- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:WWD

Taking Stock of Woodward (WWD): How Does Its Strong Multi‑Year Rally Shape Today’s Valuation?

Reviewed by Simply Wall St

Woodward (WWD) has quietly turned into one of the market’s stronger compounders this year, with the stock climbing over the past month and the past 3 months as earnings and cash generation keep improving.

See our latest analysis for Woodward.

That momentum is not a flash in the pan, with Woodward’s 30 day share price return near 20 percent and its three year total shareholder return above 240 percent underscoring how steadily sentiment has swung in its favor.

If Woodward’s run has you rethinking your watchlist, this could be a good moment to uncover other aerospace and defense names using our aerospace and defense stocks.

With earnings and cash flow surging, Woodward now trades only modestly below analyst targets and at a premium to many peers. This raises the question: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 60% Undervalued

Woodward’s most followed narrative pegs fair value just above today’s elevated share price, suggesting the recent surge still understates its long term earnings power.

Strategic capital allocation toward next generation manufacturing capabilities, vertical integration, and automation is set to improve operational efficiency and cost structure, which, combined with pricing power from value added innovation, is likely to drive net margin expansion in the medium to long term.

Curious how steady growth assumptions turn into such an aggressive valuation gap, and why a richer future earnings multiple is baked in, not questioned? The full narrative unpacks a specific revenue glide path, a carefully stepped margin expansion profile, and a punchy profit multiple that would not look out of place in faster growing sectors, all combined through a single discount rate into that headline fair value. Want to see exactly which earnings and valuation levers have to fire in sequence to justify that upside?

Result: Fair Value of $317.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital investments and exposure to cyclical end markets could squeeze free cash flow and margins, which may test how durable that optimistic valuation really is.

Find out about the key risks to this Woodward narrative.

Another View on Valuation

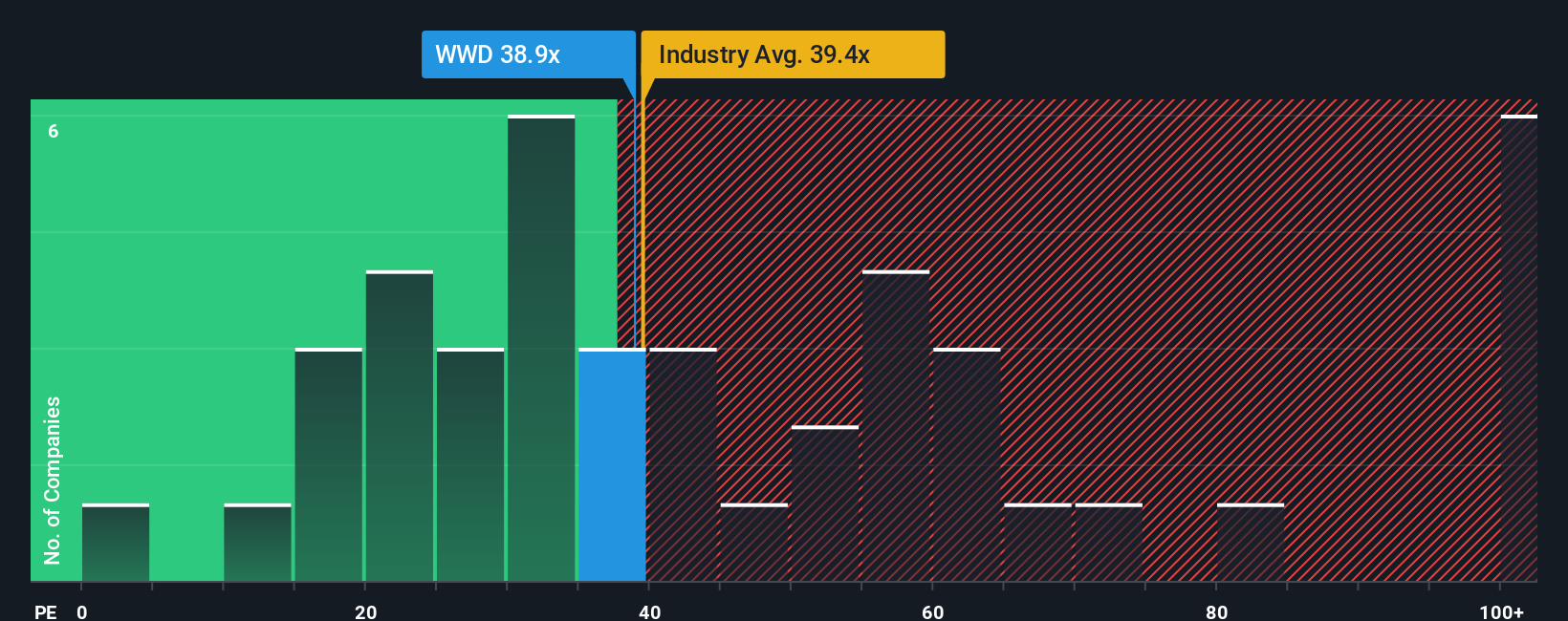

While the narrative driven fair value points to upside, our earnings based lens is less forgiving. Woodward trades on a 42.7x price to earnings ratio versus 37.3x for the US Aerospace and Defense sector and a 27.7x fair ratio, suggesting limited margin for disappointment if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woodward Narrative

If these assumptions do not quite align with your own, dive into the numbers yourself, shape a personal thesis, and Do it your way in under three minutes.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

Looking for your next move?

Before you move on, set yourself up for the next opportunity by using the Simply Wall Street Screener to uncover focused, data driven stock ideas in minutes.

- Review these 10 dividend stocks with yields > 3% to explore potential income streams that could strengthen your portfolio with reliable cash returns.

- Scan these 24 AI penny stocks to look for opportunities in the next technology wave that blend rapid innovation with market momentum.

- Use these 899 undervalued stocks based on cash flows to help sharpen your value investing approach by pinpointing ideas that the market may be mispricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Woodward might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WWD

Woodward

Designs, manufactures, and services control solutions for the aerospace and industrial markets worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion