- United States

- /

- Machinery

- /

- NasdaqCM:XOS

Xos, Inc.'s (NASDAQ:XOS) Subdued P/S Might Signal An Opportunity

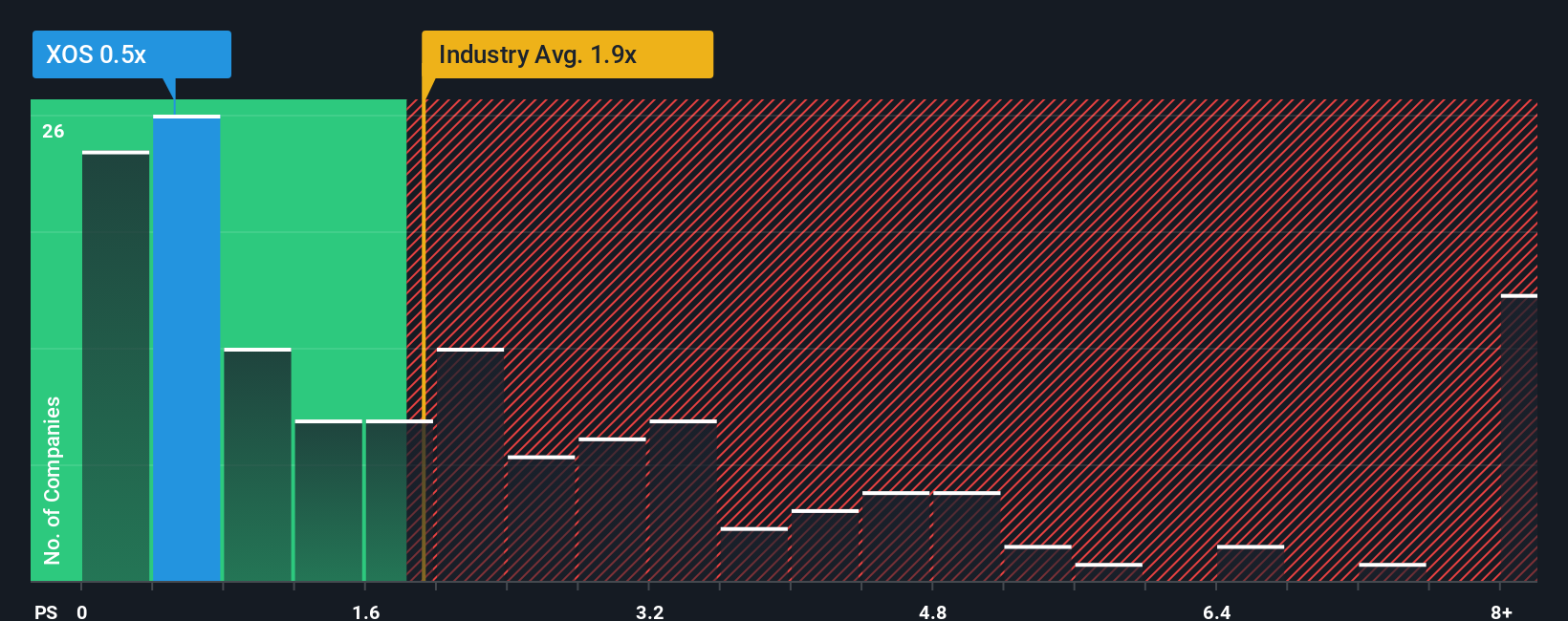

Xos, Inc.'s (NASDAQ:XOS) price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Machinery industry in the United States, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xos

What Does Xos' Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Xos has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xos.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Xos would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 8.1% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.8% per year, which is noticeably less attractive.

With this information, we find it odd that Xos is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Xos' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Xos (1 is potentially serious) you should be aware of.

If you're unsure about the strength of Xos' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XOS

Xos

Designs, manufactures, and sells battery-electric commercial vehicles.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives