- United States

- /

- Construction

- /

- NasdaqCM:WSC

Could WillScot Holdings’ (WSC) Headquarters Move Reflect a Shift in Its Strategic Priorities?

Reviewed by Sasha Jovanovic

- On October 1, 2025, WillScot Holdings Corporation updated its headquarters location and principal mailing address to 6400 E McDowell Road, Suite 300, Scottsdale, Arizona, while keeping its telephone number unchanged.

- This operational move arrives as analysts are reassessing the company’s outlook in light of recent business and financial pressures.

- We'll examine how concerns about WillScot Holdings' demand trends and profitability are now affecting its broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

WillScot Holdings Investment Narrative Recap

To own shares in WillScot Holdings today, you would need to believe in ongoing demand for modular and portable storage solutions, driven by infrastructure growth and project activity. The recent headquarters move to Scottsdale does not materially affect the near-term outlook; right now, the company’s biggest catalyst remains accelerated adoption of higher-margin FLEX and climate-controlled units, while the main risk continues to be weak demand in small and regional projects, reflected in ongoing headwinds to revenue recovery.

A recent round of analyst price target reductions, such as Jefferies cutting its target to US$23 and DA Davidson to US$35, highlights the market’s focus on demand softness, revenue trends, and profitability concerns. While the headquarters address change is largely administrative, these downward revisions are more relevant, as they underscore how investor sentiment and immediate outlooks remain closely tied to signs of improved utilization and volume growth.

By contrast, the risk of continued sluggishness in small project demand is something investors should keep in mind as...

Read the full narrative on WillScot Holdings (it's free!)

WillScot Holdings' narrative projects $2.5 billion in revenue and $363.1 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $253.4 million earnings increase from the current earnings of $109.7 million.

Uncover how WillScot Holdings' forecasts yield a $33.00 fair value, a 54% upside to its current price.

Exploring Other Perspectives

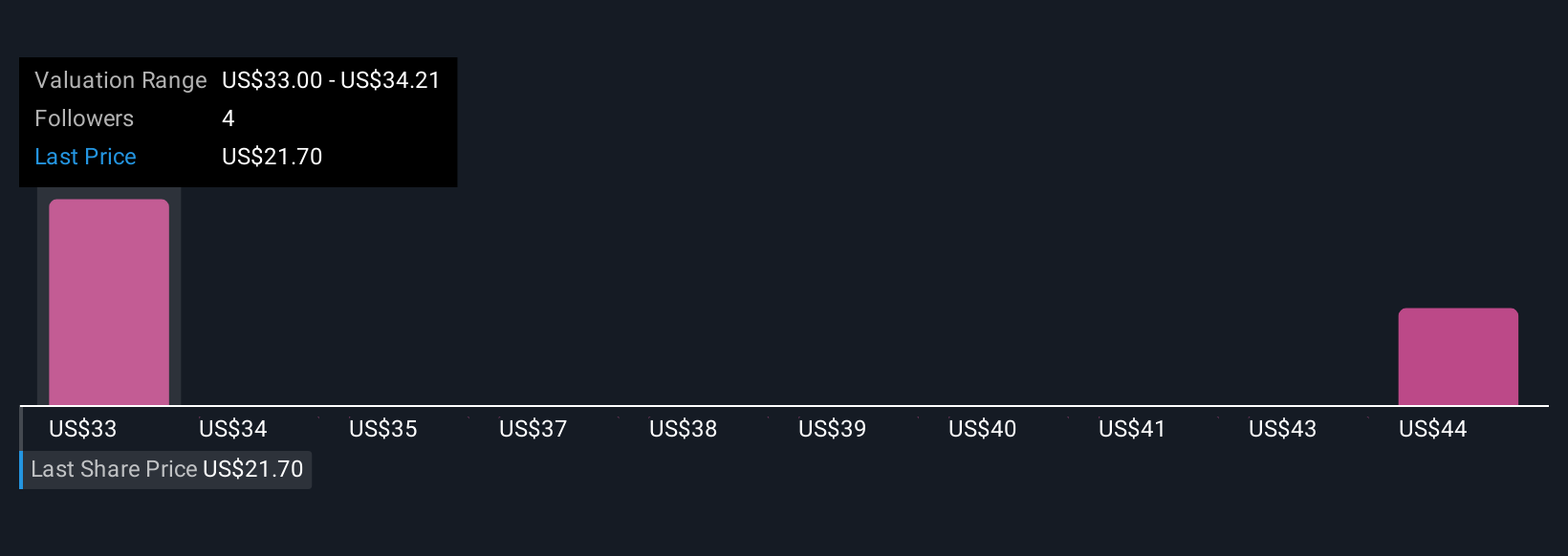

Simply Wall St Community analysts offered two fair value estimates for WillScot ranging from US$33 to US$44.84 per share. While projections vary widely, ongoing revenue pressures and mixed demand trends could weigh on performance, see how your outlook compares with these views.

Explore 2 other fair value estimates on WillScot Holdings - why the stock might be worth just $33.00!

Build Your Own WillScot Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WillScot Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free WillScot Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WillScot Holdings' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WillScot Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WSC

WillScot Holdings

Provides turnkey temporary space solutions in the United States, Canada, and Mexico.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives