- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Evaluating Valuation After Options Surge and Analyst Downgrades

Reviewed by Kshitija Bhandaru

If you follow UFP Industries (UFPI), chances are the recent moves in its options market have caught your eye. Activity has spiked, with the October $55 call contracts showing unusually high implied volatility, which is often a sign that investors think something significant is coming. Meanwhile, analyst sentiment has turned more bearish in the short term. This creates a classic tug-of-war scenario with heightened expectations on one side and analyst caution on the other. Whether you are holding shares or sitting on the sidelines, moments like these can tempt investors to take a closer look.

Looking at the bigger picture, it has not all been smooth sailing for UFP Industries this year. The stock is down over 14% year-to-date and off about 26% compared to last year, despite continued revenue and net income growth on an annual basis. Yet, with strong three- and five-year total returns, momentum has clearly cooled, even as the company’s longer-term record hints at resiliency. Options traders seem to sense the potential for a significant move, but the underlying equity market has yet to show signs of renewed risk appetite.

With mixed signals between options traders and analyst sentiment, investors may be wondering whether UFP Industries offers a genuine buying opportunity now, or if the market is already factoring in any future growth.

Most Popular Narrative: 19.5% Undervalued

According to the most widely followed valuation narrative, UFP Industries appears significantly undervalued, with upside potential projected by analysts based on long-term growth expectations and financial performance improvements.

Continued geographic expansion, targeted M&A activity (with a $1 billion multi-year capital commitment), and gains in both retail and distribution channels position UFP to tap into fragmented markets and secular urbanization trends. These factors directly support multi-year revenue and earnings growth.

Curious why analysts are predicting nearly double-digit upside? The full story reveals ambitious growth bets and bold profitability targets that could drive shares much higher. Want to know which key assumptions are powering this optimistic price target? Uncover the factors propelling UFP Industries' valuation calculation. Some of the numbers may surprise you.

Result: Fair Value of $118.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key end-markets or ongoing price competition could present challenges for UFP Industries as it seeks to sustain margin and earnings growth in the coming years.

Find out about the key risks to this UFP Industries narrative.Another View

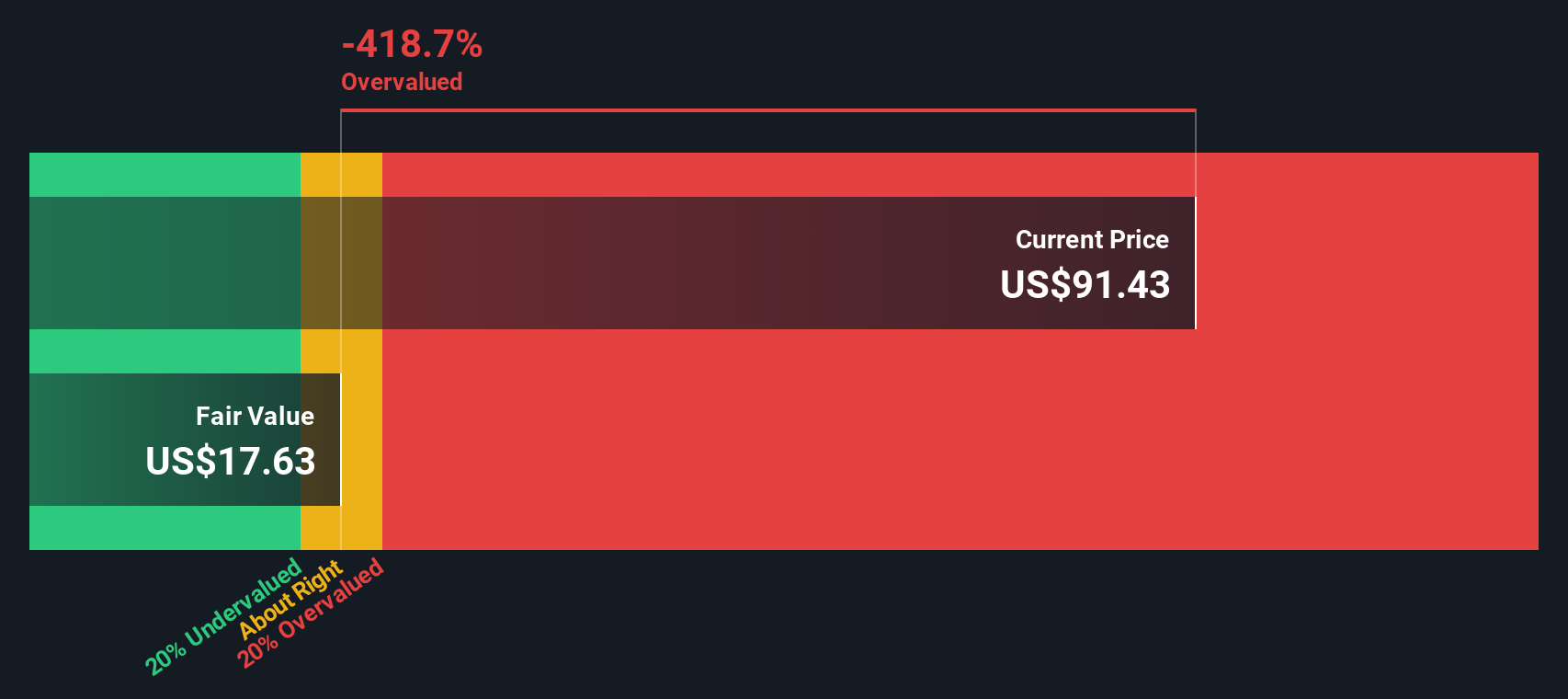

Taking a different approach, our DCF model suggests a much less optimistic picture for UFP Industries. Instead of undervaluation, this method indicates the stock may be overvalued. Could these models be missing a key future catalyst or risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UFP Industries Narrative

If you have your own perspective or want to test different assumptions against the data, you can build a completely personalized narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for More Investment Inspiration?

Smart investors never settle for just one opportunity. Now is the perfect time to broaden your watchlist and put your capital to work in dynamic markets with these game-changing themes.

- Accelerate your portfolio’s potential by targeting penny stocks with strong financials. These stocks stand out from the crowd in today’s volatile climate: penny stocks with strong financials.

- Harness the income power of companies offering dividend stocks with yields greater than 3%, letting your investments work harder for you: dividend stocks with yields > 3%.

- Ride the wave of technological transformation by tapping into healthcare AI stocks at the forefront of the medical revolution: healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives