- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:WWD

Woodward (WWD) Profit Margin Hits 12.4%, Reinforcing Quality Narrative Against Premium Valuation

Reviewed by Simply Wall St

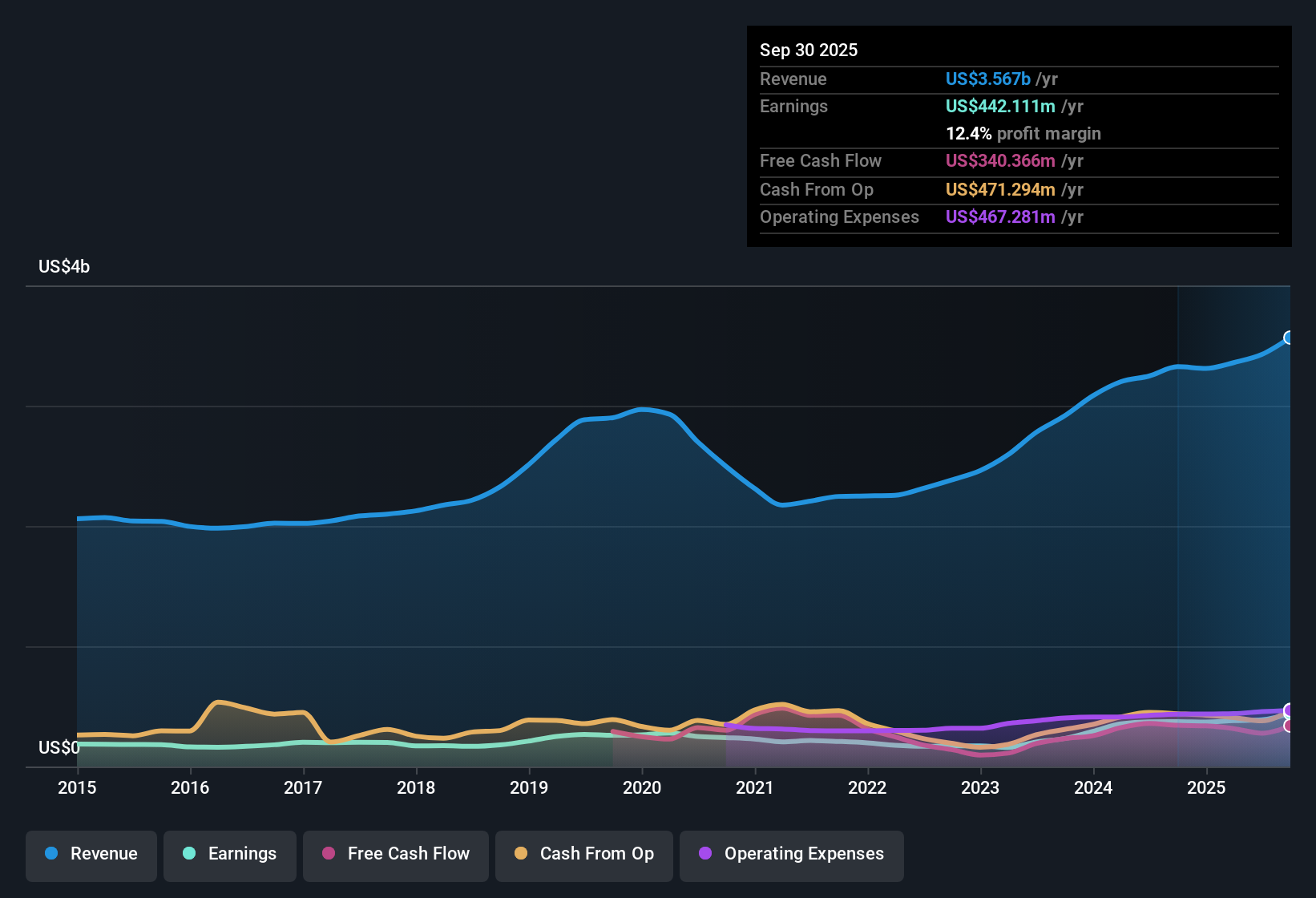

Woodward (WWD) just posted its FY 2025 Q4 results, revealing revenue of $995.3 million and basic EPS of $2.30 for the quarter. Over the past year, the company has seen revenue climb from $3.3 billion to $3.6 billion, while EPS moved up from $6.21 to $7.42 for the trailing twelve months. Profit margins expanded, capping off a report that puts operational improvements in the spotlight for investors focused on bottom-line performance.

See our full analysis for Woodward.Now, let's see how these headline figures compare to the prevailing market narratives. We will break down which stories the numbers confirm and which ones are put to the test.

See what the community is saying about Woodward

Profit Margin Climbs to 12.4%

- Net profit margin rose to 12.4% for the trailing twelve months, up from 11.2% a year ago. This signals leaner operations even as revenue growth trailed the broader US market rate of 10.5%.

- According to the consensus narrative, Woodward’s margin improvement is viewed as a sign of resilience and high-quality execution. Analysts note, however, that recent margin gains may face pressure from heavier capital expenditures and integration costs relating to new manufacturing and acquisitions.

- Consensus narrative indicates that strategic investments in automation and operational efficiency are designed to maintain margin progress and stable earnings. These efforts carry the risk that higher spending could reduce future profits if returns are slower than expected.

- Consensus also highlights that improved profitability leads to stronger recurring revenue streams, but warns that external factors such as volatile end-markets and industry shifts toward new propulsion technologies could impact long-term margin stability.

Valuation Outpaces Peers and Fair Value

- The current Price-To-Earnings Ratio is 40.4x, above the US Aerospace & Defense industry average of 38.1x and internal DCF fair value of $258.95, with shares trading at $298.15 as of the latest close.

- Analysts’ consensus narrative states that this valuation premium is largely based on Woodward’s history of strong earnings growth and margin improvements. However, it increases the risk that any disappointment in growth or cash flow could have a greater effect:

- Valuation expectations are built on a forecast of earnings per share growth at 11.53% per year, which is lower than the US market average of 16%. This suggests investors are focusing on long-term resilience rather than near-term growth outperformance.

- The consensus narrative highlights ongoing market confidence in Woodward’s premium positioning but notes that the current stock price requires even faster progress on revenue and profit expansion to justify its multiples.

Earnings Growth Accelerates Past Five-Year Trend

- Earnings per share grew 18.5% year over year compared to the company’s five-year average of 17.8%. Trailing twelve-month net income reached $442.1 million.

- Consensus narrative indicates that this acceleration in earnings is viewed as a clear positive for the long-term case, especially with the company’s strategic focus on automation, proprietary technologies, and expanding recurring revenue streams.

- The company’s recent momentum is cited by the consensus as supporting expectations for stable, high-quality profit growth. However, it is also noted that future earnings are projected to grow more slowly than the market, raising the bar for ongoing outperformance as forecasts become more moderate.

- Analysts agree that while increased shareholder returns are supported by recent trends, continued execution on capital projects and effective navigation of sector challenges will be important to maintain earnings progression.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Woodward on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data from another angle. Shape your take in just a few minutes and add your perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

See What Else Is Out There

Woodward’s premium valuation and slower projected earnings growth compared to the broader market highlight risks for investors seeking both resilience and upside.

If you want to uncover stocks with stronger upside and lower valuation risk, check out these 927 undervalued stocks based on cash flows to find companies with better potential for growth at a fairer price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WWD

Woodward

Designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success