a closer look at our US Penny Stocks list of 360 companies by clicking here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives