- United States

- /

- Building

- /

- NasdaqGS:UFPI

UFP Industries (UFPI): Assessing Valuation Following ProWood’s Launch of TrueFrame Joist Deck Framing Solution

Reviewed by Simply Wall St

UFP Industries (UFPI) is making waves as its subsidiary, ProWood, unveils the TrueFrame Joist. This deck framing solution is designed for professional builders seeking greater durability and precision. The product is rolling out across several regions, sparking fresh interest in the company’s approach to innovation.

See our latest analysis for UFP Industries.

Shares of UFP Industries have come under pressure despite ProWood’s product launch, with the stock falling 17.9% year-to-date and logging a 1-year total shareholder return of -28.9%. Momentum has clearly faded lately, yet those who’ve held on for the long haul still see a solid 90.9% total return over five years. This highlights the company's long-term growth potential amid recent volatility.

If a fresh rollout like TrueFrame has you eyeing other opportunities, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 25% below analyst price targets and growth products reaching new markets, is UFP Industries now attractively undervalued, or is the market already factoring in all the future gains?

Most Popular Narrative: 20.3% Undervalued

UFP Industries' most widely followed narrative sets fair value at $114.50, which is notably above the latest closing price of $91.27. The analysis focuses on robust growth plans, operational pivots, and margin expansion, suggesting the market may be overlooking long-term transformation beneath recent share price weakness.

“The company's $60 million cost reduction program, restructuring activities (such as consolidating or closing underperforming facilities and exiting less profitable lines), and automation investments are projected to materially lower the cost structure by 2026. This is expected to drive net margin expansion even if industry conditions remain mixed.”

Curious about the bold financial maneuvers and strategic reallocations that could fuel the next surge? The narrative focuses on ambitious cost discipline, margin improvements, and growth that could surprise even seasoned analysts. Wondering which forecasts power that knockout fair value? Uncover the real story inside the full narrative.

Result: Fair Value of $114.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in housing markets and intensifying price competition could still derail UFP Industries' growth assumptions if conditions do not improve.

Find out about the key risks to this UFP Industries narrative.

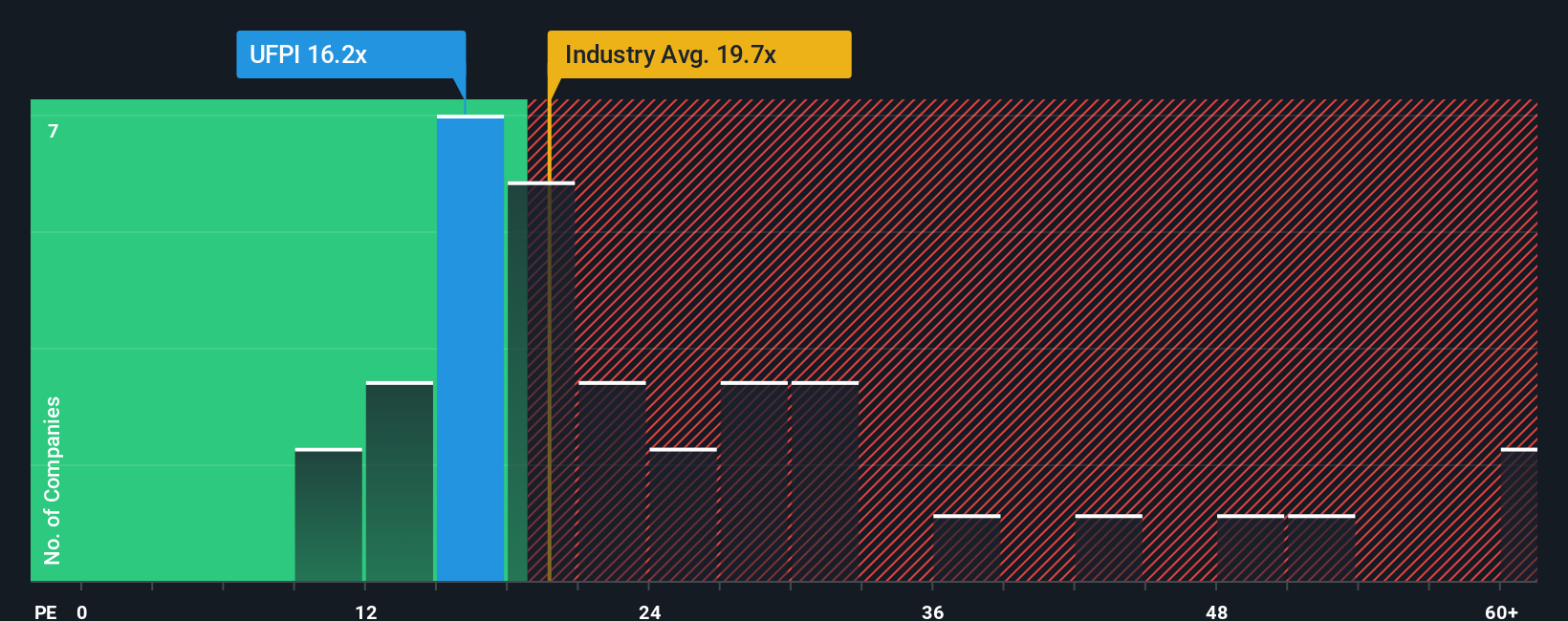

Another View: Market Multiples Send a Clearer Signal

While analysts point to long-term upside, the current valuation tells a nuanced story. UFP Industries trades at a price-to-earnings ratio of 15.9x, well below the U.S. Building industry average of 20.5x and peer average of 30x. The fair ratio, estimated at 21.6x, suggests the market could re-rate the stock higher if company fundamentals strengthen, but also exposes investors to the risk that valuation gaps may persist. Does this discounted multiple point to an overlooked opportunity, or is it a caution flag for ongoing softness?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UFP Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UFP Industries Narrative

If you see the numbers differently or want to dig into the details yourself, it's easy to craft your own perspective and narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding UFP Industries.

Looking for More Smart Investment Ideas?

Why watch from the sidelines when you can seize the moment? The Simply Wall Street Screener unlocks timely picks tailored for today’s ambitious investors.

- Snap up opportunities in high-yielding companies and see which stand out by checking these 17 dividend stocks with yields > 3% now.

- Capitalize on rapid tech sector momentum by searching these 24 AI penny stocks that are reshaping tomorrow’s industries right now.

- Secure positions in companies the market may be overlooking. Start with these 872 undervalued stocks based on cash flows and pinpoint untapped value others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UFPI

UFP Industries

Designs, manufactures, and supplies wood and non-wood composites, and other materials in the United States and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives