- United States

- /

- Electrical

- /

- NasdaqGS:VICR

Vicor Corporation's (NASDAQ:VICR) Shares Climb 38% But Its Business Is Yet to Catch Up

Vicor Corporation (NASDAQ:VICR) shares have had a really impressive month, gaining 38% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 76%.

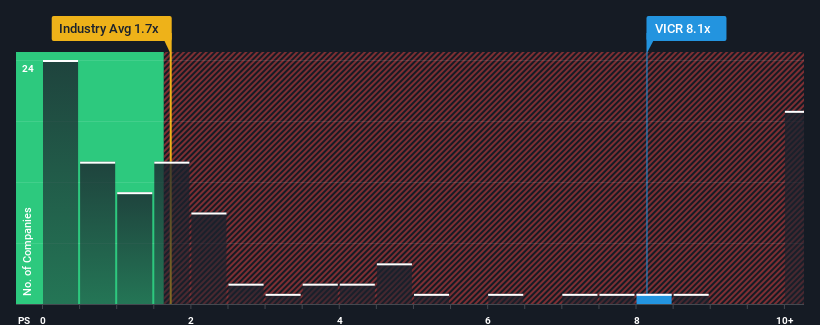

Since its price has surged higher, when almost half of the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Vicor as a stock not worth researching with its 8.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Vicor

How Vicor Has Been Performing

Vicor could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vicor.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Vicor would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. Meanwhile, the rest of the industry is forecast to expand by 17%, which is not materially different.

In light of this, it's curious that Vicor's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Vicor's P/S?

Shares in Vicor have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Vicor's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Vicor has 4 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VICR

Vicor

Designs, develops, manufactures, and markets modular power components and power systems for converting electrical power in the United States, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives